Wind turbines on floating platforms have significant advantages over those mounted on fixed offshore foundations. For instance, there is much more deep water than shallow and the platforms can be anchored out of sight, just over the horizon, yet still close to load centers. Four designs discussed at the recent AWEA conference reveal the promises, challenges, and many ideas at work.

Paul Dvorak / Editor

Offshore wind turbines are mounted on at least five different types of foundations, and a few hybrids, not shown. Pick on any of the images here for a large version.

A session at the recent AWEA Offshore Windpower 2016 conference – Technology Spotlight: Floating Wind – presented four competing ideas for floating platforms that appear close to commercialization. Their timing is right because about 58% of the U.S. wind resource potential is on water with depths greater than 60 meters, a distance monopile foundations would find hard to tap.

The floating platforms are in a range of development stages. One is in commercial use, two have passed prototype stages and are in pre-commercial phases, and one advanced concept appears to combine the advantages of the others without the drawbacks.

Statoil’s Hywind Scotland

Statoil’s Hywind Scotland is the world’s first floating wind farm and is using a spar buoy design. There have been individual floating concepts but this will be the first floating wind farm. “We need several technologies and several markets for this idea to work,” said Trine Ulla, Head of Wind Asset Management, New Energy Solutions, Statoil ASA. Although the project is under construction, but Ulla said the story starts in 2001 when someone in our oil and gas company Statoil had the innovative idea that you could supply an offshore oil and gas plant with wind generated power. That, however, required new technologies.

“This technology could open up a new global renewable market, and supply markets with electricity in large scale,” said Ulla. “In 2009 we installed a demo offshore Norway – the first full-scale version using a 2.3-MW turbine, which was then state-of-the-art. That turbine is still producing power with excellent results. With the opening of the pilot park offshore Scotland, we’re now verifying that this concept is really working in a multi-turbine setting and that all technical systems are functioning well. Statoil’s Hywind Scotland is sited in water 90 to 120-m deep and uses standard turbines.

The sub-structure, under construction in Spain, measures 95-m long and 14-m diameter. Its fabrication methods have been adjusted several times, says Statoil.

The Hywind Scotland project will be commissioned in 2017, with 6-MW turbines on five platforms, similar in size to Block Island. “Other than that we also want to prove that this wind farm concept will work with the forces from the wind, waves, and current along with forces that come from the wake affects between the turbines,” she said.

Ulla added that the company’s goal is to demonstrate the economy of scale, even with the relatively small scale of five turbines. When viewed on a per MW basis, the £200 million ($249 million) investment is already producing a huge cost reduction from the demo project in Norway.

Average site wind speed is good, about 10.1 meters/sec, with fairly challenging weather conditions, such as an average wave height of 1.8 meters. The cable will be 13-km long from site to a substation onshore.

Suppliers for the project have been selected from all over Europe while smaller components and engineering come from all over the world. “We’ve had design changes that affected the sub-structure because the marine operations also affect your design. We did not manage to bundle the turbine and tower contract in one because the tower is purpose built for floating and the turbine supplier is used to mass production for fixed. One contract should be possible in the future.

In the two years preceding construction, we’ve already seen that it is possible to reduce costs for a commercial scale wind farm by more than 20%. A lot of things are going on in Europe, and we have a lot to learn from the fixed-bottom industry.”

The WindFloat rests at dockside during its recent decommissioning in Portugal. It was deployed in 43 m of water and came online in 2011.

WindFloat

The prototype from Principal Power has floated for five years offshore in Portugal and produced 18,000 MWh from a Vestas V80, 2 MW turbine. In that period, it survived several bouts of bad weather that generated 17 to 18 m waves. Its recent decommissioned also marks the start of the project’s phase two, which will be two wind farms in Europe.

“One value proposition for WindFloat is its potential to bring it to shore with commonly available tugs and in relatively shallow water in the event it requires a large unanticipated corrective action,” said Kevin Banister, VP of Business Development at Principle Power Inc. The design differs from Statoil’s Hywind in that it does not penetrate the water column as deeply and it’s inherently stable. He adds that the design came out of the gas industry as did the spar buoy.

Decommissioning was a fairly simple process, he says. “We detached the electrical cable from WindFloat and then it from its moorings. The demonstration project used four catenary mooring lines, like the spar buoy, one line from each of the two columns that did not hold the turbine, and then two mooring lines from the column on which the turbine was mounted.”

