Research & Consulting firms such as MarketsandMarkets monitor and analyze the world’s businesses providing a perspective that might not be available to those much closer to a smaller slice of their industry. Recently, Rajiv Roychaudhuri, Associate Director with the Energy and Power Practice of the firm answered several questions.

How are companies bringing down the cost of offshore wind?

Offshore wind is gaining importance nowadays as countries are focusing on harnessing the energy of strong, consistent winds found over the oceans. Offshore wind farms currently account for a small amount of the total installed wind-power capacity in the world. The offshore wind market has been rapidly growing, especially, in Europe because it provides a significant contribution to meeting European Union (EU) renewable energy targets for 2020.

Of course, offshore wind farms are more expensive than fossil fuel-based power plants and cost twice as much as the onshore ones. However, the cost is expected to decrease significantly over the next couple of years owing to technological advancements.

Players integral to the value chain of wind energy include turbine manufacturers, electric utilities, government agencies, and even the academic institutions. These companies are keenly working on bringing down the cost of offshore wind.

For instance, DONG Energy AS (Denmark) has partnered with Oxford University to bring down the costs associated with foundations for offshore wind turbines. Similarly, government organizations, such as Offshore Wind Programme Board (U.K.), and Renewable UK are developing solutions for eliminating project losses and has a target of cutting costs by 30% by 2020. Furthermore, Siemens AG, Germany aims to lower offshore wind levelized cost of electricity (LCoE) to below €0.08/kWh by 2025 through initiatives relating to turbine technology, foundations, improved operation of service vessels, use of remote diagnostics, improved power ratings, and innovative structural design and services.

What electric generator developments are you tracking?

Regarding electric generators (used in wind turbines), we maintain an elaborate database of developments that have occurred over the past five years. We mainly focus on four types of developments: new product launches, contracts & agreements, mergers & acquisitions, and expansions.

New product launch refers to all products, in this case, all the new electric generators launched by key players over the last five years. Contracts & agreements refer to tracking all projects (including the value) awarded to key players for offering the electric generators. Mergers and acquisitions refer to the deals that companies make which will directly impact the electric-generator market and expansions relate to the companies’ product extension in producing more electric generators. Apart from that, we also analyze the market share of the companies with respect at a product level.

What are the notable developments in direct-drive turbines?

Direct drive (gearless) wind turbines are less complex because the design eliminates the need for a gearbox. This feature makes the operations and maintenance of direct drive wind turbines easier than those with gearboxes and hence the design is more suitable for offshore wind farms. These turbines also have a higher nominal power rating, being the lowest wind speed that generates nominal wind power. However, these wind turbines are costlier than geared versions.

So companies such as Siemens AG (Germany), and General Electric Company (U.S.), among others, are actively involved in lowering the levelized cost of energy as well as improving the efficiency of the direct drive wind turbines.

For instance, in 2016, Siemens launched SWT-8.0-154, an offshore direct-drive wind turbine which features new magnet technology that enables a rated power increase of more than 14%, from 7 to 8 MW. By 2020, Siemens expects 1,000 offshore direct-drive turbines to have been installed, increasing the combined energy produced by the platform (Høvsøre, Denmark) by more than tenfold, to 27 TWh.

Also, Siemens has introduced SWT-3.6-130, a new onshore direct drive wind turbine for medium wind sites. It features an integrated cooling system in the nacelle that ensures optimal cooling of the generator and other electrical components.

In the early half of 2017, Siemens was awarded three contracts for the supply and installation of 13 of its gearless turbines in Lower Saxony and Schleswig-Holstein. For the WPD Windpark Damme GmbH & Co. KG, Siemens is likely to install and commission six units of the latest type SWT-3.3-130.

Siemens has introduced SWT-3.6-130, a new onshore direct drive wind turbine for medium wind sites. Source: Siemens

Earlier in 2016, Siemens announced the addition of three new wind turbines to its onshore, direct-drive portfolio. “Our new wind turbine portfolio is the result of an intelligent platform strategy that allows maximum flexibility,” said Onshore CEO Thomas Richterich. “Our customers benefit from benchmark setting performance in different wind classes and from the adaptability of our technology that meets nearly every site-, grid- and project specific requirement. Thanks to digitalization, these turbines are open for further optimization and individualization.”

