This year’s fiscal cliff legislation temporarily extended several federal renewable energy tax incentives.(1) The legislation included a one-year extension on the PTC. It was too little and too late for some wind enthusiasts. But for others, it was enough to continue industry growth. Fully understanding the guidance from the IRS ensures owners and operators are able to take advantage of the extension.

Leah Karlov / Counsel / Milbank Tweed Hadley & McCloy LLP

Randy Clark / Associate / Milbank Tweed Hadley & McCloy LLP / www.milbank.com

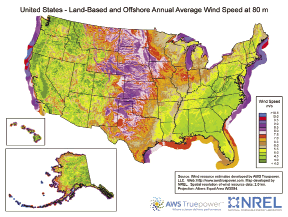

The United States still has a large amount of untapped wind energy potential. The PTC lets owners and developers capitalize on this clean energy source.

On January 2, 2013 President Obama signed into law the American Taxpayer Relief Act of 2012, commonly referred to as the Act.(2) It was intended to avert the so-called “fiscal cliff” and includes a number of extensions and modifications related to renewable energy tax provisions, including the 2.2 cent-per-kilowatt-hour production tax credit (PTC)(3) and the 30% investment tax credit (ITC)(4) that could impact the development and financing of wind and other renewable energy projects located in the United States.

The availability of the PTC and the ITC was extended to otherwise qualifying wind facilities for which construction begins before January 1, 2014.(5) In addition to wind energy facilities, this requirement replaces the prior “placed in service before January 1, 2014” requirement applicable to several other types of renewable energy facilities, including closed and open-loop biomass facilities, geothermal facilities, landfill gas facilities, trash facilities, qualified hydropower facilities, and qualified marine and hydrokinetic renewable energy facilities. Consequently, any such otherwise qualifying facility (or the electricity generated and sold from any such facility) construction of which begins before January 1, 2014 will also be eligible for the PTC or the ITC, regardless of when the facility is placed in service.

Notice 2013-29

On April 15, 2013, the IRS published Notice 2013-29 providing guidance on what it means to begin construction under the Act.(6) Under the Notice, there are two alternative methods by which a taxpayer can demonstrate that construction has begun before January 1, 2014. First, by beginning physical work of a significant nature before January 1, 2014. The other alternative is by paying or incurring at least 5% of the total cost of the facility before January 1, 2014, which is commonly referred to as the “5% safe harbor.” Similar, but not identical, standards applied for purposes of determining whether an applicant had commenced construction for purposes of cash grants payable under Section 1603 of Division B of the American Recovery and Reinvestment Act of 2009.(7)

Physical work of a significant nature

Under the Notice, physical work of a significant nature does not include work to produce inventory, whether that property is in existing inventory or is normally held in inventory by a vendor. Based on the language of the Notice, if the property is produced by someone other than the taxpayer under a binding written contract, this restriction applies regardless of whether the inventory was produced before or after the binding written contract was entered into.

The Notice defines what it means to begin construction with respect to a facility. A facility includes all components of property that are functionally interdependent, meaning that each component relies on the others being placed in service to generate electricity. As in the case of the cash grant guidance, for purposes of determining whether construction of a facility has begun before January 1, 2014, multiple facilities that are operated as part of a single project will be treated as a single facility. This is significant, especially in the case of a wind farm, because, as illustrated by the Notice, if a taxpayer performs physical work of a significant nature before January 1, 2014 on ten out of fifty wind turbines comprising a wind farm that is treated as a single project or facility, the taxpayer will be treated as having begun construction before January 1, 2014 with respect to the entire wind farm.(8) The Notice provides a nonexclusive list of factors indicating that multiple facilities are operated as part of a single project.(9)

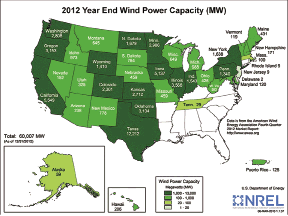

In 2012, the United States’ total wind capacity was 60,007 MW. With the PTC extension, wind energy can continue competing with other energy sources.

The IRS will closely scrutinize whether the construction of a facility has begun before January 1, 2014 if the facility is not under a continuous program of construction, based on relevant facts and circumstances.

5% safe harbor

Unlike the cash grant requirements, under the Notice, in addition to incurring 5% or more of a renewable energy facility’s cost before January 1, 2014, taxpayers relying on the 5% safe harbor also must make continuous efforts to advance towards completion. Whether a taxpayer is considered to make continuous efforts to advance towards completion of the renewable energy facility will be determined based on all of the facts and circumstances. However, the Notice provides a nonexclusive list of examples of activities that may indicate continuous efforts to advance towards completion that includes, paying or incurring additional costs, entering into binding written contracts for components or future work, obtaining permits or performing physical work of a significant nature.