The overall budget for the decommissioning operation was less than €500,000. “That should give a sense of O&M costs for larger wind farms with tens and tens of turbines. It’s quite likely that large corrective actions on the turbine will be needed in the project’s life,” said Banister.

He added that the company met all its goals. “We demonstrated an understanding of how the project works and identified ways to reduce costs from all its aspects − Capex, Opex, and de-com or decommissioning expenditures.”

The advantages he sees for WindFloat include the fact that it uses drag anchors so it does not rely on pilings for installations. The design addresses some of the Right whale issues in this market and does away with some of the Jones Act compliance issues that more traditional bottom fixed projects might face.

The project is in phase two, a pre-commercial demonstration phase of a 25-MW project off Portugal in 2019 and a 24 MW project off the coast of Mediterranean France in 2020.

The successful decommissioning demonstration was important, “because there was no waiting for a special handling vessel or jack-up barge to come available. This also gave more options when selecting a port. So real-time savings come with the potential to bring this thing to shore.”

The good news is that costs come down as projects move to full commercial scale. “Reductions can come from commodity costs such as future reductions in the weight of the steel hull. Bids from the real world that show a path to meeting expected markets around the world,” said Banister.

A lot of the off-shore wind technologies respond well to economies of scale at the project size and the individual unit size. So the larger the turbine, the more efficient our structure becomes,” he said.

For instance, the next demonstration project will use Vestas V164 turbines which have been upgraded for this project to 8.3 MW. The power production capacity from each foundation will increase four-fold, but the hull only increases by 30% or 40% in weight.

The next deployment will be for a 25-year duration. “We’ve taken advantage of many structural improvements and optimizations, equipment improvements, better accessibility, and we’ve improved the mooring system going from four lines to three,” said Banister.

“We’re proud of the fact that as a small company we did all the planning, and conducted the operation ourselves. Although we sub-contracted two tugs, but planning was done in-house.

A final investment decision on the project could come early 2017. He adds that the project will follow the traditional finance models so commercial banks are involved.

VolturnUS

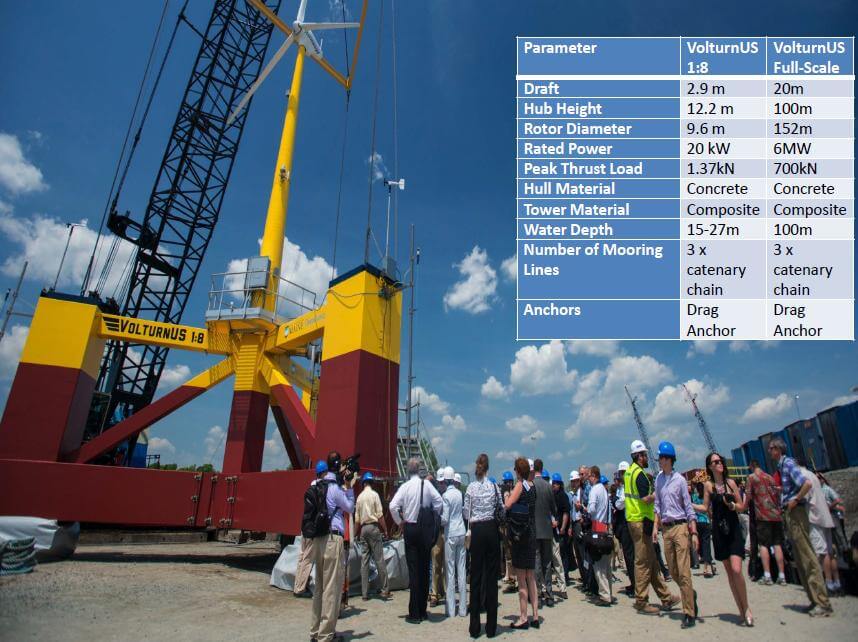

This design, also a semisubmersible, comes with a twist in that the hull is made of relatively inexpensive concrete. What’s more, its prototype boasts of being the first grid-connected offshore wind turbine in the US.

Team Dagher’s proof of concept mounted a 20-kW turbine on a floating concrete platform. The initial project was a 1:8 scale of a 6 MW floating turbine launched in the Gulf of Maine in 2013. The next project will be a modest farm of two 6-MW floating turbines anchored about 14 miles off the coast of Maine near Monhegan Island, for which the DOE provided a $39.9 Million grant.

