Editor’s note: As utilities close coal-fired plants, demand will be filled with gas-fired plants and power from wind farms. Activity in the heavily populated eastern U.S. provides opportunity for additional wind plants.

Genscape reports that beginning in October, line work on a large, high voltage transmission line between New Jersey and New York, will shift dynamics between PJM and NY, likely driving exports to PJM.

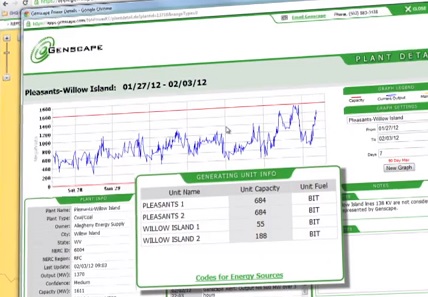

Genscape’s newly released 2013 NYISO Fall Outlook reports long term transmission outages will compound recent coal-fired generation retirements to drive bullish price anomalies this fall. The retirement of 500 MW of coal-fired generation in western New York has had a strong bullish impact on prices in the west of the state, helping drive multiple record high daily clears in West Zone. Upside congestion that is resulting from the retirements is expected to persist through the fall, according to Genscape analysts.

Genscape reports that beginning in October, line work on a large, high voltage transmission line between New Jersey and New York, will shift dynamics between PJM and NY, likely driving exports to PJM. “Barring a major weather event, generator and transmission availability will be the main drivers for fall prices, not demand,” says Matt Oatway, Senior Analyst on the NYISO desk. Genscape’s NYISO analysts plan to monitor this outage and report updates via live webinars and real time updates to clients as the outage approaches.

In recapping what happened this past summer, the study finds the following:

- The new Hudson Transmission Project line, a 660 MW controlled line from North Jersey into New York City has not seen favorable spreads to drive strong flows into New York and the lack of opportunity has resulted in a low capacity factor.

- Zones A, G and J all finished the summer up year-over-year despite weak demand in June and August due to generation retirements and long term transmission outages. In Zone A, the retirement of coal fired units drove record high daily clears on multiple days.

- Contributing to the strong summer clears was strong load in July. NYISO reached all-time peak demand of 33,956 MW on July 19th versus a previous record of 33,939 MW on August 2, 2006.

- Zone K cleared down year-over-year, the only major zone to do so, as the Neptune cable returned to full capacity after a long term outage derated it to half capacity.

Genscape’s PowerIQ reports are for electric power traders, analysts, and risk managers active in real-time markets, next day markets, and balance of month and next month markets. Through Power IQ market participants have access to market-specific analyses and price forecasts to make informed trading or operations decisions on a daily basis. Each regional team delivers a comprehensive, seasonal outlook four times a year. To learn more or register for a free trial, visit: info.genscape.com/power-iq-press

Join Nick Zieja, Regional Director of NYISO and Senior Analyst Matt Oatway on Wednesday, September 11 at 1:45 EDT for a live, complimentary webinar and question and answer session featuring Genscape’s 2013 NYISO Fall Outlook. Registration for the upcoming webinar is available at info.genscape.com/NYISO-2013-fall-outlook-press.

Genscape

www.genscape.com

Filed Under: News, Policy