I recently posed the question, Will the wind power industry survive without the 1603 cash grant, but fortunately the answer to that can be postponed for another year. Last week Congress finally agreed on the controversial extension of the bush era tax credits. And while that in and of itself is good news for businesses across the country, what’s more is that included in the bill was a one year extension of the ARRA 1603 cash grant program.

This, of course, is great news for the wind industry. For while the industry may be able to survive without federal subsidies, it will certainly grow more with some extra cash. In a response to this development, Denise Bode, CEO of AWEA, wrote, “This is a great holiday present for the 85,000 American workers in the wind energy industry, tens of thousands of whom will now be able to get back to work in a sector that has been a bright spot in the recession so far. Orders will be on the rise for new wind power, and investors will put more capital into the U.S. economy because of what happened in Congress last night.”

So, what does this mean for you? That’s the real question after all, isn’t it? Well, if the past is any indication of the future, then we can safely assume that a 30% decrease in the installed cost of wind power will result in an even greater increase in the number of new installations.

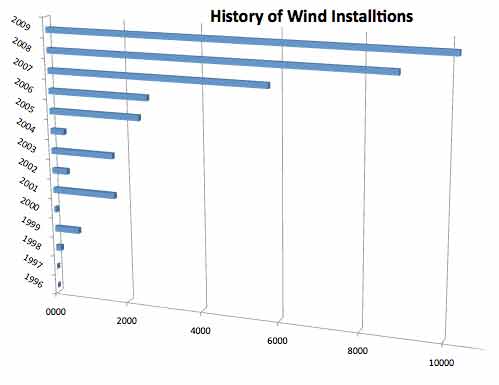

Annual installations of wind turbines in the United States by MW.

Note the graph to the right. This graph shows the annual installed wind power generating capacity by MW for the United States. As you can see 2001, 2003, and 2006-2009 have been stand-out years. It may also interest you to know that these years closely correlate with that addition of federal stimulus plans such as the Investment Tax Credit (ITC) or the more recent Production Tax Credit (PTC). Furthermore, it wasn’t until the addition of the ARRA 1603 cash grant program that the wind industry really took off.

Now, you may already be aware that 2010 was an especially bad year for the wind industry. Orders fell by nearly 50% from 2009 and subsequently suppliers, constructors, developers, and manufacturers all took a big hit, especially with the impending end of this tax credit. But just look at the graph, this has happened before, ie. 2000, 2002, 2004. Owners were looking at their situation and determining that if they placed orders for turbines but were not able to get their project in the ground by the end of the year, then they would essentially be paying 30% more than they had before. So, it stands to reason that these owners were holding on to their money.

I mention all of this because we are now at the other end of the situation. Owners have one full year to get their projects started, those who already have received permitting will be placing orders. Those manufacturers receiving the orders will begin to produce, requiring more help from their suppliers. Constructors will receive more RFP’s, they will put out more bids, and they will receive more jobs. And when all is said and done, the industry will be thriving; just as it was before the recession.

So, how do you get involved and ensure that you don’t miss this expansion? Well, you get your company out there. You visit with clients face-to-face. You promote your companies and highlight where and why you should be involved in the industry. After all, how can you expect manufacturers to ask you for your help if they don’t even know where you can help them?

Filed Under: Uncategorized

Rivers Edge;

Look into the Manufacturing Tax Credit, also known as 48C. This incentive offers manufacturers assistance in getting started. It can help cover expenses such as new machinery, plants/factories, and more.

A 30% investment tax credit (even when it can be monetized by converting it to a cash grant under the 1603 program) is not equivalent to a 30% reduction in cost. You need to compare to the situation that would exist without the 1603 program. In its absence, project owners would take advantage of the federal Production Tax Credits (which they forego by taking the 1603 cash grant); these PTCs have a present value roughly equal to the 30% tax credit. The PTCs do require a source of equity with taxable income that needs to be sheltered, but that market — while smaller than in 2007 and early 2008 — does still exist. The fall-off in 2002 and 2004 was caused by federal failure to extend the PTC program on a timely basis — and this did indeed have the effect of removing a roughly 30% cost reduction, because back then the 1603 program didn’t exist. But, as long as there is still a functioning PTC program and a functioning tax equity market, the eventual loss of the 1603 program will not have consequences as severe as the article suggests.

Are there any grants available to help offset some of the start up costs to begin manufacturing wind turbines here in the US?

This is a fine discussion and very useful. However, in my line of work in the renewable industry there is no “boost” funding to help a service provider such as my company. I have to rely on the wind farm operations itself in order to get work. Does anyone know where I could dip into any type of funding to sustain my company? thank you.