Dr. Habib Dagher, executive director, University of Maine’s Advanced Structure and Composite Center began with the project goal: Get the cost of this technology to compete on the grid without subsidies. Good news: He thinks his team is getting close. Dagher is also the principal investigator of the 12 MW, DOE-funded Aqua Ventus I offshore wind advanced technology demonstration project.

Dagher says he and his team spent years figuring out how to drive costs down. “We didn’t just think of submersibles. We looked at spars and at tension line platforms as well. In fact, we tested these three different hull designs at 1:50 scale in 2010, each under about 50 different metocean conditions and came to the conclusion that for our application, submersibles made more sense.” The University maintains an elaborate and large wave-wind basin, featuring a movable wind tunnel over a wave basin that allows physical model testing.

Furthermore, he says, it made more sense to make the hull out of concrete. “We modeled the design after highway bridges that cross bodies of sea water. We were thus developing a whole different supply chain to help us drive costs down. Our numbers show, at least in the U.S., it is feasible to drive hull costs down by 50% over other types of floating hull technologies. To prove that back in 2013, we went from a 1:50 scale to 1:8 scale turbine. Next is a 6-MW machine.”

The VolturnUS design from the University of Maine uses a floating concrete hull with the turbine on a composite tower. The inset table provides more details on the next phase. More immediate plans are to reach financial close next year, start construction 2018, and be in the water in 2019.

The VolturnUS1:8 scale concrete foundation was launched in May 2013. Dagher’s team kept the prototype at sea for 18 months with 60 sensors. “The beauty of a 1:8 scale is that we were able to see a lot of extreme wave conditions relative to the hull size during the deployment.”

“We collected a lot of valuable data during the storms. The one pictured is from Winter Storm Electra, in December 2013. It had a 50-year return period wave environment. A 50-year wave has a probability of 2% of being exceeded in any single year.

Winds were about 45 mph along with the 50-year waves, yet you barely see or measure the structure moving. That’s a major advantage of the VolturnUS concrete hull design, it has more mass than a steel hull and that drives natural hull motion periods higher than the extreme wave periods. Also, the particular design and geometry of the VolturnUS hull moves a significant amount of added water mass, further elongating the natural periods while increasing motion damping. So waves are less likely to affect the motions of the turbine. The hull design is able to limit both pitch motion and nacelle accelerations.”

The VolturnUS1:8 is towed out to sea. Dahger says many simulations made sure that it was stable during tow and that it can be towed in variety of conditions.

The 18-month deployment exposed the platform to 40 storms, each relative to the hull dimensions is between a 50-year and a 500-year return period. “A wealth of useful of data came from 60 sensors. One thing that we learned is the maximum nacelle acceleration in all these storms was less than 0.2g, an important result. And the maximum heel angle was less than 7° in a relative 500-year storm. That’s the kind of data one needs to prove out prediction models and to build confidence with turbine suppliers and sponsors. We demonstrated that a turbine designed for a fixed bottom application is going to successfully operate and stay within its design parameters in the floating environment,” he said.

Two 6-MW full scale hulls, the next step in the project, will be sited two and a half miles south of Monhegan Island, Maine. Dagher adds that the project has site control and a 20-year PPA Term Sheet approved for the project. Construction will start in 2018 and complete in 2019.

TetraSpar

Each of the three previous designs comes with advantages and disadvantage. Henrik Stiesdal, formerly with Siemens and now president of his own company, suggested that there might be a way to combine the advantages into a design without the disadvantages. “Like everybody else, this idea is about reducing costs by industrializing,” he said.

A TetraSpar would be towed to its site with the keel up. Once on site, mooring lines would be set and the keel would be lowered to act as ballast.

Stiesdal first evaluated three floating platform concepts. “The spar is an extremely simple platform. It’s stable and has small wave loads. Its only problem is that it needs a minimum of 80 meters water depth in the harbor and all the way out to the site which is not that easy to find,” he says. “The semi-submersible makes it is easy to install the turbine in port, and the design handles most water depths. However, it is somewhat lively in some sea conditions, needs either moveable water ballast or great weight to limit tilt angles.”

The tension leg platform (TLP) has low weight, the turbine can be installed a quayside, and towed to site. It also generates moderate wave loads and has low dynamics. On the downside, the tether arrangements are demanding and expensive, and it calls for a complex steel structure. There are also limitations on water depth unless supplementary mooring is used. Installation typically requires assistance from a purpose built vessel.

