Cosmin Laslau / Lux Research

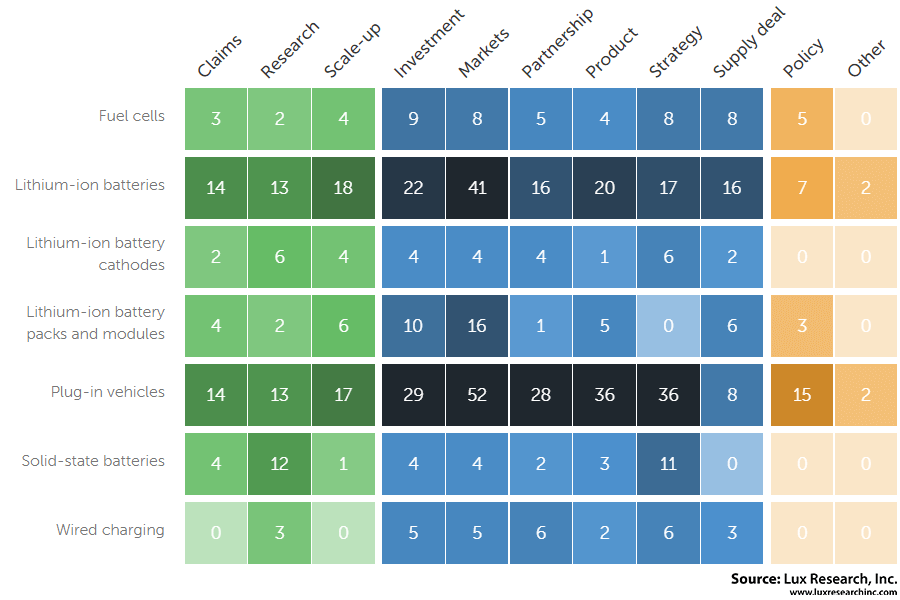

Using our News Commentary feature (client registration required), Lux Research analysts have been tracking the energy storage space with unprecedented detail, covering more than 300 chosen individual developments during the past half year. These innovation-related events span from partnerships and investments to new research and new factories and include information about the companies involved and our own takes on the developments. While this set of coverage is not meant to include every single development, it does capture much of what Lux analysts think is worth considering. The full dataset is available to Lux members to explore (client registration required), which includes interactive versions of the visualizations shown below. To help extract insights from this wealth of data, in this summary we analyze the trends that have emerged out of this in-depth coverage of how the energy storage landscape looks like in 2017 thus far, using the following heat map:

The heat map shows how the top seven areas of innovation within energy storage break out, by technology category (the rows) and type of activity (the columns).

Green-colored developments are related to technology; blue to companies; and orange for other categories. Within our energy storage taxonomy, we cover more than 20 different areas, and the seven shows above are the ones that have been most active in 2017 thus far: Plug-in vehicles; lithium-ion batteries, cathodes, and packs; solid-state batteries; fuel cells; and wired charging. Looking deeper within these areas, three key trends jump out from this heat map, driven by important new activity from leading and emerging players:

- Plug-in vehicles are by far the most active area within energy storage today, with market-related activity and product roll-out being the most active types of development: Among the most important developments within plug-ins in 2017, we have tracked how Volvo is planning a shift all of its vehicles towards more electrified drivetrains, China’s CATL is expanding to Germany to better tap the European market, and both Samsung SDI and SK Innovation are dialing back investments in China due to unfavorable plug-in subsidy policies for foreign supplier firms.

- Lithium-ion batteries have seen a flurry of activity, including new investments and scale-up of factories, as well as a strong push into new markets with new products. Within this category, the most important Li-ion developments thus far of 2017 include Audi’s claim of an astonishingly low $110/kWh cost, A123’s skyrocketing revenues thanks to 48 V micro-hybrid uptake, and Daimler investing $0.6 billion towards a second battery pack factory in Germany. The strong momentum here points towards a much more mature and serious stage for Li-ion batteries, with falling prices, rising revenues, and continued investments making for a virtuous cycle of accelerating deployment.

- Solid-state batteries are the only next-generation technology to make it into our list of the top seven most active energy storage categories, driven by particularly strong research activity, as well as investments and market-related activity.

The resounding theme is the ever-broadening participation of industry players, small and large, in researching and strategizing how to bring these higher capacity and potentially safer batteries to market: The players range from Samsung Electronics, looking to bounce back from its smartphone safety incidents; to China’s up-and-coming Ganfeng Lithium, a materials supplier that is looking to capture more of the value chain; to Panasonic’s president acknowledging the eventual need to move beyond Li-ion incremental improvements and that “solid-state batteries are one answer.”

Aside from these top three, it also worth noting what technologies did not feature prominently in the major developments of 2017 thus far within energy storage: Although fuel cells just barely crack into our top seven, they are an order of magnitude behind in the level of innovation event activity that we have seen in the leading categories above. Other technologies like lithium-sulfur, sodium-ion, supercapacitors, energy harvesting, and even flow batteries also fail to make much of an impact. (Stationary storage, on the other hand, was present but captured mostly under our lithium-ion battery-related categories, as they relate to Li-ion deployments for projects and supply deals.) Against this backdrop of growing scale for energy storage in the first half of 2017, key takeaways for readers are that Li-ion batteries are here to stay and that despite the interest in fuel cells, solid-state batteries, and other alternative approaches, they are still lagging in terms of innovation activity.

Filed Under: Energy storage