Readers who follow the tweets of @Windpower_Eng find them occasionally referring to entertaining notices from Salvex, a reseller of surplus wind-turbine components and materials. A recent notice, for instance, listed 50 surplus cases of grease valued at $23,000 and 23 accumulator assemblies for a particular turbine model worth $35,000. It makes you wonder: Why are companies stocking so much unneeded stuff?

That kind of over-ordering is not uncommon says Fisher Johnson at MaxUp Advantage, a developer of spare-part management software. His company conducted a survey of about 60 companies and frequently found unneeded parts in stock, while critical parts went unordered. “Inventory management is one of the largest investments on the corporate balance sheet,” says Johnson. “Yet our research shows that most spare parts that companies keep on hand are inactive or non-critical. Worse yet, many of those held in excess are obsolete and likely never to be used.” Their research also indicates that nearly a quarter of the spare parts that companies need most are not regularly held in inventory, resulting in expensive spot buys and expediting charges.

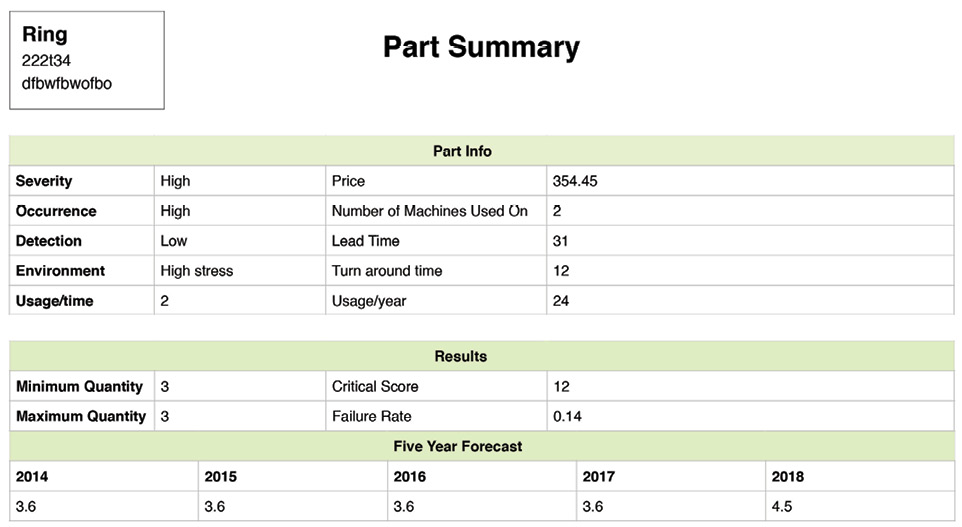

A Part Summary screen tells of a part’s use history, its critical score, and a use forecast. Criticality scores are ranked as critical, moderately critical, and non critical. Their levels are based on weighted scores using Failure Mode Effect Analysis. For instance, a score of 8 or lower is non critical, 9 to 15 are moderately critical, and greater than 16 is critical. Criticality levels are determined for both machines and parts.

A better way to manage inventory might be with smarter software that tells what’s in stock, what is not, and what should be. “For instance, when a company sets up our web-based software, it asks users questions about each part. For instance, if this part breaks, will it stop production? How quickly is it procured? What does it cost? In what environment is the part used, high or low stress?”

“With this information and more, algorithms refined from accepted part-management practices and refined for more insightful results evaluate a part’s importance along with a maximum and minimum level of parts to stock,” he says. The software also considers usage per year or how many machines use the part.

Transferring to the new software is not difficult, Johnson says. When an existing part inventory is available in Excel, it can be uploaded to the new system. He adds that part descriptions need not be extensive. One recent upload involved 9,000 parts each described by data in five or six columns, along with answers to the questions mentioned earlier.

The software’s more refined algorithms lessen the importance of pricing, and focus more on usage and lead time. Johnson says the developers also applied ideas from failure mode effects analysis to stocking. For instance, if the part fails, will it cause immediate dysfunction or will the problems be more moderate?

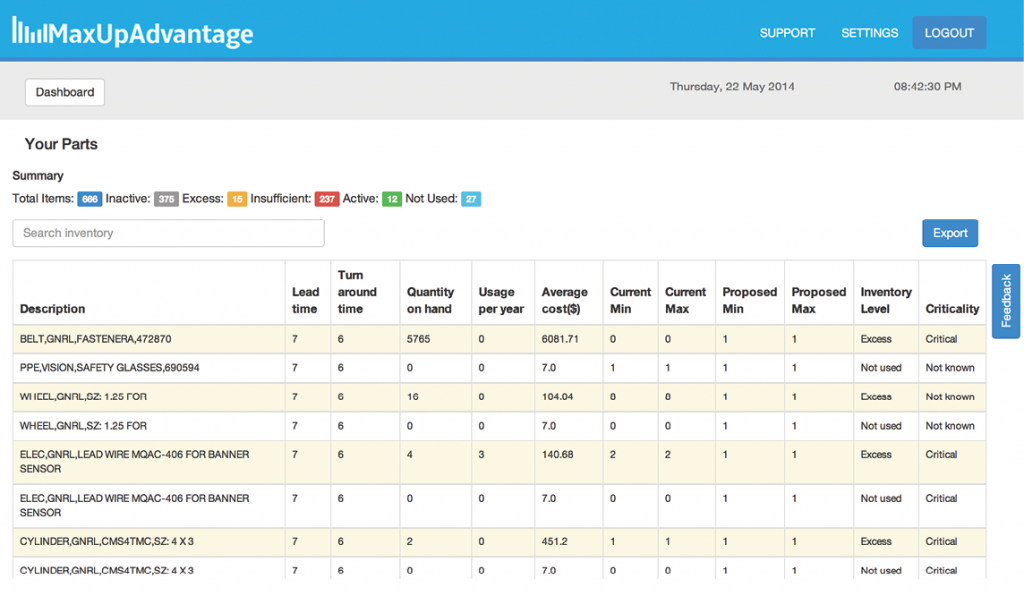

The Dashboard for MaxUp Advantage gives users an easy-to-read list of stocked components. The two columns on the far right may be the most eye opening.

Johnson says the system fills the gaps in most company-wide Enterprise Resource Planning systems, Computerized Maintenance Management Systems, schedules, and spare-part-tracking systems. Any of these systems, he says, could curtail machines for extended periods, because they would not recognize that needed parts are unavailable. For parts that will not cause dysfunction, the system suggests keeping fewer on hand.

Algorithms track part use, and after sufficient data, the software predicts when that part might break again. Johnson says the software sports a range of features such as the probability of part failure so users can proactively schedules predictive maintenance. The software will identify obsolete inventory based on usage history and criticality. Then you can call Salvex. The same maintenance philosophy is applied to a production environment in which machines are the components and the factory is the operation.

“We spun this company off of another firm that manages traveling technicians and reliability engineers, jobs similar to wind technicians,” says Johnson. In addition, the software is web-based in a secure environment so users need not maintain a large database. It does not replace existing systems but rather fills the gaps they create.

“We are getting to the point where RFID (radio frequency identification) could be the next step in MaxUp Advantage’s part control,” he adds. The tags would bring more automation to inventory control. WPE

Filed Under: Featured, O&M