This article comes from a Chadbourne newsletter and is authored by Brian Christopher Greene and Deanne M. Barrow

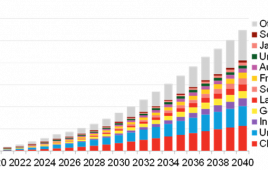

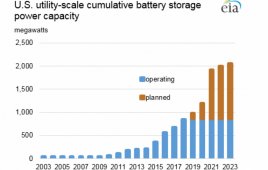

Technological and cost breakthroughs are expected to lead to rapid growth in the number of utility and behind-the-meter storage projects.

Industry insiders say the energy storage market in 2017 feels like the rise of the solar industry in the late 2000s. In 2016, energy storage developers in the US installed 336 MWh of storage, double the amount from the previous year. By 2022, energy storage installations are expected to reach 7,300 MWh and generate revenues of $3.3 billion.

States are stepping in to provide rebates and energy storage mandates. Deal flow is picking up, with lenders and investors eager to move in on this emerging trend.

In the last two years, at least two non-recourse project financings of standalone energy storage projects have closed in the US. For the energy storage market to reach its expectations, lenders and investors will

have to get their heads around the unique risks posed by storage projects

Two types

Utility-scale storage projects provide services to the utility grid.

An important service is integrating energy from variable renewable sources. Energy storage helps in two ways.

First, it smoothes out fluctuating output from solar and wind that can otherwise wreak havoc on a grid by upsetting frequency balance. Both solar and wind are prone to rapid ramp up and ramp down, leading to grid instability. Batteries having short charge-and-discharge cycles on the order of seconds can respond to fluctuating renewable output more quickly and accurately than thermal power plants.

Second, energy storage can help integrate renewables by shifting supply to better align with demand. By doing so, curtailment of these sources is avoided. This service requires batteries with longer charge-and-discharge cycles on the order of hours.

Behind the meter systems

These provide services to the grid as well as to the host customer. These systems are installed on the customer side of a utility meter. The customer can be either commercial and industrial or residential. Both residential and commercial customers benefit from having a backup supply of power. If the customer is commercial or industrial, then it gets the added benefit of demand charge savings under its retail rates. Demand charges are what utilities charge customers for their maximum load during a certain interval. They can make up a significant portion of a customer’s bill. By drawing on the battery instead of the grid during periods of peak electricity use, the customer can avoid expensive demand charges.

Behind-the-meter storage also helps with integration of distributed resources. The energy storage system can store excess energy produced by a solar system on the customer’s roof, usually during the day when the customer is not home, and release the energy when demand increases, usually during the evening. Without energy storage, the excess energy gets fed back into the grid at a time when there is no matching demand, which can cause problems for the grid.

Creditworthy corporate offtakers like Whole Foods, Walmart and Amazon are increasingly interested in energy storage. The interest of these players in energy storage is an extension of the “corporate PPA” trend that took hold in 2016.

California is the dominant market leader for storage in the United States. Total deployments in 2016 increased 100% over the previous year largely due to a burst of activity in California in the fourth quarter of 2016, when more than 200 MWh came online. The deployments were driven by fast tracking of procurement to compensate for potential electricity shortages after a gas leak was discovered at the Aliso Canyon natural gas storage facility. Other markets such as Hawaii, Massachusetts, New York and Texas are waking up.

For the rest of the article: https://goo.gl/sek5ln

Filed Under: Energy storage