The PTC extension has been the most substantial news for the wind industry in recent months, but there are other positive developments in the sector. For instance, average turbine nameplate ratings are trending towards 3 MW, which surprisingly may cost a bit less to install than smaller 2MW class machines. Today’s turbines are capable of achieving gross capacity factors in excess of 50%. The next generation of wind turbines, due to be released over the next three to four years will be competitive with natural gas without the tax credit. That was the news from Make Consulting Partner Dan Shreve as he kicked off AWEA’s Windpower 2016 in New Orleans in May.

The big news over the last few weeks has been the unexpected four-year COD deadline associated with the recently extended production tax credit. “This has consequences. Obviously it makes the full, 100% production tax credit available through 2020. One consequence has been an upgrade to our forecast for Q2. We’re forecasting an additional 7.7 GW on top of our first quarter base case scenario,” said Shreve.

What’s coming, what’s new

In terms of the overall total market, Shreve sees more then 70 GW of aggregate demand through 2025. That is fantastic demand that provides great business certainty,” he said. What’s more, that business certainty can aid in driving R&D efforts that will lower the unsubsidized cost of wind power to around $46/MWh.

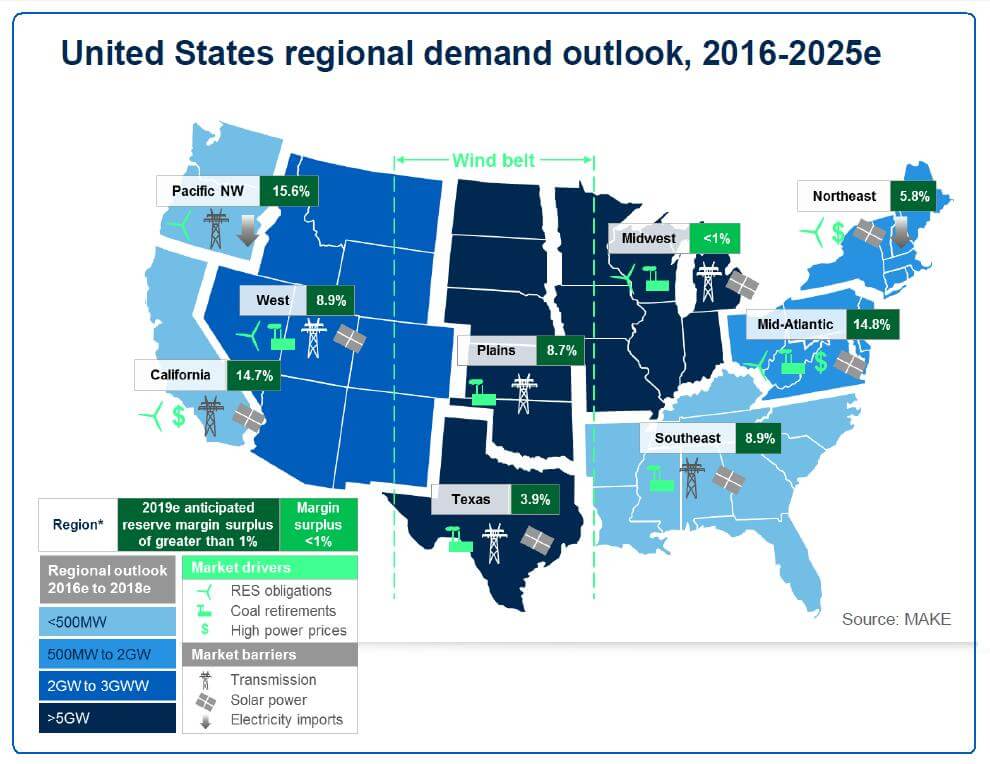

There are market drivers and market barriers in his forecast. “Coal-plant retirements will be a driver in terms of the need for new capacity, and utilities are preparing themselves for the Clean Power Plan. Wind will be competitive with fossil generation but is facing more competition from solar across the global renewables market. Commercial and industrial demand is also a driver. In the later stages of the forecast period, 2020 to 2025, the Clean Power Plan starts to take over from the PTC.”

When talking about the major macro-economic drivers, not much has changed. Natural gas prices continue to linger at low levels, about $2 to $3 per million BTU. “This is the primary challenge to wind. It sets the marginal power prices and is the real competition.”

Shreve also forecasts low load growth. “We’re talking about growth of around 0.8%. The load growth is just not there. Energy efficiency measures will also reduce load growth. Removing coal generated power will allow more wind industry growth. “Will the loss of coal plants be a driver for wind adoption in the Southeast? Possibly. That area’s lower wind resources are a challenge. However, this is good news for Texas which might find markets for its power to its east,” he said.

