Ali Mamujee / Senior Investment Associate / Mercatus Inc / Financial Modeling Best Practices: Part 1

Financial models are the backbone of the investment process in the energy industry. For most companies, it is the hub where each business unit interacts with a power project in development. While it is imperative that the economic nuances of each project are represented, a common mistake is to provide insufficient attention to when and where complex financial modeling best fits in a larger investment process. Companies that can effectively leverage simplicity and accuracy in early stages of the investment lifecycle can realize drastic efficiency gains.

For companies with ambitious pipeline targets, a business development or origination team should be built to quickly find, process and screen a lot of projects. Therefore, it is beneficial to get them to be able to input basic project information and run their own screening analysis accurately. Companies that allow their sales people to complete the up-front screening analysis see a butterfly effect in efficiency because it lets them filter bad projects from the get go.

At the same time, it’s imperative that this upfront screening model be simple – not be created for sophisticated financial analysis. There are 3 primary reasons 1. Front-end resources should be spending time filling a project pipeline with a lot of projects, not complex financial analysis 2. Complex financial modeling completed by business development and origination teams often needs to be corrected by financial analysts for mistakes anyway 3. Even if there aren’t mistakes, complexity too early creates incomparability between projects. Financial analysts will need to normalize project analysis to evaluate a portfolio of assets.

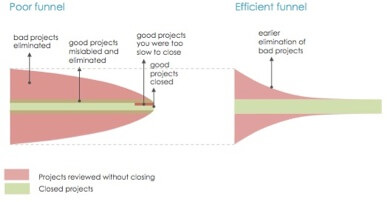

If we think of the development pipeline as a funnel, the power of appropriately screening projects ensures that the most promising projects to get the most attention in the most efficient manner.

If we think of the development pipeline as a funnel, the power of appropriately screening projects ensures that the most promising projects to get the most attention in the most efficient manner.

A healthy business process can manage a large project pipeline because bad projects don’t burn expensive resources in later stages of diligence. This saves financial resources and allows diligence teams to identify and move on good projects extremely quickly.

Creating a simple, user-friendly model that still meets each region and each business unit’s needs is a difficult task. While different regions and technologies have individual complexities, the 80/20-rule serves as a good measuring stick for building a stellar screening model. Build the 80% for all, or the key inputs that determine a project’s viability, and then work in the remaining 20% for each anomaly over time as a project matures. This helps prioritize what’s really critical and prevents analysis paralysis.

After projects are screened and move from the front-end of the business into a later stage of diligence, complexity can be built into the financial model to account for individual nuances. However, complexity should only be built into a financial model when there is a high probability that a project will actually close. Doing so enables a project pipeline that is fast and drives organizational efficiency.

Ali Mamajee is a Senior Investment Associate at Mercatus Inc. He is an experienced energy professional with over seven years finance experience across a variety of technologies consisting of: solar, wind, biomass, and unconventional liquid fuels. His specialties include energy project finance, financial modeling, M&A, project due diligence, industry analysis, business development, project development, private placements, investor relations

Filed Under: Financing, News