This is the first few of nine pages from the executive summary of the 2011 Wind technologies market report issued by the DOE. A link to the full report is below.

The U.S. wind power industry is facing uncertain times. With 2011, capacity additions rose from 2010 levels and with a further sizable increase expected in 2012. This leads to reason for optimism. Key factors driving growth in 2011 included continued state and federal incentives for wind energy, recent improvements in the cost and performance of wind power technology, and the need to meet an end-of-year construction-start deadline to qualify for the Section 1603 Treasury grant program. At the same time, the currently-slated expiration of key federal tax incentives for wind energy at the end of 2012 – in concert with continued low natural gas prices and modest electricity demand growth – threatens to dramatically slow new builds in 2013.

A few key findings from this year’s “Wind Technologies Market Report” include:

Wind power additions increased in 2011, with roughly 6.8 GW of new capacity added in the U.S. and $14 billion invested. Wind power installations in 2011 were 31% higher than in 2010, but still well below the levels seen in 2008 and 2009. Cumulative wind power capacity grew by 16% in 2011, bringing the total to nearly 47 GW.

Wind power comprised 32% of U.S. electric generating capacity additions in 2011. This is up from 25% in 2010, but below its historic peak of 43% in 2008 and 2009. In 2011, for the sixth time in the past seven years, wind power was the second-largest new resource (behind natural gas) added to the U.S. electrical grid in terms of gross capacity.

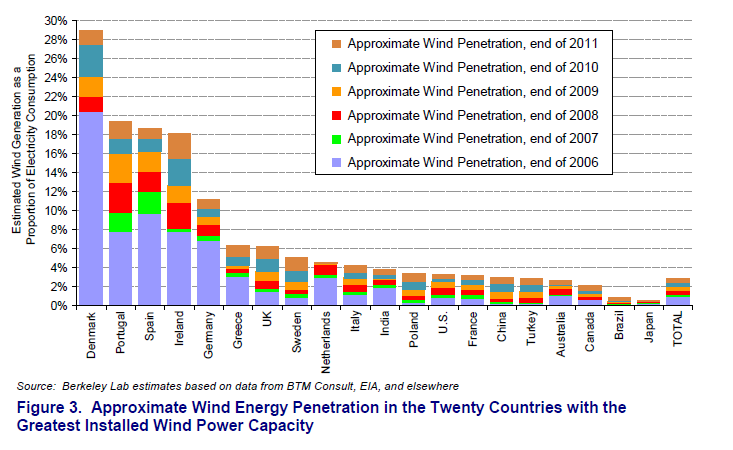

The U.S. remained the second largest market in annual and cumulative wind power capacity additions, but was well behind the market leaders in wind energy penetration. After leading the world in annual wind power capacity additions from 2005 through 2008, the U.S. has now – for three years – been second to China, comprising roughly 16% of global installed capacity in 2011, up slightly from 13% in 2010, but down substantially from 26-30% from 2007 through 2009. In terms of cumulative capacity, the U.S. also remained the second leading market, with nearly 20% of total global wind power capacity. A number of countries are beginning to achieve relatively high levels of wind energy penetration in their electricity grids: end-of-2011 wind-power capacity is estimated to supply the equivalent of roughly 29% of Denmark’s electricity demand, 19% of Portugal’s, 19% of Spain’s, 18% of Ireland’s, and 11% of Germany’s. In the United States, the cumulative wind power capacity installed at the end of 2011 is estimated, in an average year, to equate to roughly 3.3% of the nation’s electricity demand.

California added more new wind power capacity than any other state, while six states are estimated to exceed 10% wind energy penetration. With 921 MW added, California led the 29 other states in which new large-scale wind turbines were installed in 2011, ending Texas’ six-year reign (Texas fell to ninth place in 2011). Other states with more than 500 MW added in 2011 included Illinois, Iowa, Minnesota, Oklahoma, and Colorado. On a cumulative basis, Texas remained the clear leader. Notably, the wind power capacity installed in South Dakota and Iowa as of the end of 2011 is estimated, in an average year, to supply approximately 22% and 20%, respectively, of all in-state electricity generation. Four other states are also estimated to exceed 10% penetration by this metric: Minnesota, North Dakota, Colorado, and Oregon. The full 93-page report is available at: http://www.windpoweringamerica.gov/pdfs/2011_annual_wind_market_report.pdf

Department of Energy

Filed Under: News, Policy, Projects