By Ivan Mednikov and Ivor Shaw, Stantec

With recent pro-renewables legislation passing in both the United States and Canada that encourage energy storage adoption, the North American wind industry enters a new era. This intermittent energy resource can now more easily be supplemented by energy storage to provide a dispatchable electricity solution. This makes wind power competitive not only at the cost level, but also in reliability.

With recent pro-renewables legislation passing in both the United States and Canada that encourage energy storage adoption, the North American wind industry enters a new era. This intermittent energy resource can now more easily be supplemented by energy storage to provide a dispatchable electricity solution. This makes wind power competitive not only at the cost level, but also in reliability.

From Stantec’s extensive experience, we have found historical serial decrements in capex for wind paired with energy storage. It is now possible to baseline the lowest cost of electricity for an intermittent wind generation project at around CA$0.04/kWh. Furthermore, including dispatchability via energy storage could range up to 50% of additional cost depending on the desired duration as well as site- and system-specific factors. At such competitive prices with reliable power delivery, the end users do not need to fear where their power comes from, and grid operators can receive desired electricity to specifications.

Reliability of wind + storage

The variability of wind power has been studied profoundly by numerous associations, agencies, and laboratories, including NREL. These groups have accumulated a plethora of historical information and created wind models capable of predicting the wind power at different hub heights with a previously unseen accuracy. The increasing availability of high-quality wind resource databases means that feasibility-level assessments of wind resources can be undertaken for a fraction of historical costs. Of course, many projects have site-specific challenges such as icing or rapid elevation differentials that may still require meteorological mast studies. But nonetheless, the information gathered over the years provides a smoother road to accurate estimates. An early example of how this can be applied was shown by the Saskatchewan Research Council’s (SRC) reliable wind storage system, known as the Cowessess First Nation Project. From a request-for-proposal to the final performance summary, SRC provided a first-hand source of data on implementing a grid-connected wind and storage system.

It is clear to Stantec that we can meet the specific needs of the industry with renewable power and storage. Increasingly, our clients are pushing us to develop energy plans that support both sustainability and resilience goals. We see sustainability-driven projects in the commercial sector, such as NS trains in the Netherlands, and Raglan Mine in the mining sector, as present and future beneficiaries of the wind and storage systems’ synergy. The key to implementation success is an ability to adequately control the system. Within Stantec, we routinely use software-based modeling and optimization approaches to assess the resource, define power demand and delivery at points of interconnection, and fast-track commercial operation dates of our projects.

The question of reliability certainly becomes more substantial for off-grid projects. It has become clear to us that diversifying energy generation by including other sources such as solar further improves reliability. For instance, during low-wind, high-sunlight intensity hours, the burden of meeting the demand load can be partially or fully offset from storage systems to solar generation, thus potentially prolonging the lifespan of the storage setup by decreasing the number of cycles. Historically, we have seen that, due to the unavailability of grid connection coupled with site-specific topographies, the cost of energy storage often becomes the deciding factor. At larger scales, for example, with continuous 50 MW of demand, a system would require 200 MWh of energy storage to meet four hours of electricity requirement. With the latest NREL projections, the capex of the batteries this size is estimated at over $68 million today. However, accounting for a projected 35% drop in cost by 2030 and existing tax incentives, in the next 10 years project owners could expect the capex to be less than half of what we are seeing today, making fully renewable solutions even more attractive. All of that, naturally, with the lowest greenhouse gas emissions power sources.

Wind + storage options

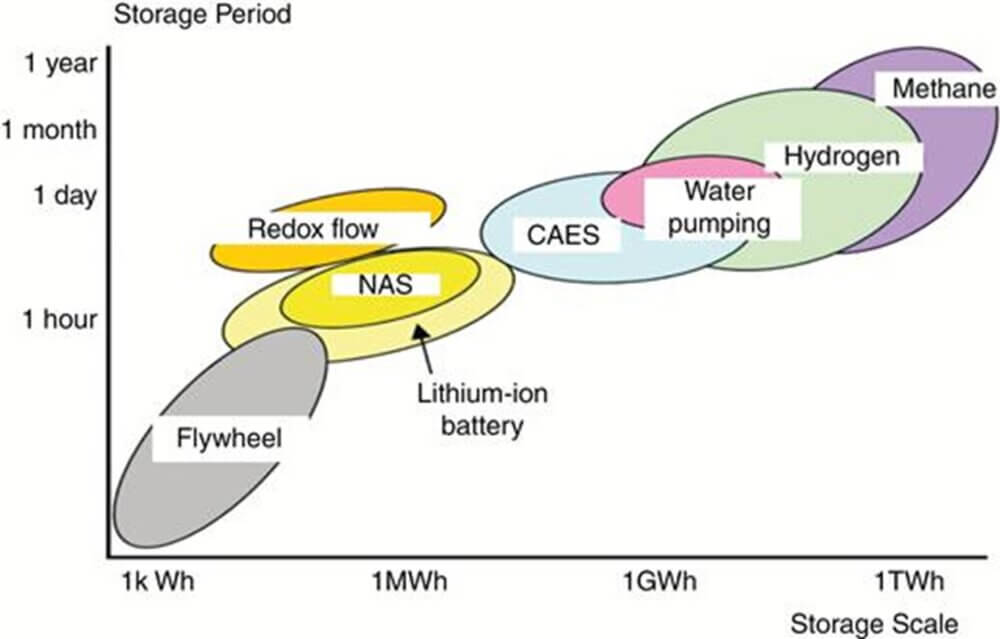

What are the energy storage options for wind farms? Shigeki lida and Ko Sakata provide a good illustration of available options based on the storage scale and required duration, as shown in Figure 1.

