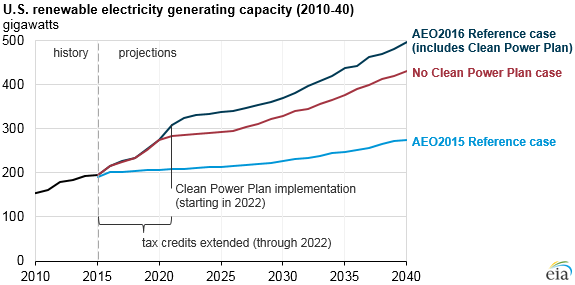

Projections for renewable electricity capacity in the U.S. Energy Information Administration’s most recent Annual Energy Outlook (AEO) are significantly higher than the projections in AEO2015. The December 2015 enactment of the Consolidated Appropriations Act, 2016, which extended certain tax credits for renewable generation technologies, and the August 2015 promulgation of the U.S. Environmental Protection Agency’s final Clean Power Plan (CPP) are policies that have a significant effect on projected renewables deployment. Reductions in technology costs and some changes in state policies on renewables also affect the new AEO projections. Additional AEO cases to be released later this month will show how certain policy and economic assumptions, including choices made at the state level regarding CPP implementation, affect projections for renewables deployment.

The PTC, as it relates to the generation of electricity from wind plants, provides a 2.3 cent per kilowatthour (kWh) tax credit for the first 10 years of production.

The Consolidated Appropriations Act extended tax credits for wind and solar installations. Both the investment tax credit (ITC) and the production tax credit (PTC) were extended another five years, but the value of the credits declines in the later years of the extensions.

- Investment tax credit.The ITC provides a 30% tax credit for the cost to develop solar energy projects. This credit is now extended until the end of 2019, when it will begin to decrease incrementally until 2022. In 2022 and beyond, a 10% tax credit for both utility and commercially operated solar projects will be available, while the tax credits for residential solar projects will expire in 2022. Before the extension took effect, the tax credit was set to decrease from 30% to 10%, or expire completely, depending on the sector, in 2016.

- Production tax credit.The PTC, as it relates to the generation of electricity from wind plants, provides a 2.3 cent per kilowatthour (kWh) tax credit for the first 10 years of production. This rate currently applies to plants that are under construction by the end of 2016. After 2016, the value of the tax credit for wind generation will decrease incrementally until it expires in 2020. Before the extension, the tax credit had expired at the end of 2014.Read the full report here: https://goo.gl/p5d8fF

Filed Under: News