Similarly, Northern Power Systems (U.S.) launched a 2.3 MW, direct-drive design featuring permanent magnet technology which reduces the weight of the turbine. Companies such as Goldwind (China), Vestas Wind Systems A/S (Denmark), and others are focusing on bringing down the cost of the direct drive wind turbines.

The direct drive PMG synchronous generator offers significant advantages over conventional gearbox turbines:

- Lesser components and higher availability: average availability exceeding 98%

- Lower maintenance costs

- Higher partial load efficiency; 5 to 7% higher energy production due to permanent-magnet excitation

- Low voltage, low speed, and a reliable generator

- Few moving parts, leading up to reduced noise levels

- Rotor Diameter is large and it has the highest hub height in its class

What are the hot wind topics you are pursuing?

We have published various reports on wind energy such as small wind market, wind turbine composites material market, wind turbine rotor blade market, direct drive (gearless) wind turbine market among others. The most recent is the offshore wind market, which covers the market for turbines, substructures, electrical infrastructure, and logistics & installation. The turbine discussions cover nacelle modules, tower modules, and rotor modules. The substructure includes foundation, scour protection, and marine systems. The electrical infrastructure includes offshore substation, cables & accessories, and land-based transmission infrastructure. Moreover, the logistics, transportation, assembly, and installation (electrical, turbine, & foundation) associated with offshore wind is also a part of the study. Furthermore, we are presently working on a report on floating power plants that will focus on the market for new floating wind turbine technology.

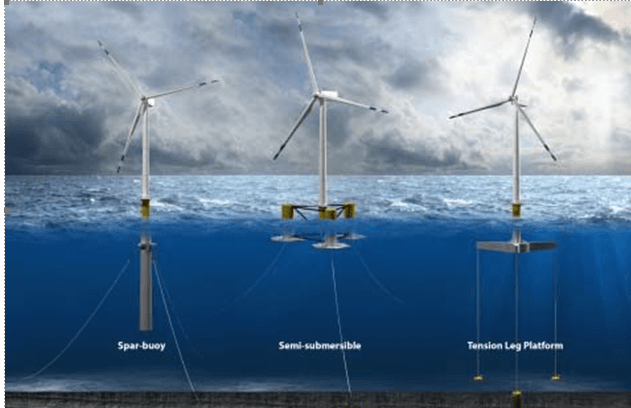

The world has plenty of deep water for the winds offshore and a growing number of platforms for wind turbines. Source: DNV GL

Semi-submersible platform: This is a buoyancy stabilized platform which floats semi-submerged on the surface of the ocean whilst anchored to the seabed with catenary mooring lines and often requires a large and heavy structure to maintain stability, but a low draft allows for more flexible application and simpler installation

- Spar-buoy: This is a cylindrical ballast-stabilised structure which gains its stability from having the center of gravity lower in the water than the center of buoyancy. Thus, while the lower parts of the structure are heavy, the upper parts are usually lighter, thereby raising the center of buoyancy. The simple structure of the spar-buoy is typically fairy easy to fabricate and provides good stability, but the large draft requirement can create logistical challenges during assembly, transportation, and installation, and can constrain deployment to waters >100m depth.

- Tension leg platform (TLP): It is a semi-submerged buoyant structure, anchored to the seabed with tensioned mooring lines, which provide stability. The shallow draft and tension stability allows for a smaller and lighter structure, but this design increases stresses on the tendon and anchor system.

Some of the variations to these typologies include the multi-turbine floating platforms and the Hybrid wind/wave floating devices. Each typology does carry its own strengths and weakness, majorly dictated by the site conditions. Nearly 30 concepts are in development, with more than two thirds emanating from Europe. Design standards are still under development and as developed by DNV-GL & ABS

Filed Under: Offshore wind