From Miller Howard Investments

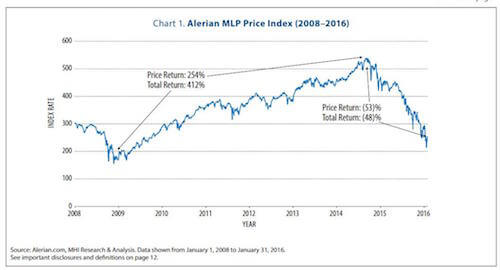

As of this writing, MLPs were falling toward their 2009 lows as measured by the Alerian MLP Index. What could have been a garden-variety market correction after a remarkable six-year rally has deteriorated into what might appear to be a full-blown meltdown that has erased much of the price gains made during that period.

Some journalists and financial advisors are questioning the MLP business model, asking how it will weather this storm. Investors are rightly confused about MLP valuations, long-term prospects and the very viability of the business model. But perhaps there is some myopia here, brought on more by stock price movements than by business fundamentals.

The business MLPs and midstream corporations engage in—namely, the transportation, processing and storage of oil and gas—dates back 150 years—the February 2016 business is hardly a fad. And we think it is helpful to consider MLPs in relation to their close cousins, utilities. MLPs, like utilities, provide services that are essential to society. They own monopolistic assets that, for the most part, generate enough cash flow to pay their current distribution commitments to shareholders. Plunging stock prices have triggered a negative feedback loop, in particular by raising an MLP’s cost of capital when selling equity and stressing their ability to fund expansion projects—the driver of future cash distribution increases.

We see this not as the end of the road for MLPs, but rather a bump in the road. Quality MLPs and midstream companies have sufficient resources to manage through this turbulence, just as utilities managed and then thrived 13 years ago. We’ve often spoken of MLPs and midstream companies in similar businesses as “utilities without walls.” Yet after the jarring price activity in 2015 and 2016, seemingly associated with first declining oil prices and then natural gas prices, is this characterization still valid?

Similarities and differences

We first became involved with MLPs in 1997 in our Income-Equity Strategy and in our utilities portfolio, and one reason we did so was that there was a great pipeline consolidation during the 1990s (as a result of FERC Order 636, which changed the structure of the industry). We had owned nearly all of the pipelines that soon became consolidated into energy MLPs, so naturally we studied this new vehicle and came to understand how an MLP works—which is not always clear to the average investor.

MLPs are uniquely connected to utilities, as a primary function for both is to provide services essential to our society. In fact, many of today’s MLPs were created from assets previously owned by utilities. So we think there is much validity in comparing MLPs to utilities in determining fair valuations. Similarities The underlying MLP business is indeed utility-like in several regards.

■ Essential services at the heart of both. Pipeline and processing companies bring natural gas from its extraction source to users, such as utility companies, factories, refineries, chemical companies, residential heating systems and shipping terminals. Oil infrastructure also brings product from drillers, refineries and terminals, plus inflow and outflow from storage tanks. The energy in question is essential: we would not have society as we know it without energy. Energy is in constant use, and use grows with the economy in an almost perfect correlation. The midstream (transport pipes and processing) makes the downstream (refineries, electric and gas utilities, and so on) possible, and the demand for its services is just as constant as the demand for utility services.

■ Durable revenues. Like utilities, MLP revenues are derived from long-term contracts charging fees (there is some small degree of commodity-based revenues in the space, but most revenues are “tolls”). These contracts do have end dates (5–20 years), but at the end of the lease a shipper (E&P company) or receiver (utility) will not have another vendor to negotiate with, since there is typically only one facility for shipping and processing. Utilities, of course, have no competition in exchange for revenues that are protected and limited.

■ Limited competition. MLPs are monopolistic because rights of way for infrastructure are so difficult to create. It is extremely rare for two pipelines to compete. This is not the same as a legal utility monopoly, but it is a de facto monopoly. Differences The comparison between MLPs and utilities is strong, though not perfect.

For the rest of the 12 page report, go here.

Filed Under: Uncategorized