In an ideal world, logistics directors would schedule a train to deliver tower sections, nacelles, and blades to a storage area within a few miles of their wind farm. Trucks would complete the delivery. But the ideal quickly runs off the rails because a few rail tunnels are too narrow for nacelles, many loads are almost too heavy for trucks, and ports too small for storage. Yet, turbine designs are getting larger. Are OEMs listening?

Minnesota-based ATSI contracted the Justin Foss to pull the barge of turbine towers to a port in California. Shipping them this way was less expensive and faster than by trucks. Photo: Dennis Schwartz

How many of you are raising your children to be truck drivers?” a speaker asked at a recent AWEA conference. No one raised their hand. “This is partially why there will be a shortage of skilled drivers,” he teased. The other reasons he suggested were that this lifestyle is not attractive to young people today who are looking for more of a white collar way of life which rewards them financially and affords them a homelife that driving a truck does not. Others followed Doug Miller, VP of Operations for Lone Star Transportation LLC, detailing the frequent challenges of delivering large heavy loads in the wind industry. To make the work more difficult, such loads are growing larger and heavier with multi-megawatt turbines.

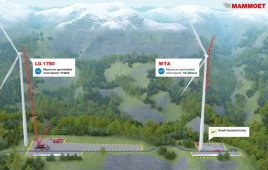

Railroads seem the ideal way to move huge and heavy goods, but even these are hampered by turns too tight for long loads, such as blades, and a few tunnels too small for the 12.5-ft wide nacelles. Here’s what else that keeps logistic directors up at night as they struggle to get turbines and towers to sites on time, and how OEMs are responding to their boat-in-the-basement problem.

Trouble with trucking

Before a driver even starts a diesel to deliver a turbine, a detailed logistics plan must be laid out. Inexperienced planners have a habit of overlooking this detail until the end of the project. Trucking managers warn that it can take months to formulate. In a nutshell, the plan involves assigning lots of specialized and expensive equipment, filing for and receiving permits from several states, and then finding drivers and support personnel.

The Schnabel trailer, built by Trail King Industries (trailking.com) shows the complexity of equipment needed to haul large wind turbine towers. The $300,000 trailer is intended only for moving large base and lower-mid tower sections. Trailer sections attach to opposite ends of the tower.

And consider this: moving just one complete turbine takes 9 to 10 trucks, most of which are specialized trailers. Different trailers are needed for the nacelle, blades, and towers. Lone Star Transportation’s (LoneStar-LLC.com) Doug Miller says hauling nacelles and tower sections require equipment that cost up to $425,000 or more. For instance, three vehicles are needed to move each blade set, one specialized trailer moves the nacelle, and up to four specialized trailers transport tower sections. In some cases, the latter group requires even more specialized rigs, called Schnables. These trailers are used as the diameter of the tower increases and to lower the transport’s overall height to obtain more direct permitted routes. Generally, the smaller sections, ship on more conventional specialized trailers. Finally, one or two more trailers are often needed for other smaller components.

Let’s keep counting. Depending on the distance the components are transported over, delivering six turbines per week could requires up to six or more trailers and rigs, plus 18 ore more blade trailers. So a trucking company may have $12 to 13 million tied up in assets. “Furthermore, that shipment calls for 54 drivers to lead the glamorless life style I described, not to mention support equipment such as escorts, pilot cars, and others needed for a safe delivery,” says Miller.

As a specialized 48-state carrier over irregular routes, the complaint Miller hears most often from drivers is short home time and not enough money. “The two don’t go together because spending time at home means you can’t make money. You cannot fix the monetary compensation without raising costs for everyone else. We have to balance that problem if we want an industry to attract people.”

Logistic Director at Suzlon (suzlon.com) Gary Kowaleski also recognizes the trucking problem and highlights a few more details that OEMs and wind farm developers should appreciate. For instance, the drivers that move super loads are the more senior drivers and few younger drivers are moving up to replace retirees. An average truck driver salary is about $40,000/yr, and tops out at about $60,000.

To make matters worse, rules and regulations are changing with respect to work hours. Lone Star’s Miller says a driver can work 70 hrs in eight days under current regulations. That person can spend 14 total hours working on the job in the course of a day, 11 of which may be spent behind the wheel.

