Primary credit analysts and authors:

Michael T Ferguson, CFA, CPA, New York, michael.ferguson@spglobal.com

Aneesh Prabhu, CFA, FRM, New York, aneesh.prabhu@spglobal.com

Michael Pastrich, New York, michael.pastrich@spglobal.com

Corinne B Bendersky, San Francisco, corinne.bendersky@spglobal.com

Gabe Grosberg, New York, gabe.grosberg@spglobal.com

Ben L Macdonald, CFA, Centennial, ben.macdonald@spglobal.com

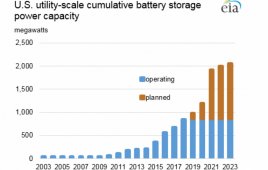

It’s becoming increasingly clear that the accelerating pace of change of various technologies is disrupting the energy markets. One of those technologies, battery storage, is potentially one of the most transformative developments in the power markets during the past few decades. While the emergence of the battery storage industry remains in its nascent stages, with less than 1 gigawatt (GW) of installed U.S. capacity to date, a number of factors are converging to prime it for significant growth.

To understand the potential repercussions for the U.S. power industry, S&P Global Ratings has evaluated how it would view some of the credit risks of battery storage on a stand-alone basis. We analyzed what sorts of changes need to be made to improve the cost efficiency and marketability of batteries. Additionally, we assessed how battery storage proliferation could disrupt power markets in the U.S. We also assessed how utilities will seek to capture this burgeoning market in years to come, the impact of battery storage taking more end users off the grid altogether, and who could be the winners and losers.

Overview

- Battery storage is poised for growth in the U.S., as investments in renewable energy rise and the cost of batteries decrease over the next five years.

- States with relatively substantial renewable energy output and supportive regulatory schemes are likely to be the early adopters of battery storage to complement their other renewable sources.

- While battery storage will likely disrupt U.S. energy producers, we don’t expect to take many negative rating actions in the next two years.

The ramifications for credit quality on power industry players are substantial, though impossible to fully estimate at this point. The best historical precedents for understanding rate of adoption, efficiency improvements, and cost reductions are imperfect at best. For instance, solar and wind generation have seen greater-than-expected penetration in the last decade, partly because their associated costs have fallen so dramatically that they have become competitive on economic grounds. Additionally, expectations for solar and wind installations have continuously been revised upwards, demonstrating that technological change is not often linear, but more likely occurs in fits and starts.

In the past year, inquiries from market participants about battery storage have increased. S&P Global Ratings published a series of commentaries highlighting the prospects for, and risks attendant to, battery storage in the U.S. (see Related Research below).

How close is the battery storage revolution?

Our discussions with investors, sponsors, and regulators suggest that the development of battery storage capabilities is inevitable. But less certain are the answers to the two major questions: when? and where?

The first question is a vexing one. Typically, equity markets and, to a lesser degree, debt markets have a short-term orientation. With this in mind, maximizing returns while still addressing longer-term concerns could become a potential pain point for management teams during the next few years. Battery storage as a disruptive force, however, can provide management teams an answer–perhaps more quickly than is needed. Generators acknowledge that battery storage will affect their businesses–and they also understand that the strategies necessary to mitigate this technological risk are costly.

Although our credit ratings are inherently medium- to long-term assessments, substantial, near-term capital expenditure could negatively affect both credit quality and an issuer’s access to the capital markets. What’s more, while it’s not clear when battery storage might reach its figurative tipping point, the rationale around why this may happen is much clearer: because the cost of batteries will have fallen so substantially that they will be among the most cost-effective means of generating reliable and clean power.

The question of “where” may have an easier answer, though perhaps still an incomplete one. During the next few years, sizable state-level initiatives, such as those in California and Massachusetts, should propel installed capacity. Given that these states are home to a large proportion of renewable generation sources, these programs have a complementary effect. Wherever the increased market penetration is seen, we expect battery storage’s costs to fall and its efficiency to improve. We also note that battery storage is best used when supplementing renewables resources, which are already prominent throughout the country. The placement of these battery facilities will likely be determined by both regulatory and economic rationales, as well as by the facilities’ suitability within the existing grid.

Renewables and batteries: The perfect pair?

For the rest of the extensive report: http://bit.ly/SPusbattery

Filed Under: Energy storage