Wind industry growth should expect a bumpy ride with the expiration of the PTC, although yieldcos, a recent financial idea, may provide some financing relief. The second 10 years in the working life of most turbines will be a big question mark, but the advent of reliable data analytics shows good potential for lowering wind’s cost of electricity. Those were a few of the remakes made by Dan Shreve, Partner with MAKE Consulting, as he kicked off the recent O&M Conference in Dallas. The annual event is organized by Wind Energy Update.

Shreve’s firm recently released its North American Wind Power Outlook and he summarized it for the audience. “The industry will have a bumpy ride predicated on the assumption that the recently expired PTC may be the last one. We do have an upside scenario that includes a phase out approach. However, our base case illustrates a substantial construction drop off in the 2017 time frame. As such, the focus of market participants is turning towards the substantial installed base in the U.S., about 66 GW as of last year, due to the enormous opportunity it presents in terms of the distribution of assets, their age and makeup,” said Shreve.

The bumpy ride he refers to is near-term market demand: “Volatility in the space is heavily driven by policy uncertainty at the federal level and continued natural gas market dynamics. Natural gas prices, approaching all-time lows again, combined with the oil glut, negatively impacts long-term forecasts when talking about LNG (liquified natural gas) demand. Expectations for LNG in the U.S. markets have diminished based on reductions in global pricing. That reduces long term domestic demand projections to support natural gas exports, which in turn lowers natural gas prices that set the marginal prices for power in most markets. This is a big challenge for the wind industry. As a consequence, there is huge focus on wind’s LCOE. How do you make a bullet-proof economic case for wind so you can complete with fossil fuel generation?” he said.

Then there is the impact of the services market. In volatile markets, he said, people look for stability from a corporate perspective, whether a turbine OEM, a component OEM, or specialty repair providers. There is enormous opportunity especially when you consider the size of installed base.

So what is unique in the U.S. market? “It comes down to the size and sophistication of the asset owners. When you look at the top echelon of asset owners, they have substantial market strength in terms of their installed based and capability. The items in green (referring to a chart shown here) are companies with a preference for in-house maintenance programs or a captive/partner ISP group attached to them. When segmenting major asset owners, a separation is evident around the 1 or 2-GW level where you start to see asset owners move to lower risk turbine OEM sponsored service agreements. For instance, consider yieldcos and their increased level of asset transactions over the past twelve months. yieldcos that must be fed over time so they continue to grow, and midsized portfolios of low risk wind projects are going to be in play” he said. (Editor’s note: Yieldcos, a relatively new financial vehicle, are companies that own other companies for the steady and predictable yields they provide.)

So what is unique in the U.S. market? “It comes down to the size and sophistication of the asset owners. When you look at the top echelon of asset owners, they have substantial market strength in terms of their installed based and capability. The items in green (referring to a chart shown here) are companies with a preference for in-house maintenance programs or a captive/partner ISP group attached to them. When segmenting major asset owners, a separation is evident around the 1 or 2-GW level where you start to see asset owners move to lower risk turbine OEM sponsored service agreements. For instance, consider yieldcos and their increased level of asset transactions over the past twelve months. yieldcos that must be fed over time so they continue to grow, and midsized portfolios of low risk wind projects are going to be in play” he said. (Editor’s note: Yieldcos, a relatively new financial vehicle, are companies that own other companies for the steady and predictable yields they provide.)

Shreve said his company has performed due diligence work for some yieldcos with respect to recent project acquisitions. One of the first questions he gets is: Who is the service provider and are they able to service the warranty on the existing units?

“Yieldcos are a risk adverse population. Their basic model looks for predictable cash flows. This is not a high-return investment and it must be stable. Surprises are not welcome,” he said.

Shreve predicts that a good deal of risk will be pushed to the service provider, so from a financial standpoint, there must be strong financial stability for those providing the service, excellent capabilities, a proven track record, and an ability to take care of assets to preclude any type of surprises. “The number of yieldcos operating in the United States right now is fairly limited, about five or six different groups hold about 1 GW each but they are growing rapidly. We have seen this already with companies in the yieldco sphere looking overseas, at international markets. So there is movement to build these portfolios as more companies entering this space.”

Outside the top 20 asset owners, the accompanying slide touches more on the core industrial groups Shreve has seen blossom in the U.S. in the last 24 months. Corporate buyers, companies such as Google, Ikea, and Wal-Mart are wind farm owners. MAKE thinks this is an important emerging buyer segment especially with the demise of the PTC.

“Turbine OEMs and wind developers are looking for new sources of financing, for new buyers, as many traditional wind buyers such as utilities and IPPs pare back operations, In terms of the wind services market, many of these buyers will have a heavy reliance on their technology providers, or service providers, or both,” said Shreve. “The largest corporate wind owners will have dedicated energy divisions, such as Google, that will want to know how to best to manage their projects and best maximize returns. Other corporate buyers will view their wind assets as less strategic and more of a cost center, and thus are in strong need of expert support from their service providers and repair providers. Consequently, the corporate and industrial owner segment offers a potentially lucrative opportunity in terms of the engagement if these groups seek out, full wraps (full service agreements with warranties). Basically, this type of client (a corporation) wants to have a wind farm but does not want to worry about it.”

MAKE sees continued growth of the in-house, wind-services model in a top-heavy market when talking about the top 20 asset owners and their representation of the overall standing in the asset base. However, smaller asset owners, companies that might have 100 to 200 MW, are not large enough to in-source (maintenance) effectively. They are potentially risk-adverse and looking for some sort of warranty that is difficult for ISPs to provide due to high costs and fine print associated with insurance backed warranties. So they are left with turbine OEMs and few options. What is being done to help those companies? “It’s a fragmented base and difficult to attack, but at the same time it offers interesting opportunities,” he said.