Over time, how might construction and demand change? “We’re hearing more discussion regarding larger turbines and how modular technology can open up new regional markets, specifically in California and New England.

The wind belt remains the focus for U.S. developers given its world class resource and ease of permitting. There is opportunity for the installation of larger turbines on the east coast as capacity factors continue improving. Low hydropower prices inhibit demand in Pacific NW. Strong solar resources moderately hinder wind development in the southwest.

C&I (commercial and industrial buyers) activity is growing, with with non-traditional power buyers such as Google and Facebook . “They’re not IPPs, but we expect a sizable chunk of the market to be represented by those types of buyers. We’re talking about 16 GW of demand, separate from the commercial and industrial segment.. The PPAs through 2017 total about 2.5 GW with expectations for another 13 GW moving forward. It’s incredible to see how company leaders are looking at wind as being a long-term power hedge.”

In addition, many companies interested in renewable energy are not power people. “They’re data people, internet folks, organizations without power generation as core competencies. When we talk to real energy brokers, they say their biggest challenge is education – how do you educate people about a synthetic hedge and what its benefits could be?” said Shreve.

Those inclined to think long term now have more time to understand the markets while brokers have more time to figure out how to reach the Tier 2 companies. They are the next step. “We’ve got the big guys, such as Google and Apple. Now how about the Tier 2 people, those that don’t need 200 MW? What about companies that need 20 MW? How can we make a cookie-cutter type of financial approach in which you can get that next tier of demand into the construction pipeline?”

The next generation

The next generation of wind turbines, coming in the 2020 timeframe, is expected to improve on today’s models. “We’ve been pleasantly surprised to see how quickly the LCOEs came down. We had to do a lot of digging this year because, quite frankly, we didn’t believe our own numbers. The turbines are getting better, and wind a great story to tell.”

OEM turbine portfolios rotate through products on a three to four-year cycle. “The additional demand and production tax credits are fantastic, but they complicate things. Whether developer or turbine OEM, few are used to working in a four or five-year time frame. Everyone has been operating in a fire-drill mode for the last five years, constantly fighting against a 12-month on-and-off cycle. Planners are now saying, ‘Wow, we can actually do long term technical and strategic planning.’

Shreve mentions the next four-year time frame. “The V110’s have already been out for two years. I’m expecting that machine to go over 2.2 MW with one more rotor upgrade that could take advantage of the current safe harbor blitz. Then what? Well, onto the 3 MW platform. But first focus on fulfillment. Developers are like minded, and may ask, ‘Why wait for the next best thing?’ Put in the 2.2 MW turbines. They won’t be obsolete. But we’ve seen that when the product evolves, it gets bigger, better, AEP improves, Capex gets better, and installation capabilities improve. The question remains: What happens in three years when the next best machine comes out? How can developers and OEMs figure out how to include these new units within the existing PTC safe harbor arrangements.”

Four-year COD extension complicates buying decisions for asset owners, and the development plans of turbine OEMs. For instance, the current crop of best in class technology is already 12 to 24 months old in a 36 to 48 month cycle. OEMs must demonstrate what their product pipelines can deliver within the PTC time constraints.

In reference to Capex, the 3-MW machines are a little bit more expensive, but a little less expensive to install, depending on who you talk to. Some believe it can be a lot cheaper service too, in terms of a turbines-to-technician ratio.

Here’s why Shreve expects more 3 MW turbines soon. “The Vestas V136, for one has a gross capacity factor of 55.7%. Could you imagine even saying that five years ago? Not really. If you look at the size of the machines and their capabilities, measured to lower construction costs, it’s really eye-opening stuff. A migrations towards 3-MW turbines is the trend.”

How big can turbines get? Consider modular technology. Several companies are working on modular tower-based segments and modular blades. “Acquisitions were made in prior years year in terms of IP from ModWind and Blade Dynamics. Rotor diameters in excess of 140 meters will have to be modular. New markets, such as New England may need big turbines. And they will have to be modular for transport.”

Repowering

Now we come to re-powering and re-blading, considerations that could be additional market stressors. The PTC can also be extended another 10 years to older turbines if the owner replaces components representing at least 80% of the installed turbine’s fair-market value. Older turbines, such as SLEs, XLEs, (1.5-77 and 1.5-82m) blades on GE 1.5s, and the old Siemens SWT2.3-93s are all potential candidates for re-blading and ancillary changes.

Filed Under: News