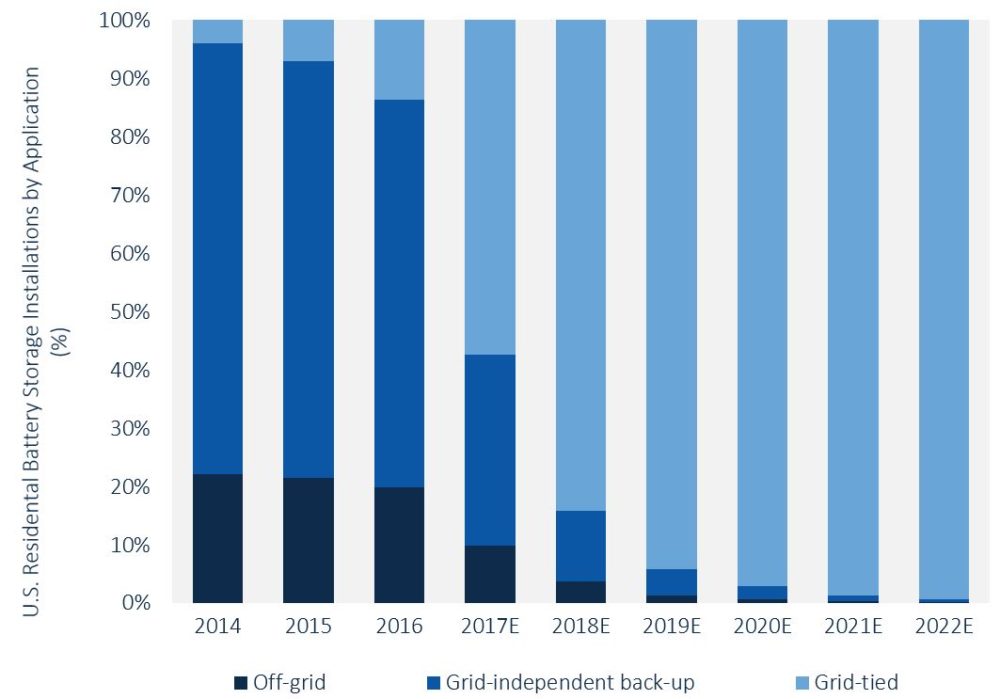

After walking the SPI show floor, there’s no denying the residential storage market is developing quickly. In fact, GTM expects that 2017 will be the first ever in which grid-tied residential battery storage system deployments outnumber new off-grid and grid-independent systems across the United States.

According to its report, U.S. Residential Battery Storage Playbook 2017, the U.S. residential storage market is currently large and thriving, principally driven by off-grid applications. The opportunity will unfold unevenly across applications and markets over time, especially as the currently nascent grid-tied market begins to develop.

This is similar to grid-tied solar projects overtaking the off-grid solar market.

GTM Research estimates that in 2016, over 4,400 residential battery systems were deployed across the U.S. It reports that 86% were off-grid or grid-independent backup. But by the end of this year, GTM expects grid-connected deployments will make up 57% of annual deployments, and 99% by 2022, as annual off-grid and grid-independent backup deployments remain relatively flat.

In addition to off-grid installations, the strongest applications today are time-of- use and self-consumption in Hawaii and backup power for a niche set of customers in PJM territory and the Northeast. However, the market opportunity will evolve to potentially include more prevalent TOU applications in California, New York, Massachusetts and Arizona, a more robust backup market in PJM and the Northeast, and grid services markets in California, New York and Texas.

GTM sees homeowners adding storage for backup power or financial savings, and utilities looking to mitigate the effects of high solar penetration on the grid driving the storage market. Local regulations, policies and incentives are also contributing to or inhibiting growth.

Filed Under: Uncategorized