MAKE sees continued growth of the in-house, wind-services model in a top-heavy market when talking about the top 20 asset owners and their representation of the overall standing in the asset base. However, smaller asset owners, companies that might have 100 to 200 MW, are not large enough to in-source (maintenance) effectively. They are potentially risk-adverse and looking for some sort of warranty that is difficult for ISPs to provide due to high costs and fine print associated with insurance backed warranties. So they are left with turbine OEMs and few options. What is being done to help those companies? “It’s a fragmented base and difficult to attack, but at the same time it offers interesting opportunities,” he said.

With respect to a value-chain evolution, interesting things are happening for clients, competitors, and partners. What’s more, there is some level of confusion as to who is who. OEMs are not facing a situation where longtime IPP clients are evolving into competing ISPs, Shreve observes.

The role of the ISP has shifted quite a bit over the last year. MAKE sees the hybridization of the O&M model in which the OEM contracts some maintenance work to a few ISPs that could be doing it more efficiently, at a lower cost, and with the expectation that the quality be maintained.

“But the technical service, warranty backing, spare-parts management and other aspects, are often maintained by the turbine manufacturer, added Shreve, “So with that type of collaboration in place, we think such split scope arrangements can grow in the years ahead.”

In terms of the other activities, such as technical upgrades and advanced diagnostics, most asset owners and ISPs are unable to match the engineering firepower of the turbine OEMs. “It will be interesting to see how this model develops as the low hanging fruit is picked over and whether or not OEMs are able harness their engineering teams to service competing turbines.”

MAKE also expects some level of consolidation or contraction in the market. “We see it already. Look at the order volumes in the last 12 to 24 months you see the Vestas, Siemens, and GE have essentially mopped up the market. Gamesa has a distant fourth position compared to their volume of orders. There will be questions for some of these tier-two or tier-three turbine OEMs over time. Do they exit the market? Do they stay in the market as a service-only group? Do they partner with ISPs and outsource what’s left of the portfolio here and focus on different regions? There are interesting opportunities in terms of potential orphan assets, such as the Clipper turbines,” said Shreve.

What happens when wind turbines approach retirement? Repowering, retrofits, upgrades, fatigue failures are possible in their second 10 years. “There is a realm of interesting things that will happen and we have not yet defined the optimal solution. People thought they understood what the failure rates would be when the turbines were first installed. Performance requirements were written with one gearbox exchange or major repair over the life of the turbine, and we found that was not a viable assumption for early generation turbines. We now know there will be multiple major repairs over the 17 to 20-year time frame,” he said.

That time frame is also likely to see blade issues. For instance, if a blade breaks and an owner cannot get a replacement, what does he do? “Or if lightning strikes and damages the blade beyond repair, try to find the guy with the mold for that blade. Where do you buy an aftermarket blade? Similar issues will move down the drivetrain as well,” said Shreve.

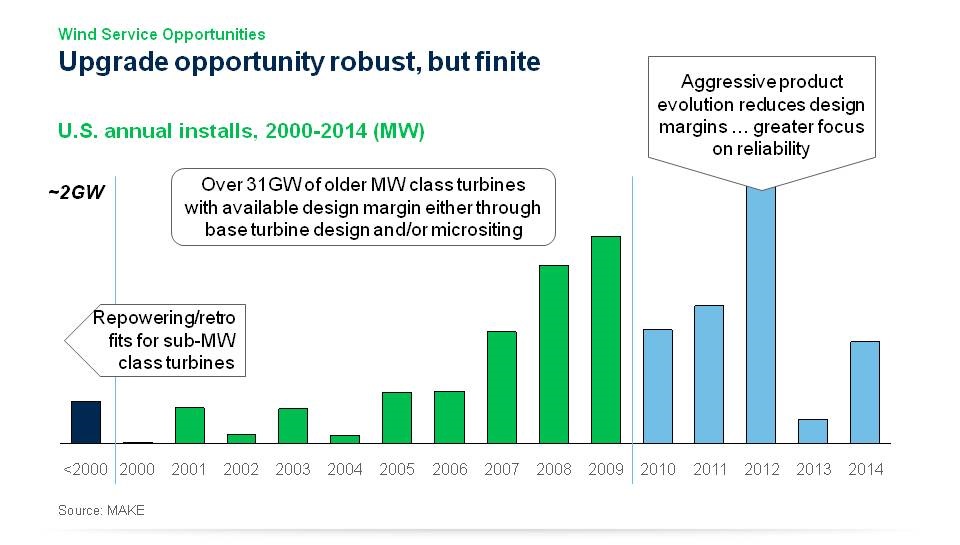

Performance upgrades and opportunities are hot topics. Vortex generators, blade enhancements, reliability improvements regarding CMS are all possibilities. “We have seen a lot more retrofit activity on the older assets. What do you do with those sub-MW turbines? We see more traction on repowering along different avenues. Some people look to retrofit instead of repowering. Then, what will be the availability of upgrades for MW class turbines moving forward? Will the opportunities for upgrades diminish over time as design margins on new turbines are minimized? We still expect to see continued evolution of product portfolios in the major turbine OEMs,” said Shreve.

Really interesting developments are pushing the envelope in terms of minimizing design margins, costs, and maximizing performance, he added. How far can you push those turbines safely? When doing a resource assessment, competencies have increased substantially in the last five years.

MAKE also see significant advances in terms of analytics. “Not so much in hardware, but more on the diagnostic side and the algorithms being able to effectively diagnose issues in a manner that reduces the cost of maintenance, which is a major component of the operating expenses,” concluded Shreve.

Filed Under: Events, News, O&M

Excellent article!