This report, from S&P Global Ratings, is authored by Primary Credit Analysts Gonzalo Cantabrana Fernandez, Madrid (34) 91 389 6955, gonzalo.cantabrana@spglobal.com and Massimo Schiavo, Paris +33 144206718; Massimo.Schiavo@spglobal.com/

Remuneration for new renewables is changing dramatically in Spain with the end to subsidies and the exposure of the sector to market pricing. It used to be that the huge investment required to develop renewable power plants was not financially feasible if the remuneration was limited to standard power prices, which created the rationales for subsidies.

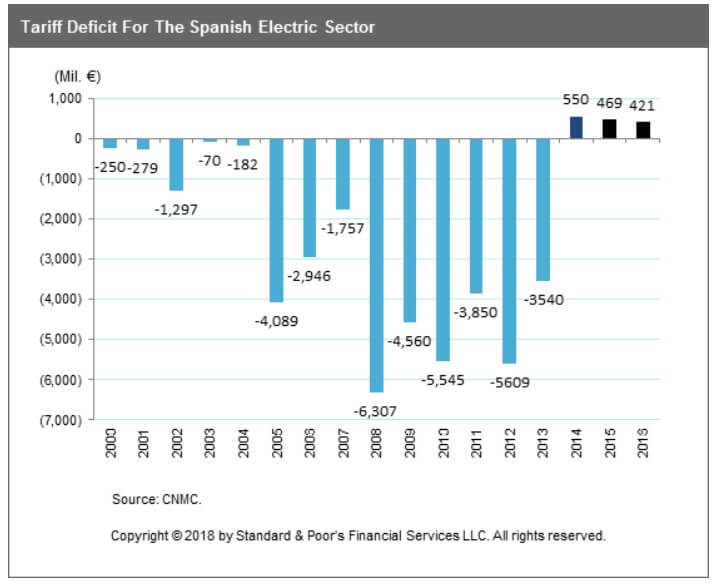

At the end of 2015, Spain’s power sector posted its first electricity tariff surplus in 14 years. The consequence was a large and growing “tariff deficit” that crushed the sustainability of the electricity system (for a more detailed explanation see “Why We See Spain’s Electricity And Gas Regulatory Frameworks As Mostly Supportive,” May 11, 2017, and see chart 1 in that article). From 2008 until 2012, the government made a series of retroactive changes to the renewable remunerations. Since these measures were not sufficient to contain the electricity tariff deficit, in July 2013 a full revision of the remuneration was announced.

Today, the drop in production costs across the supply chain and growing production scale have some governments thinking that renewables are now competitive without subsidies. As a result, they are now structuring auctions with a reduction of the subsidies.

Spain has taken this approach one step further and has awarded 8.7 GW of new renewables in 2016 and 2017 that may not receive any government subsidies. Yet, after the auction, bankers and advisers are scratching their heads about the best approach to finance what is seen as a new era of renewables.

Overview

- Spain has successfully auctioned 8.7 GW of new renewable projects, which may not receive any subsidy. We see the proposed remuneration mechanism for the new renewables as much weaker than what we observed so far in Europe.

- These new renewable projects are mostly merchant projects exposed to pool prices. Their cash flow profile is, therefore, less predictable and relies on each market participant’s long-term view of power prices.

- The remuneration of the new renewables includes an implicit floor price guaranteed by the government. This floor price is expected to change on an ongoing basis for all of the plants, and hence it is valid only under certain scenarios.

- In our view, financing the new renewable assets will be challenging due to the merchant exposure of the new plants and the tight timeframe and size of the investments. The auctioned 8.7 GW will need to be in operations by January 2020.

- More precisely, sponsors may need strong balance sheets to fund the new renewables. Project financing may be more challenging to structure, due to the implied volatility of earnings and the limited leverage potential, unless they manage to sign solid and long-term PPAs with third parties.

Lead author Mr. Gonzalo Fernandez discuss the report findings here.

Regulatory missteps still weigh on the sector

Renewable energy has been the No. 1 subject of debate in the Spanish energy market for 20 years now. Spain’s bet on clean energy through a generous endorsement program led to a massive investment in renewable power on a much wider scale than the government had expected. As a result, renewable subsidies drove increasingly high regulated costs that could not be matched by the corresponding increase in fees paid by energy consumers.

For the rest of the 11-page analysis: S&P Global Ratings or here. A link to a video discussion of the report findings is here.

Filed Under: Financing