Proposed regulations also say drivers can work 70 hrs in eight days, but a daily total cannot exceed 13 hours, with 10 behind the wheel, and two mandated 30-min. breaks. “On the surface, the new rules are not too bad. But this industry is over-dimensional so it is already restricted by curfews in metro areas,” says Miller. “So an average day actually runs from about 9 am to 3 pm because you only drive in daylight hours. Factor in the new deal with two 30-minute breaks and drive times drop to five hours or less each day. So this regulation will be detrimental. All it does is require us to buy more equipment and hire more people because of the short cycles.”

On the plus side, a recent standard from the Federal Motor Carrier Safety Administration (FMCSA) shows some promise. “It’s probably the best measurement tool we have in the industry,” says Miller. “It will weed out some bottom feeders that don’t do the job right. But it needs some refining and tweaking.” For example, he says, a measurement system puts companies into peer groups. Lone Star is a specialized carrier, but the FMCSA groups it with van carriers that have the same population of trucks or drivers. “We operate 1,000 special trucks while JB Hunt, for instance, operates 1,000 vans. But we are graded the same. That makes no sense.”

Likewise, the points assessed for violations needs adjusting. “For instance, a driver involved in a fatal accident is assessed a violation of two points. But if an inspector find a frayed strap or securement device, the company is assessed a penalty of ten pts. “It seems the fatality should carry a lot more weight or point value than a frayed strap. So the point system also needs an adjustment,” he adds.

The nacelle arrives at a wind farm on a 13-axel rig operated by Lone Star Transportation. Almost each part of a wind turbine requires specialized equipment for transport.

In port Keeping up with advances in the wind industry is one challenge ports face. They must foresee what cargo will be offloaded and provide storage for it, as well as infrastructure that gets cargo to a final destination. “That means anticipating changes that might take place, such as how wind industry loads influence port facilities,” says Alastair Smith, Senior Director of Marketing Operations for the Port of Vancouver, Wash. For example, in 1999 turbines were mostly 660-kW units and weighed about 19 metric tons (1 metric ton = 1,000 kg or 2,200 lb). “Now we handle nacelles that weigh about 90 metric tons and some manufacturers hint they could be up to 132 metric tons in the near future,” says Smith. “So we’ve had to make sure we have the capability to handle those.”

One rising issue is having enough space to handle large components. For ports, it’s not a matter of handling a single construction project, but balancing multiple projects at one time. For example, Smith finds turbine shipments are frequent in a year’s first quarter. But construction firms don’t get access to wind farms until second quarters. Hence, the port has to stockpile a lot of material prior to construction firms taking stuff out. “Construction companies want the turbines all in one place when they get access into wind-farm sites. Then they want components delivered at a steady pace.”

Smith says his team allocates acreage for all projects and ensures that if they do not have enough acreage available, they will develop more. This year, the port developed 25 acres and will add 24 more.

With regard to costs, most shipping charges do not come from ports. Smith says the Port of Vancouver has an advantage over others in that it has the best access to about five major areas in the U.S. where wind is growing: Pacific NW, California, Colorado, Texas, and Upper Midwest. “The transit time from Asia, where a lot of towers are made, to the West Coast is about 15 days. “Taking a shipment to a Gulf port would take 30 days, so the port has a 15 day advantage,” he explains. Cost estimates for the extra 15 days include the vessel charter rate, fuel consumed, and fees for going thru the Panama Canal. Thus, the charter rate for a vessel can be $25,000/day for an extra $375,000. Fuel cost is close to another $225,000. Then add $100,000 for the canal.

Wind on the rails

A few OEMs have addressed their logistics problems in part by locating factories on the Great Plains. From there, shipping by rail across the relatively flat expanse is less problematic than over mountains. However, although railroads are generally considered more efficient than trucks, a few tunnels in the East and West are too small.

Wide nacelles are problematic because tunnels and tight mountain turns are a constraint on rail shipping. For instance, if turbines must be transported through some parts of West Virginia, Pennsylvania, and Maryland, the 13-ft max width drops due to smaller tunnels and tight turns. Long blades, 55m and more, are also difficult to transport through some tunnels.

Railroad limitations also fall into structural and operational categories. Structural limitations refer to loads that cannot exceed the 13-ft width. Flatbed rail cars are 10 ft 8-in.wide, so nacelles can exceed that by a small margin, but 12.5 ft is about max. Width is so critical that trains with wide loads cannot pass each other on adjacent tracks.

