Editor’s note: This battery update from Lux Research reports on market growth in the electric vehicles. This is good news for the wind industry because most cars would recharge at night when wind contributes well to grids. What’s more, the thought of disconnecting the influence of imported oil will also fuel growth in the RE and EV markets.

Panasonic’s lithium-ion battery division is resurgent: In Q2 2013, it made about $40 million in profits, a turnaround from one year before, when it lost $20 million in Q2 2012. As a result, Panasonic will invest $200 million over the next year to expand its Li-ion production lines in Osaka and Kasai, making batteries destined for automotive applications.

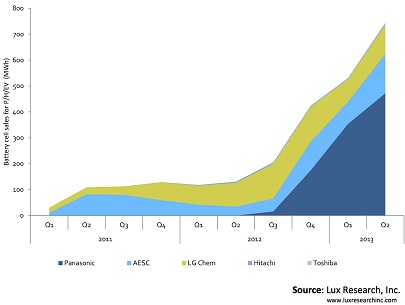

The company’s improved Li-ion fortunes coincide with its customer Tesla Motors beginning to ship the Model S, an electric vehicle (EV) that packs a massive 60 kWh to 85 kWh worth of batteries. About 16,000 Model S units have been sold thus far, accounting for more than $400 million in revenues for Panasonic. Moreover, Panasonic has become the leading battery supplier for plug-ins and hybrids sold in the U.S. Its market share by capacity sold has increased to 54% during the last year, overtaking LG Chem and Nissan’s AESC in the process. This breakthrough has been four years in the making and involved Panasonic investing $30 million in Tesla in 2010.

Remarkably, the upstart Tesla now drives more of Panasonic’s battery revenues in the U.S. than the world’s largest automakers, like Toyota and Volkswagen. A mere 20,000 Tesla Model S units use three times more battery capacity than the U.S. sales of Toyota’s popular Prius hybrid family (which moved about 230,000 units during the past year). Tesla’s battery demand now outweighs all other OEMs in the U.S., taking 49% of the market share for battery capacity shipped in the U.S. plug-in and hybrid market in Q2 2013. Others are taking notice of Tesla’s increased clout: Samsung SDI, BYD, and LG Chem have reportedly been in talks with the automaker, seeking to supplement or displace Panasonic. However, they may have to wait for Tesla’s next model, because Tesla could find it difficult to mix cells from different suppliers, due to battery management system considerations, and because the Panasonic-Tesla contract stipulates supplying 80,000 vehicles by 2015. Interested parties should now expect increased development and more pricing pressure for the Panasonic-Tesla battery solution, including more research on 18650 automotive cells and a strengthening nickel cobalt aluminum (NCA) cathode value chain.

To learn more about this graphic and related intelligence from Lux Research, click here or email Carole Jacques.

Lux Research

www. luxresearch.com

Filed Under: Energy storage, News