Making stand-alone energy storage systems eligible for a federal Investment Tax Credit (ITC) would create jobs and help modernize the U.S. electricity grid, according to over 150 companies and industry groups representing storage, wind, solar, hydro, manufacturing and other sectors.

A broad coalition of over 150 companies and energy groups have asked Congress for a stand-alone storage ITC.

Today, these businesses issued a letter to Congressional leadership in support of The Energy Storage Tax Incentive and Deployment Act (S. 1868 & H.R. 4649), which would ensure a level playing field for energy storage to compete with all other energy resources currently eligible for the ITC.

The American Wind Energy Association (AWEA) signed onto the letter and issued the following statement in support:

“Energy storage technology will play an important role as we build an even more affordable and reliable electricity grid for the 21st Century,” said Tom Kiernan, CEO of AWEA. “We’re asking Congress to reduce uncertainty for investors by creating a stand-alone energy storage ITC for which all storage technologies can qualify. A level playing field for the full range of storage technologies will ensure consumers benefit from competition and will boost job-creating investment in infrastructure projects, including new opportunities for wind farm development.”

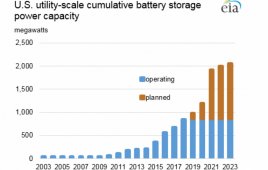

Energy storage technologies — including batteries, flywheels, pumped hydro, thermal storage, compressed air, and others — are a source of reliability services and flexibility when connected to the grid as an independent resource or when paired with any energy source. Current law only allows energy storage to qualify for an ITC when paired with a solar project under certain circumstances.

Storage is a foundational component of a more robust electric grid, helping to balance power supply and demand instantaneously by storing electricity from low-cost energy sources and releasing that power during periods of high demand. When emergencies strike, energy storage can provide invaluable storm resiliency and backup power.

Filed Under: Energy storage, News, Policy