The full report says it tells of global and U.S. market revenue from 2011 to 2016 and spots the key trends in advanced energy growth

Register for the report summary: https://goo.gl/AN8fca

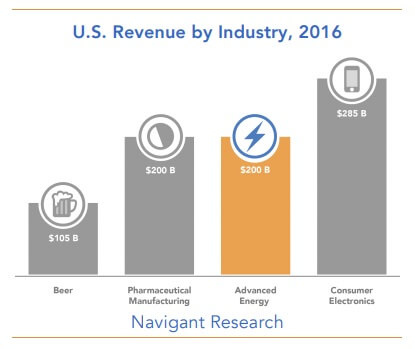

Advanced energy is a $1.4 trillion global industry, almost twice the size of the global airline industry, and nearly equal to worldwide apparel revenue. The U.S. advanced energy industry generates $200 billion in revenue, nearly double beer sales, equal to pharmaceutical manufacturing, and approaching wholesale c In the six years that AEE has been tracking, advanced energy in the United States has grown by an average of 5% annually for a total of 28% compared to 2011. Growth last year was 1%, primarily due to the effect of low oil and corn feedstock prices on ethanol revenue. Without ethanol, U.S. advanced energy grew 5% in 2016, three times faster than U.S. GDP (1.6%).

U.S. Advanced Electricity Generation was up 8% in revenue, or $3.9 billion, led by solar PV, which capped off five years of growth with a 30% surge, to $24.9 billion in 2016. U.S. Wind revenue held relatively steady at $14.1 billion – a welcome change from the boom-and-bust pattern from earlier in the decade. Sales of fuel cells for on-site power jumped 21% to $373 million.

Overall U.S. Building Efficiency products and services grew 8%, or $5 billion, led by energy efficient lighting and commercial building retrofits, both up 7% reaching $26.4 billion and $8.4 billion, respectively. In U.S. Transportation, Plug-in Electric Vehicle (PEV) revenue has grown tenfold over five years, from $700 million in 2011

Beer is a $100 billion industry? Advanced energy, of which wind power is a part, is a $200 billion industry.

to $7.8 billion in 2016, and 48% over 2015, as all-electric alternatives to gasoline-powered vehicles caught on in the marketplace. Under pressure from low gasoline prices, however, hybrid electric vehicles saw revenue fall for the third straight year, dropping 11% to $8.9 billion. If this trend continues, revenue from PEVs may surge past hybrid vehicles in 2017. Energy storage also had another big year, with revenue jumping 54% to $427 million in the U.S.

Under price pressure from low prices of both oil and corn stock, revenue from ethanol fuel fell by nearly $7 billion, or 24%, to $20.6 billion despite steady production levels. For the second year in a row, declines in ethanol revenue counter-balanced nearly all the growth in other advanced energy market segments. Revenue from ethanol has dropped by half from its 2012 peak of $40 billion.

For the full Advanced Energy Now 2017 Market Report: https://goo.gl/gL5ag9

Filed Under: Financing