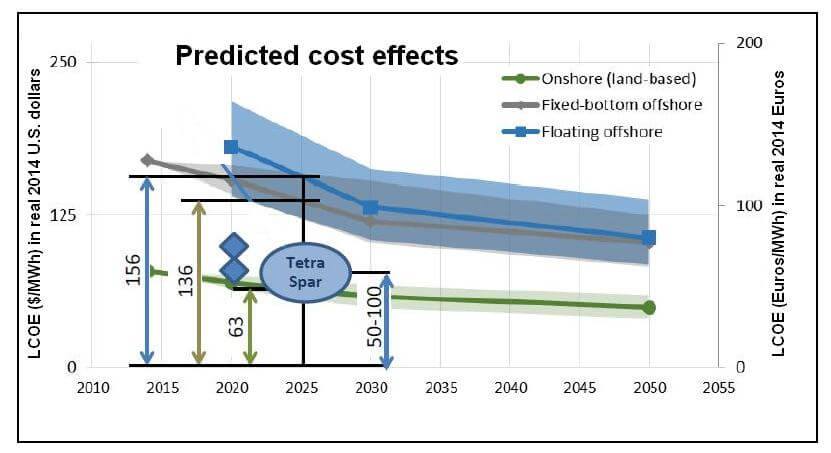

Stiesdal suggests that the shaded areas and markers indicate the response of experts for the LCOE for several floating platforms. Source: Berkeley National Lab.

“Why not combine the best of those three?” asks Stiesdal.

For example, the spar’s dynamic behavior is solid like a rock. The semi-sub allows quayside turbine installation and it is easy to tow. The TLP allows a relatively light-weight structure. “The logic is if you build a structure that acts like a semi-sub when you assemble the turbine in the harbor and once out, it becomes a spar,” he said.

His proposed design works this way: “When in port, the keel or the counter weight of the structure floats because it displaces more than it weighs. So it floats when full of air and ballast. Then it is towed to the site, the air of the keel is replaced with water, it becomes heavier than water, sinks, stays in position and stabilizes the structure. It’s a simple trick,” says Stiesdal.

: The cast transition piece (TP) would have the same diameter as a tower for a 6 MW turbines. Some things could be made of fiber glass. And assembly on a dock would mean there is no Jones act to deal with.

The proposed design includes all four options: the semi-sub as it is towed, the TLP for medium water depth, the Spar for deep water, and to complete the picture, the fixed-bottom when there is insufficient water to make a floater possible. You can even re-inflate the keel and bring it to the surface for inspections. All that operation would require is one person and a compressor.

Stiesdal says that while the design is clever, the second part of the story, even more important, is about industrialization. For instance, a problem with floating structures is that they invariably end up quite large and not suited for mass production. That is a critical omission. “We know how much mass production matters. It dropped the cost of solar cells from about $100/Watt in the 1970s to about $1/Watt today. The same thing can happen to bigger equipment.”

Stiesdal envisions a dock-based assembly area like this with many smaller components that have their costs driven down by mass production.

Stiesdal suggests using what has worked well onshore and applying it to offshore designs so the structure is built with components that have the same familiar dimensions and weights and they are less expensive onshore – just assembled by the ocean.

If the components are supplied from existing onshore suppliers, a new supply chain is not needed. “You just pick from those already there, and you don’t need an installation vessel. The existing supply chain provides volume benefits as it has for turning out towers and other equipment. We have reduced the weight because of high-quality welds as in onshore towers that eliminate fatigue issues. These developments have led to energy costs that the experts predict to be 6.3¢/kWh for land-based, 13.6¢ for fixed-bottom offshore, and 15.6¢ from a floating device, all in 2025. That’s what the experts believe.”

According to Stiesdal, a cost on the order of 15¢/kWh is too high. “We have to compete with land-based wind, and solar plus storage, so 15¢ is not low enough. I think it is eminently possible to be in the range of 5 to 10¢/kWh. You might be tempted to say, come on, the experts have spoken. However, Let’s not forget what happened this year. In July, DONG won the Netherlands tender with a bid of 10¢/kWh including all transmission costs, and in September Vattenfall won the Danish tender for near-coastal offshore wind farms with a bid of 7¢/kWh, so expert predictions should be taken with a grain of salt. Nobody believed that today land-based wind would be competitive with natural gas. Nobody predicted that, but that’s where we are. Let’s do the same thing offshore.”

Filed Under: Featured, News, Offshore wind