By the end of last year, eight countries had more than 10,000 MW of installed capacity including China (145,362 MW), the U.S. (74,471 MW), Germany (44,947 MW), India (25,088 MW), Spain (23,025 MW), UK (13,063 MW), Canada (11,205 MW), and France (10,358 MW).

According to the Global Wind Energy Council (GWEC), China crossed the 100,000-MW mark in 2014, adding another milestone to its already exceptional history of renewable energy development since 2005. This year it made history again and strengthened its position on the leaderboard. Europe and North America both had strong years in 2015, led by German and the U.S. respectively. Guatemala and Jordan each added their first large commercial wind farms, and South Africa became the first African market to pass the 1 GW mark.

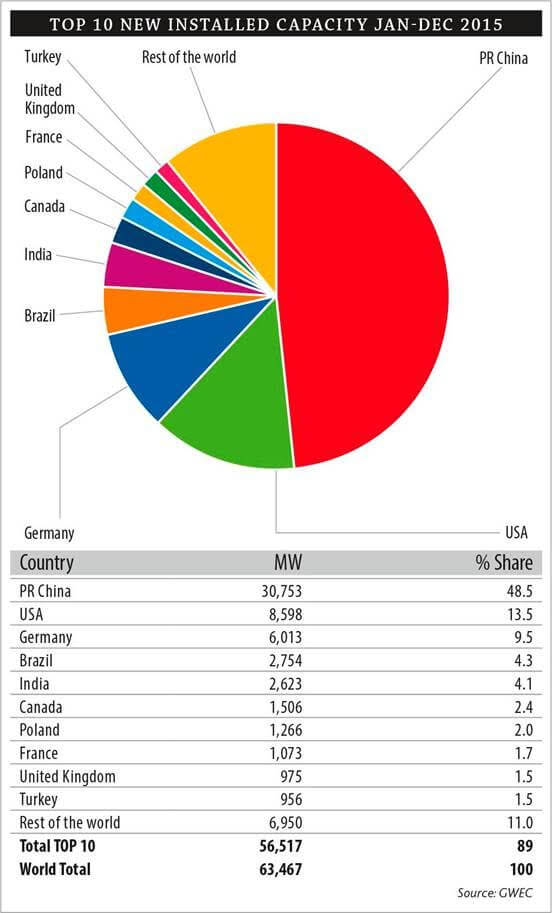

After setting new records in 2014, the wind-power industry surprised many observers with another record breaking year in 2015, chalking up 22% annual market growth and passing the 60 GW mark for the first time in a single year; and this after having broken the 50 GW mark for the first time in 2014. Once again, the big story was China, installing an astonishing 30.8 GW against the backdrop of a slowing economy and nearly flat demand. Europe and the United States had surprisingly strong years; and Canada, Brazil, Mexico and other ‘new’ markets continued to develop. Read more here.

The United States, as a pioneer in the global wind industry with some of the best wind resources in the world, has had much lower prices than most of its OECD competitors for some time, but the difficulty was always the on-again, off-again nature of the U.S. market, as it was subjected to short term policy frameworks which left policy gaps every few years and hampered the growth of the industry.

So it was very welcome news when U.S. Congress passed and the President signed into law a long-term extension and phase out of the Production Tax Credit (PTC), which has been the main federal policy term support for wind energy in the U.S.

The American wind industry now embarks on its longest-ever period of policy stability, and the potential implications of this go far beyond the U.S. market in terms of company strategies, manufacturing location choices, and development of the supply chain. Five years from now the wind industry will be very different and much stronger.

In addition to climate and competitiveness, energy security ranks high up on the list of drivers for the global market, as does the need to clean the air of the choking smog that is making more and more of the developing world’s major cities unlivable.

The demand for clean, sustainable, and indigenous power sources to fuel economic growth outside will continue to grow, especially in emerging economies across Africa, Asia, and Latin America.

But what about the short term? While it’s very hard to turn the trends listed above into market forecasts for the next several years, we anticipate a period of sustained growth, although the same kind of spectacular growth we have seen in the last two years is not expected to continue.

After ‘catching up’ with the Global Wind Energy Outlook Advanced Scenario in 2014, we’ve moved well ahead of it in 2015, and we now seem to have a much better chance of keeping on that track through 2020 than we thought 12 months ago.

Last year at this time, GWEC projected a 2015 market of about 53 GW. While it’s nice to be prudent, that’s quite a large variance. What were the main differences? China, for one: just as nobody predicted that China would install 23 GW in 2014, nobody predicted 30 GW in 2015…we were looking at a flat market in China for 2015. Likewise for the U.S., while we expected an increase, we didn’t expect that the market would essentially double from 2014 to 2015. For the rest of the world, we were reasonably close.

Filed Under: News