If the total cost of multiple facilities that are treated as a single project (as described above) exceeds the estimated cost of the project, such that the amount the taxpayer paid or incurred before January 1, 2014 is less than 5% of the total cost of the project at the time it is placed in service, the 5% safe harbor will not be fully satisfied. However, the PTC or ITC may still be claimed with respect to some, but not all, of the individual facilities comprising the project, provided that the total cost of the individual facilities is not more than 20 times greater than the amount the taxpayer paid or incurred before January 1, 2014. On the other hand, if because of cost overruns or otherwise the amount spent before January 1, 2014 is less than 5% of the total cost of a completed facility that cannot be separated into smaller individual facilities, then the taxpayer will not have satisfied the 5% safe harbor with respect to any portion of the facility. Note however, that a taxpayer may be able to claim the PTC or ITC with respect the facility (or multiple facilities) if physical work of a significant nature was performed prior to January 1, 2014.(10)

There is limited guidance on how these rules provided by the Notice will apply to transferees, whether or under what circumstances a transferee of a facility can benefit from the transferor having satisfied the begun construction requirements. For purposes of the physical construction method, the Notice does provide that work performed under a master contract will be taken into account when rights to receive certain components under the master contract are assigned (pursuant to a binding written contract) to an affiliate special purpose vehicle that will own the facility for which the property will be used. However, the Notice provides no additional guidance in the context of transferees. WPE

Not covered by the act

It is important to note that the Act does not modify the current PTC and ITC placed in service eligibility requirements for all renewable energy facilities, most notably solar energy facilities. Solar energy facilities still must be placed in service before January 1, 2017 to be eligible for the ITC.(11) The Act also did not modify the current PTC and ITC placed in service eligibility requirements for small irrigation power facilities, refined coal production facilities, and Indian coal facilities. However, the Act extends the available PTC period for Indian coal facilities placed in service before January 1, 2009 from seven years to eight years.(12)

Bonus depreciation extended

The Act extends the special first-year depreciation allowance, commonly referred to as 50% bonus depreciation, to qualifying property that is acquired and placed in service before January 1, 2014.(13) Under prior law, property placed in service after December 31, 2012 would not have been eligible for 50% bonus depreciation.(14) In addition, certain long production-period property and aircraft will be eligible for 50% bonus depreciation if acquired before January 1, 2014 and placed in service before January 1, 2015.

The Act also reintroduces the special accelerated depreciation periods for business property used on an Indian reservation.(15) For qualified Indian reservation property placed in service on or before December 31, 2011, Section 168(j)(2) of the Code provided special recovery periods that were shorter than the otherwise applicable MACRS periods. The Act provides that Section 168(j) will apply to property placed in service on or before December 31, 2013, explicitly including qualified Indian reservation property placed in service in 2012.(16)

For further reading:

1) Authors: Leah S. Karlov and Randy Clark, Milbank Tweed, Hadley & McCloy LLP. Opinions expressed in this article are those of the authors.

2) Pub. L. No. 112-240, 126 Stat. 2313 (2013).

3) I.R.C. § 45. References herein to the “Code” are to the Internal Revenue Code of 1986, as amended.

4) I.R.C. § 48.

5) Section 407 of the Act.

6) 2013-20 I.R.B. 1085. The Notice was updated by the IRS on April 25, 2013 to harmonize the definition of a “binding written contract” for purposes of the new PTC and ITC rules with the existing guidance for cash grants. Consistent with previous guidance applicable to the cash grant, the revised Notice clarified that a contractual provision that limits damages to an amount equal to at least 5 percent of the total contract price will not prevent a contract from being considered a “binding written contract.”

7) Pub. L. No. 111-5, 123 Stat. 115 (2009).

8 Notice 2013-29, § 4.04(3).

9) The list includes these factors: (a) The facilities are owned by a single legal entity; (b) the facilities are constructed on a contiguous piece of land; (c) the facilities are described in a common power purchase agreement or agreements; (d) the facilities have a common intertie; (e) the facilities share a common substation; (f) the facilities are described in one or more common environmental or other regulatory permits; (g) the facilities were constructed pursuant to a single master construction contract and (h) the construction of the facilities was financed pursuant to the same loan agreement.

10) See Notice 2013-29, § 5.03(3)(a) and (b).

11) Pursuant to law in effect since 2004, solar energy facilities placed in service after 2005 have not been eligible for the PTC.

12) Section 406 of the Act.

13) Section 331 of the Act.

14) See former I.R.C. § 168(k).

15) Section 313 of the Act

16) Section 313 of the Act.

Filed Under: Featured, Financing, Policy