This edited commentary comes from Jukka-Pekka Mäkinen, president and CEO of permanent-magnet-generator manufacturer TheSwitch

Jukka-Pekka Mäkinen, The Switch President and CEO

The Switch came to the market five years ago on a mission to bring better drive train technology to wind power generation and allows more energy per turbine. The drivers today remain the same: better quality power, more energy, and more robust, compact design for PMGs.

Despite the technology transition, we’re living in a world now marked by constant turmoil. Although many things are moving forward, there is always some force pushing true success in the renewable energy industry down. This makes it impossible to predict volumes as before.

There is a demand for higher quality products with lower prices. The times are forcing turbine manufacturers to focus on their core competences and select value-adding partners who can carry responsibility for their products and services.

The players aiming to survive and thrive in the renewable energy industry must develop organizations with an ability to work in an networked manner. Vertical integration worked fine when there were shortages of components and the industry was still emerging. But those times are past. Vertically integrated companies find themselves facing challenges due to volatile market conditions when it comes to technology, production, and inflexible organizations. They’re feeling the pain of trying to do it all themselves.

The way forward for these turbine manufacturers requires a new way of working – even a new business model – that embraces cooperation and collaboration, which leads to greater effectiveness. The perfect business model during our unpredictable times is based on specialists that know how to network and add value for better end results.

Five reasons for optimism

In spite of market uncertainty, we see reasons to believe in a bright future. For example:

- Money is available from private equity, which hasn’t been there before. This is because the wind-power industry is finally mature enough and ROI becoming more attractive due to the short payback times of wind-power installations.

- Positive signs continue for offshore, especially in certain regions or countries such as Germany, France, Denmark, the UK – and eventually China and the U.S.

- Public opinion still favors renewable energy. Most governments still have it on their agendas despite the global economic crisis.

- Real advancement in nuclear power has stalled, creating gaps between the nuclear output planned and rising energy demands. The decisions in Germany are now being followed by other countries – and are putting renewable energy back into plans with greater interest.

- In good wind locations, wind power is the cheapest way of all to produce energy. Not only is it the safest, most secure energy generation investment with the shortest payback time, it is also the fastest to build.

China’s steps ahead

China has finally placed quality ahead of quantity and wants to evaluate the performance of the turbines they are installing. Growth in the overall market has slowed, but the value of higher performance equipment has been realized. Some Chinese power producers now specify PMG and fixed price contracts in their requirements.

China’s internationalization may not have materialized as expected a few years ago. The image of poor Chinese quality slowed the process. Nevertheless, the country’s turbine manufacturers and power producers have set their sights on internationalization. This will not be the “takeover” scenario of earlier feared by many, but rather a gradual and natural internationalization process, including localization of operations with new job creation.

Time: the biggest threat to growth

Time is one of the biggest threats to a rosier growth outlook. For example, how long will it take the Chinese government to regain trust and move forward? How long will it take for turbine manufacturers to get their offshore turbines developed and installed at sea for qualification? How long will it take before turbine manufacturers realize that vertical integration is an outdated model that will actually choke their future?

The way manufacturers handle their time pressure will be critical to their success. Aligning with partners long term can alleviate some of this pressure and lead to even greater added-value innovations for the industry at large.

Opportunities for the industry in 2012

We also see that permanent-magnet technology has good application opportunities in areas such as marine. High-speed motors are also in wider use and replacing the geared systems used in compressors and pumps.

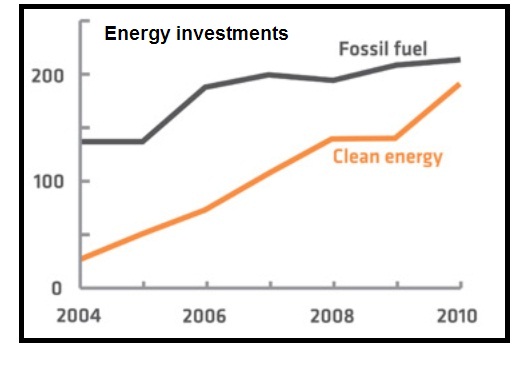

The graph plots investments in clean and fossil-based generating capacity from 2004 to 2010 ($billion). Public opinion remains favorable towards renewable energy and positive signs continue for offshore. Despite the volatile economic situation, there is growing proof that New Energy competes effectively as a source of power generation. The installed capacity of clean energy from 2004 to 2010 has nearly matched that of fossil-based generating capacity. Source: Bloomberg New Energy Finance, November 2011

We are confident about thinking once again like a winning start-up company – and are open to new partnerships and technologies that make products even better together. For instance, the horizontal supply chain collaboration between Moventas and The Switch led to the innovative FusionDrive wind turbine drive-train concept.

The company’s Model Factory concept lets clients move into new production areas such as, near-shore parks. This creates local jobs at locations convenient to final wind-farm sites.

The company is in a position to take more control in customers’ production facilities, ramping up and down in a flexible manner, and to enter regional production cooperation with them.

A recommendation for the future is to outsource risk to proven added-value partners, divide responsibility among specialists in a networked team for value-added business collaboration, and innovate new-generation turbines for the future.

The Switch

Theswitch.com

Filed Under: Financing, Generators, News, Policy