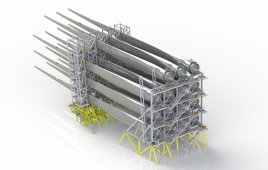

Unit trains are generally least expensive to operate. These have much the same freight, such as all turbine components. To haul such equipment, private companies such as Kasgro Rail (kasgro.com) and TTX (ttx.com) have built and own most of the about 400 8-axel cars capable of 400,000 lbs or 200 tons. The car owners would like to keep that stock busy.

At times, it has taken days to unload trains because of limited storage, or the construction firm is not ready for the equipment. Offloading a train at a spur requires a crane hired by a third-party logistics operator.

Unit trains have a few challenges. For instance, a train of nacelles might exceed the design rating of some bridges, an evaluation that calls for limiting a load per distance. Railroads get under the limit by putting an empty car, a spacer, between each 8-axel flat bed. Hence a 25-nacelle train would require 25 spacer cars if it must use an older bridge.

As with other transport companies, railroads would like advanced notice to plan big shipments and involvement in the development of new turbines. GE, for example, had the foresight to consult with CSX while designing its 2.5-MW turbine which the company manufacturers in Florida. The company involved the railroad in 2009 when work began and shipments now proceed without difficulty.

A few solutions

Almost every transportation representative sees solutions to logistics problems. For example, all agree it’s a good idea to partner with your shipper. Lone Star’s Miller says his company would like to act as a transportation consultant. “We ask, ‘can your components become modular?’ If so, what does that do you for the reassembly tasks? And, can sourcing and suppliers be more localized? Also, we suggest opposing regulation changes and support lifting other restrictions we face with respect to over dimension loads.”

Miller says his company would rather spread its assets around and do more projects with less equipment per project by having other transportation modes such as rail bring components close to the site and let his trucks work the last few miles. “That would let us put one truck on site instead of six. Then I can assign the remaining five to other projects. We work with other modes of transport because we know one carrier can not do it all. Strategic partnerships are a huge part of this business.”

This year, the port of Vancouver Washington allocated 70 acres just for wind energy. It takes about one acre to park about six towers (24 sections) with room between to effectively move trucks and trailers. Two years ago the port purchased Terminal 5, which adds 100 acres for project cargo, enough for 600 tower sections.

Energy Transportation Inc. Business Developer and Logistics Manager Shelli Short (energytran.com) says her company found a successful and similar strategy in building a large flat gravel lot near a rail spur chosen because it’s within 200 mi of several wind farms. The lot is intended to hold large parts that will be trucked the final leg to sites. She reports that the strategy has been working well. Short also suggests that country-wide permitting for transports would be a good place to start fixing the problem of turbine shipping and its expenses. Each state differs in planning, permits, and costs, and some charge up to $50,000 for the permit alone.

Maintaining nacelle sizes and weights will allow fitting new turbine designs on existing 13-axel trailers, equipment acceptable in most states. But if nacelle weight exceeds 165,000 lb, 19-axel trailer might be an option, while actual transport and timing becomes a research project. Suzlon’s Kowaleski says designers at OEMs are listening. “For example, Suzlon recognized an opportunity to expand its existing tower line from an 80-m design to include 90 and 100 m. There were no difficulties with the 80-m tower relative to transport, but two years later, a 90-m tower design was introduced which could be manufactured at our supplier in Mexico. However, it would not have been possible to transport it by rail to North America due to a wide base diameter that could not have passed over a particular bridge. During the design of the 100-m tower, transport details were requested and supplied to engineering relative to North America logistics. When the design for the 100-m tower arrived, we saw it had the same base diameter as the 80-m unit, which made our 100-m unit viable for rail transport from Mexico. The OEM engineering team is listening.”

If OEMs don’t listen to the logistics people, things can get messy. For example, a construction manager recently explained that if a load at a rail stop is too heavy for one truck, as with one recent nacelle, they’ll take pieces and parts off until it’s under a weight limit. Just keep the reassembly manuals handy.

WPE

Filed Under: Construction

how can you move a 90 metrics tons transformer

Would it be less costly to deliver the materal to the job site, and form it and assemble them on spot. Then you could save on the high cost of large equipment and transporting on land. On water it would be the same and have large barges to deliver them and erect them.

Hi, I am Angolan, civil engineering diploma hoder. I am interested in learning everything about renewable energy. I have so far aquired some materials for the “do it yourself ” experiences.

Please help.