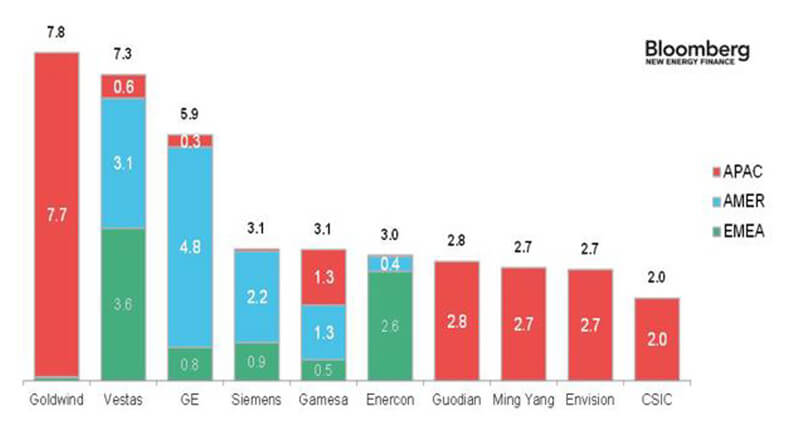

For the first time, a Chinese firm in has topped the annual ranking of onshore wind-turbine manufacturers in 2015. Xinjiang Goldwind Science & Technology led Bloomberg New Energy Finance’s (BNEF) annual rankings with 7.8 GW of capacity commissioned, buoyed by a surging Chinese market that installed a record 28.7 GW last year.

Virtually all Goldwind’s 2015 capacity was built in China, a market where, combined, foreign manufacturers accounted for less than 5% of market share.

Goldwind surges to the top: ranked number one onshore turbine seller in 2015 by commissioned capacity.

Denmark’s Vestas followed in second place with 7.3 GW commissioned, up 2.5 GW from 2014. The company pursued a global strategy, commissioning projects in 32 countries globally, 18 more than the next-highest competitor.

GE fell from first place last year to third in 2015 with 5.9 GW, 700 MW more than it commissioned in 2014. GE is the largest turbine provider to the U.S. market, which accounts for 62% of its global installations.

“It’s hardly surprising that five Chinese manufacturers made the top 10 ranking in a year where China contributed roughly half of the global capacity,” said Amy Grace, head of wind research for BNEF. “It is more surprising how dominant Goldwind was in its domestic market. The company commissioned more than two-and-a-half times the amount of capacity as the next largest Chinese manufacturer, Guodian.”

In the onshore segment, which accounts for the vast bulk of the market, Germany’s Siemens tied for fourth place with Spain’s Gamesa as both companies installed 3.1GW in 2015. Meanwhile, German firm Enercon fell to sixth place. Enercon continues to dominate its home market, which accounted for 48% of its turbines commissioned in 2015.

Four Chinese manufacturers feature in the bottom half of the global top 10 onshore ranking. Guodian fell to seventh place from sixth last year, Ming Yang and Envision tied for eighth place, and CSIC joins the list for the first time in tenth place with 2 GW of installed capacity.

For offshore wind power, Siemens was the number one turbine manufacturer last year by a wide margin. The company commissioned 2.6 GW in 2015, more than four times second-ranked Adwen, a joint venture between Gamesa and Areva.

Bloomberg

www.bloomberg.com

Filed Under: News