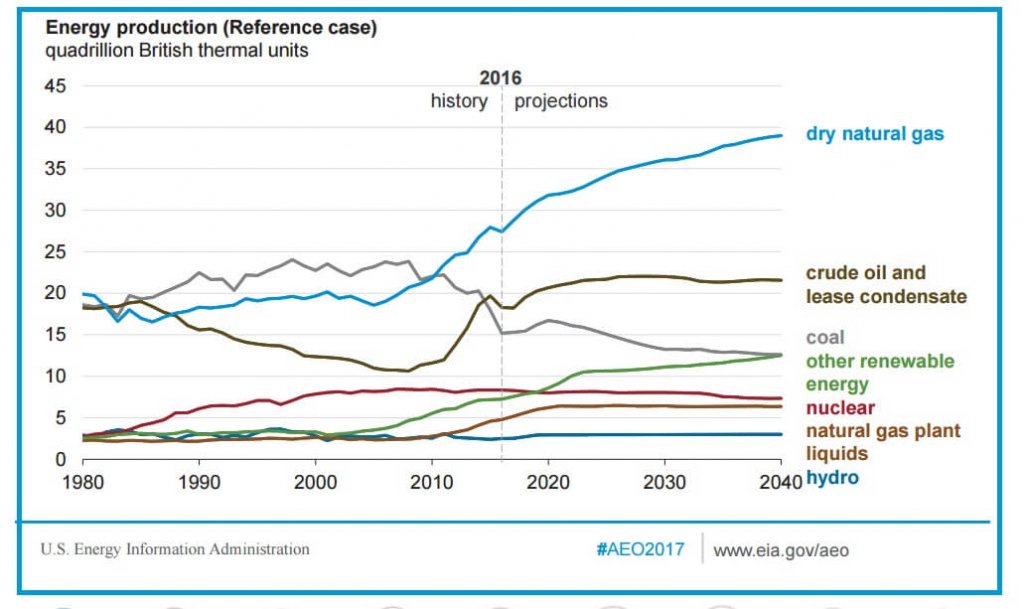

EIA’s Annual Energy Outlook provides modeled projections of domestic energy markets through 2050, and includes cases with different assumptions of macroeconomic growth, world oil prices, technological progress, and energy policies. With strong domestic production and relatively flat demand, the United States becomes a net energy exporter over the projection period in most cases.

The Annual Energy Outlook provides long-term energy projections for the United States

- Projections in the Annual Energy Outlook 2017 (AEO2017) are not predictions of what will happen, but rather modeled projections of what may happen given certain assumptions and methodologies.

- The AEO is developed using the National Energy Modeling System (NEMS), an integrated model that aims to capture various interactions of economic changes and energy supply, demand, and prices.

- Energy market projections are subject to much uncertainty, as many of the events that shape energy markets and future developments in technologies, demographics, and resources cannot be foreseen with certainty.

- More information about the assumptions used in developing these projections is available shortly after the release of each AEO.

- The AEO is published pursuant to the Department of Energy Organization Act of 1977, which requires the U.S. Energy Information Administration (EIA) Administrator to prepare annual reports on trends and projections for energy use and supply.

With strong domestic production and relatively flat demand, the United States becomes a net energy exporter over the projection period in most cases.

What is the Reference case?

- The Reference case projection assumes trend improvement in known technologies, along with a view of economic and demographic trends reflecting the current central views of leading economic forecasters and demographers.

- It generally assumes that current laws and regulations affecting the energy sector, including sunset dates for laws that have them, are unchanged throughout the projection period.

- The potential impacts of proposed legislation, regulations, or standards are not reflected in the Reference case.

- EIA addresses the uncertainty inherent in energy projections by developing side cases with different assumptions of macroeconomic growth, world oil prices, technological progress, and energy policies.

- Projections in the AEO should be interpreted with a clear understanding of the assumptions that inform them and the limitations inherent in any modeling effort.

What are the side cases?

Oil prices are driven by global market balances that are mainly influenced by factors external to the NEMS model. In the High Oil Price case, the price of Brent crude in 2016 dollars reaches $226 per barrel (b) by 2040, compared to $109/b in the Reference case and $43/b in the Low Oil Price case.

- In the High Oil and Gas Resource and Technology case, lower costs and higher resource availability than in the Reference case allow for higher production at lower prices. In the Low Oil and Gas Resource and Technology case, more pessimistic assumptions about resources and costs are applied.

- The effects of economic assumptions on energy consumption are addressed in the High and Low Economic Growth cases, which assume compound annual growth rates for U.S. gross domestic product of 2.6% and 1.6%, respectively, from 2016–40, compared with 2.2% annual growth in the Reference case.

- A case assuming that the Clean Power Plan (CPP) is not implemented can be compared with the Reference case to show how the absence of that policy could affect energy markets and emissions.

Led by growth in natural gas and renewables

Natural gas production accounts for nearly 40% of U.S. energy production by 2040 in the Reference case. Varying assumptions about resources, technology, and prices in alternative cases significantly affect the projection for U.S. production.

- Crude oil production in the Reference case increases from current levels, then levels off around 2025 as tight oil development moves into less productive areas. Like natural gas, projected crude oil production varies considerably with assumptions about resources and technology.

- Coal production trends in the Reference case reflect the domestic regulatory environment, including the implementation of the Clean Power Plan, and export market constraints.

- Nonhydroelectric renewable energy production grows, reflecting cost reductions and existing policies at the federal and state level that promote the use of wind and solar energy.

- Nuclear generation declines modestly over 2017 to 2040 in the Reference case as new builds already being developed and plant uprates nearly offset retirements. The decline in nuclear generation accelerates beyond 2040 as a significant share of existing plants is assumed to be retired at age 60.

Filed Under: Uncategorized