This article comes from Bird & Bird, and through Lexology.

Large companies are increasingly setting the agenda for the growth of renewable energy across the globe. Purchasing power directly from renewable energy generators under a Corporate Renewable Power Purchase Agreement (Corporate PPA) allows corporate consumers and generators to take advantage of a range of economic, reputational and sustainability benefits. Bird & Bird’s lawyers advised on one of the earliest corporate PPAs in 2009 and we have become an experienced advisor on these structures both in the UK and globally.

What are corporate renewable power purchase agreements?

A corporate PPA let corporate consumers purchase power on a long term basis directly from renewable energy generators without being co-located. This is an alternative to the traditional model where a utility purchases power from lots of generators, transmit it on the electricity grid and then on-supplies power to consumers.

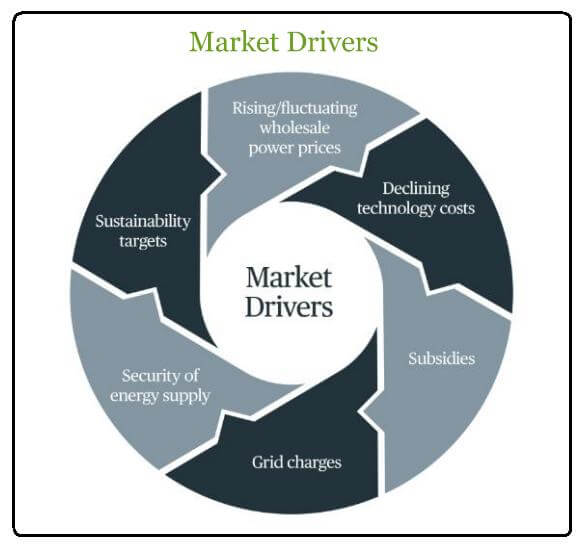

Global corporates are becoming increasingly pro-active in managing their energy needs: the ability to source electricity directly from renewable sources, together with achieving long term price certainty, has become a key business objective. This has led to strong growth in corporate PPAs in recent years, particularly in USA and LATAM. Major players in the global corporate PPA market to date have been Google, Apple, Amazon, Unilever, Microsoft and others.

Corporate PPAs have been around in the UK for some time (our lawyers closed a wind corporate PPA with Sainsbury’s in 2009). The rise of solar has triggered further growth. Major corporates now play in the UK market, including BT, M&S, Nestle, McDonalds, HSBC, Lloyds, and Nationwide.

Opportunities and threats for corporate consumers

|

Opportunities |

Threats |

| Fix power price – hedge against rising energy and fluctuating energy prices in the wholesale markets. Prices have almost doubled in past 10 years, with high volatility. 40 to 50% rises are expected in next 15 years1. | Board appetite for the deal – economic benefits only stack up if the board trusts the power price forecasts. Board often unwilling to pay more in short-term for lower prices in long term. |

| Power purchase not core business – lack of know-how/expertise in closing the transaction. | |

| Complexity/costs in negotiating the contracts. | |

| Achieve sustainability targets and objective to buy 100% of power from renewable sources. RE100 is a group of companies who have pledged to work towards meeting 100% of their electricity requirements from renewable sources, thereby significantly increasing the demand for renewables. | A utility will still be required in the contractual chain to provide power when the generating station is not generating (renewable power is intermittent) – additional contracts and complexity. |

| If a project finance lender has financed the project it may require further security – e.g. direct agreement with the corporate. | |

| Change in law risks affecting commercial balance of the deal and triggering re-negotiation, particularly post Brexit referendum (removal of LECs a recent example).

|

Opportunities and threats for generators

| Opportunities | Threats |

| Generator can achieve a stable price over the long-term as the corporate consumer often has more appetite to hedge against forecast rising/fluctuating power price rises. This is particularly attractive for projects financed by listed yieldco funds and project finance. | Creditworthiness and bankability of offtaker – a bigger issue for unsubsidised projects as the Corporate PPA will represent almost 100% of total project revenues.

|

| Power offtake not core business for the corporate – if power prices decline will the corporate default in order to buy their way out of a bad bargain? Corporate less concerned about reputational impact as it is not core business?

|

|

| Consumer sometimes willing to pay higher than wholesale prices in the short term (on the expectation that this will pay off in the long-term when prices rise and consumer still has the benefit of the fix).

|

The deal will need to be bankable – more complex to get a Corporate PPA approved by banks/investors?

|

1 DECC November 2015

The two leading models for Corporate PPAs are what are known as the “Sleeved” Corporate PPA; and the “Synthetic” Corporate PPA. The Sleeved Corporate PPA is the contract structure that has mainly been adopted in Europe, whereas the Synthetic Corporate PPA has been the preferred contract structure in the USA.

Read the rest of the report here: https://goo.gl/C6zxKu

Filed Under: News