For the lower scale projects, Mehrdad Gholami’s recent research paper provides guidelines to achieve the required level of satisfaction and can be used by the industry to appropriately size the battery and meet reliability demands. For the larger, longer duration projects, however, the figure illustrates that there is challenge in implementing lithium-ion battery storage. From Stantec’s accumulated experience, at this scale, the high financial premium of lithium batteries in today’s market repels owners from pursuing it. Large-scale alternatives with the most experience or potential are pumped storage hydropower (PSH) and hydrogen. As the U.S. Dept. of Energy notes, PSH provides energy arbitrage opportunities, bulk power and black start capabilities, operational flexibility and non-energy benefits such as flood control, drought protection, recreation, water supply and irrigation. PSH, of course, is highly dependent on the available land’s topography. And in case of non-applicability, it is often hydrogen storage that can provide many of the same benefits as PSH at reduced physical space requirements. That’s why our teams include experts in PSH and hydrogen storage solutions with decades of accumulated experience and expertise.

As a very high-level case study, let’s consider some fabricated numbers of a possible wind farm with battery system. Assuming a wind and storage site with a constant 50 MW of electrical power demand, 28 turbines (6-MW each) totaling 168 MW of installed capacity, a typical Weibull distribution of wind speed with A and k factors of 8.5 m/s and 2, respectively, and a battery with eight hours of demand capacity totaling 400 MWh. One perspective on this system is to look at it from a viewpoint of the battery. Figure 2 shows a histogram of battery charge levels between 0% and 100% over a period of around four months. Whenever the level goes above 100%, the battery is fully charged and the turbines are producing over 50 MW of electricity. This surplus energy can potentially be sold to the grid, if feasible. In cases when the level goes under 0%, the battery is depleted, and the turbines are producing less than 50 MW of power. This displays the periods of energy deficit which can be met with a grid or other solutions such as a solar generation and/or a backup generator.

Depending on the location and wind variability at a given time, the energy surplus over a long term will be similar to the energy deficit over the same period. In other words, the electricity deficit purchases can be partially offset by the surplus sales, making the system economically attractive.

As the country’s largest emitters are working to meet government decarbonization goals, the demand for clean electricity is growing dramatically. The conventional approach of using natural gas generators is not feasible anymore due to the greenhouse gas emissions. That’s why energy storage is coming under the spotlight of importance. Additionally, many of the larger emitters are sited in remote locations where grid connections are infeasible. Yet, there is still a requirement to find alternatives to the traditional gas turbines that have become insufficient in meeting the decarbonization goals.

Stantec sees wind as a reasonable economic source of power, coupled with the appropriate energy storage solution. With existing carbon taxes and caps, government decarbonization goals, new tax incentives and ever-decreasing cost of technology, there is a critical first mover advantage of clean power and storage resiliency as a distributed source. Many regions can take advantage of the investment tax credit and help us clear the air of CO2 excess.

Ivan Mednikov is a Renewable Energy Analyst at Stantec with 2 years of professional experience as a structurer and a salesperson of synthetic financial derivative products. He earned a master’s degree in mechanical engineering at the University of Toronto and a bachelor’s degree in industrial engineering with a financial engineering option at the Hong Kong University of Science and Technology. At his previous role, Ivan was responsible for the development of optimization methodologies of global equity custom baskets by analyzing extensive universes of financial data and advising large institutional clients on statistical analyses. At his current tole, he is responsible for the development of hydroelectric and wind power systems as well as optimization of energy usage and decarbonization strategies.

Ivan Mednikov is a Renewable Energy Analyst at Stantec with 2 years of professional experience as a structurer and a salesperson of synthetic financial derivative products. He earned a master’s degree in mechanical engineering at the University of Toronto and a bachelor’s degree in industrial engineering with a financial engineering option at the Hong Kong University of Science and Technology. At his previous role, Ivan was responsible for the development of optimization methodologies of global equity custom baskets by analyzing extensive universes of financial data and advising large institutional clients on statistical analyses. At his current tole, he is responsible for the development of hydroelectric and wind power systems as well as optimization of energy usage and decarbonization strategies.

Ivor Shaw is a civil engineer with over 42 years of experience in the energy and power sector in Canada, Ireland, and the US. He has been involved in the development, design, construction, rehabilitation, and commissioning of wind and hydro projects and applications to improve the client’s return on investment. He is a wind, hydro and power delivery specialist with experience in planning, management, design, evaluation, project management, procurement and construction management. Ivor has been involved in multiple complex projects developing innovative and reliable installations in hydro, wind, T&D, and hybrid power projects for public and private entities, ranging from 1-300 MW. He has experience as an owners engineer in IPD, EPCM and EPC approaches, and due diligence.

Ivor Shaw is a civil engineer with over 42 years of experience in the energy and power sector in Canada, Ireland, and the US. He has been involved in the development, design, construction, rehabilitation, and commissioning of wind and hydro projects and applications to improve the client’s return on investment. He is a wind, hydro and power delivery specialist with experience in planning, management, design, evaluation, project management, procurement and construction management. Ivor has been involved in multiple complex projects developing innovative and reliable installations in hydro, wind, T&D, and hybrid power projects for public and private entities, ranging from 1-300 MW. He has experience as an owners engineer in IPD, EPCM and EPC approaches, and due diligence.

Filed Under: Featured