Keith Martin, Partner, Chadbourne & Parke LLP

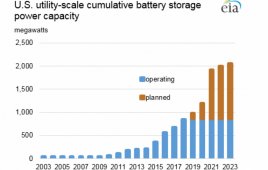

The Internal Revenue Service has issued three private letter rulings confirming that a 30% investment tax credit can be claimed on batteries that are installed as part of renewable energy projects.

The batteries must be positioned and operated in a way that they are considered part of the electric generating equipment.

Two of the rulings involved 32 and 36-MW batteries installed at merchant wind farms. One addressed batteries installed with rooftop solar systems. The U.S. Department of the Treasury paid a cash grant on another battery installed at a large contracted wind farm.

The IRS has also declined to rule in some cases that pushed boundaries beyond the cases on which it has ruled. The IRS is in the process of revisiting in what circumstances batteries qualify for investment tax credits. Tax credits can only be claimed on generating equipment. The issue is when is a battery considered part of the generating equipment. The IRS is sifting through 25 to 30 letters received in response to a request for comments. The issues are complicated and will probably take into 2017 to resolve.

IRS rulings

In the first private ruling, a 32-MW lithium-ion battery installed at original construction of a merchant wind farm qualified for a tax credit as part of the generating equipment.

The battery is on the low side of the step-up transformer. Only 3% of the electricity stored each year on average was expected to come from the grid. The main function of the battery is to act like a knob on a motor to regulate the ramp rate at which wind electricity is fed into the grid. However, the plan was to use the battery also to provide frequency regulation services to the grid. Revenue from regulation services was expected to account for roughly 20% of total revenue of the wind farm.

The second private ruling dealt with a 36-MW advanced lead-acid battery installed at an existing merchant wind farm.

The wind company said about 15% of electricity on average used to charge the battery would come from the grid. The battery is on the low side of the step-up transformer. It is being used to provide various ancillary services to the grid. These services include spinning reserves, non-spinning reserves, voltage support, ramp control and black start. Revenue from ancillary services amounts to about 15% of total revenue of the project.

Read the rest: https://goo.gl/BnE5wm

Filed Under: Energy storage