@Delroy. I concur with your overall comment, but we need to be careful to distinguish between being _Headquartered_ overseas and creating _jobs_ overseas. There are a lot of foreign corporations – Iberdrola, EDPR, EDF, Vestas, Gamesa – that create tons of jobs in the US.

In fact, the wind turbine with the HIGHEST US-content is probably the Vestas machines made in Colorado (where they invested the better part of a Billion Dollars in 4 factories in the past 2 years) — higher even than the GE machines, because more of their sub-suppliers are foreign.

Not only do we need to make sure we have manufacturing here in the United States we need the ROI to be appealing to the consumer, especially for community/distributed wind and solar projects. Not all the jobs are going to come as a result of the big projects. If it doesn’t make financial sense for the end user then we won’t see the growth, and the United States will fall behind.

Taylor & Frank: Very nice articles about the state of our renewable energy industry and the benefit of the 1603 cash grant. Frank, what is so alarming from your data is the fact that a large percentage of the 1603 grant funding went to companies that are headquartered overseas? It is also noted that a large percentage of the jobs created were overseas because majority of the equipment and parts were imported.

The Chinese and European companies are building manufacturing plants here in the US to meet local demand, why can’t US manufacturers do the same thing and set up more manufacturing plants here to meet the local demand?

There was a NY Times article by Tom Friedman about a solar panel manufacturer that had to setup his plants overseas because there was not enough market here. Do you think that the 48C manufacturing tax credit will be a big enough incentive for local manufacturing to start building here, instead of foreign entities setting up plants here to take advantage of it?

Congress has subsidized renewable energy construction In the United States since 1992.

Whether to diversify our energy base, promote cleaner energy, create new jobs, retain jobs created since 1992, or enable the U.S to complete on a global basis to manufacture renewable energy component products, with almost 20 years of support, it is difficult for me to predict that even the new tea party favored Congress will choose

to terminate the existing subsidies for renewable energy.

To do so would mean Congress chooses to abandon what at least 50% of the country thinks is a growth market with tremendous job growth and capital investment potential.

What happens if you are in congress and vote to eliminate the subsidies, and you are wrong!!!

Not only would you cause the loss of some 200,000 plus existing jobs, but the loss of over 700,000 potential new jobs.

And it would be next to impossible for the United States to ever re-enter the market with Europe and China continuing to have the dominate positions for the foreseeable future.

Not a good when we are facing unemployment in the range of 9% and above for the 2 year shelve life of the Congress and everyone sees China and Germany beating us on all fronts.

To date my focus has been on wind.

As long as the cost of coal and natural gas is considered in the energy market place to be cheaper than wind, wind energy needs to subsidized if it is to going to expand

Of course the debate as to how you define “cost” is key, but that debate will continue for many years.

So based on current energy price forecasts for coal and natural gas, new wind expansion projects need to be subsidized at least at the current levels (30% of installation costs). Otherwise the wind energy construction and manufacturing industry in the United States would virtually disappear.

Even if coal and natural prices increase, for renewable energy manufacturing to occur in the United States, we would still need subsidy in today’s global market!

Unfortunately, there is not a level international playing field in renewable energy manufacturing, and to compete with China and Europe we would still have to offer expansion incentives to make wind component part manufacturing happen in the United States.

We can make the existing incentives work much better to create jobs and investment in the U.S. and still comply with WTO incentive limitations.

Please review the attached briefing paper I recently completed:

http://www.kriegdevault.com/userfiles/file/Recovery%20Act%20Section%201603%20Renewable%20Energy%20Grant-In-Lieu%20of%20Tax%20Credit%20Program%20Binder%20(3).PDF

Across the globe high paying manufacturing jobs are attracting premium government subsidy.

China has a larger renewable energy market potential than the United States and lowest cost to manufacture, so many European companies are co-investing with China in China to expand the wind component part manufacturing capacity in China to serve both the China market and the U. S. market as the lowest cost provider with current state of art European technology.

China is aggressively offering incentives to buy the European technology and know how.

China values each job based upon its ability to reduce unemployment and poverty for its 1 billion plus population, and has our trade surplus to invest!

For the first time in history, China will out manufacturer the U.S. in 2010.

We have to start to structure our incentives to compete on a global basis and create jobs and capital investment in the United States all within the context of WTO limitations.

Please read my brief and the proposed 1603 LED PROGRAM legislation!

It offers a place to start.

HAPPY NEW YEAR!

Thank Taylor for this article. My question is how can a component Mfg. company take advantage of the Sec. 1603? Another question is about Sec. 45 and 48c. Where they extended also? Lastly is about the provisions of Sec.1703 and 1705 will they be available in the coming year?