Heavy lifting with convention chemistries

A demo facility in Vermont boasts a 1 MWh (or 250 kW for 4 hours) battery that can output up to 1.5 MW for short periods. Many possibilities come from many chemistries, says EnerSys. “We have nickel-cadmium batteries and are working on some nickel-zinc chemistries,” says EnerSys marketing director Mike Kulesky. “We also have Li-ion flat plate valve regulated, flat plate valve regulated get, flooded flat plate, and tubular flat plate.” Designer OptiGrid Stored Energy solutions has the battery pictured connected to a factory where it maintains the supply of electricity for manufacturing operations during periods of utility curtailment when electricity is diverted to power the local ski lifts and snow-making machines. A grid connection is scheduled.

The wind industry can look forward to a sort of battle of the batteries thanks to competition, falling costs, and recent regulations.

Paul Dvorak, Editor

One knock against renewable energy is that its variable delivery makes it more difficult for those responsible for transmission to keep the grid stable. The conventional and costly solution has always been to bring spinning reserves online to handle increasing demand.

A better solution would be a large battery that would let wind farms maintain steady power levels for longer and more predictable periods, which then keep Independent Power Producers (IPP) out of the volatile spot market. Such a market is necessary because when an IPP cannot deliver the power for which it is contracted, it must purchase the power on the spot market and often at a steep premium.

Large batteries, however, never seemed to pencil out, as one AWEA presenter put it a couple years ago, meaning they add too much cost for their capability. That calculation may be changing according to an IMS Research Report that estimates“the global energy storage industry will increase from about $200 million in 2012 to $19 billion by 2017.” One new battery company, EOS, is reported to have said it will sell batteries in 2014 at $200 to $250/kWh and that figure could drop to $160/kWh.

The storage methods of pumped hydro and compressed air are reasonably well covered along with lithium-based batteries. So this examination will include only batteries of other designs.

The challenges

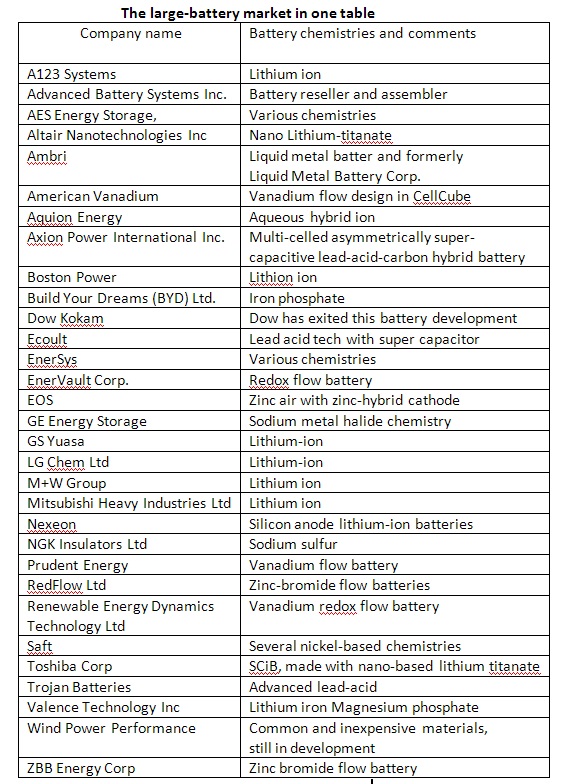

A range of power-storage companies – some well established and some still coming out of the lab – have recognized the business opportunity and are quite happy to provide solutions. One list tallies over two dozen firms with battery propositions. Government agencies are also pushing things along with rules and regulations intended to encourage development of storage batteries. For example:

The CellCube is intended as a turnkey building block for larger storage systems. When an application calls for a 1 MWh battery, the company says it would simply assemble a number of 40-ft containers of CellCubes that can be placed in any outdoor environment.

- The Federal Energy Regulatory Commission recently passed FERC order 784, which may be beneficial to the development of energy-storage systems, says law firm Bricker & Eckler. Whether using battery, hydro, compressed air, or other energy storage technology, the order “permits enterprises other than large utilities to sell ‘ancillary services’ – power sources that can be tapped quickly when needed to meet a rapidly changing supply or demand situation.” This would seem to open the door to a variety of power sellers. For instance, the Order creates opportunities for energy-storage technologies to help customers self-supply their own Regulation and Frequency Response service requirements which opens certain ancillary services markets to all generators selling at market-based rates.

- The California Public Utilities Commission recently approved a decision to establish an energy storage procurement target for California’s investor-owned utilities, electric-service providers, and community-choice aggregators. The utilities are required to collectively procure 1,325 MW of energy storage resources by 2020. Electric service providers and aggregators are required to procure energy storage resources equal to 1% of their peak load by 2020.

The chart was extracted from a larger Discharge time versus Rated power chart produced by the DOE. Lux Research says it expects flow batteries to increase to 30% of the utility-battery market by 2017 as a leading energy storage technology. Chart source: Pacific Northwest National Lab

A few newer batteries

There are dozens of companies offering batteries of several different chemistries along with services to build their base cells into large assemblies capable of storing many MWh. Space prohibits a close exam of all, so we elected to examine three significantly different designs.

Aqueous Hybrid Ion (AHI) Battery – The idea here is that a large format battery to store many MW for grid functions need not be light, small, or have a high energy density, qualities the automotive industry demands. Aquion Energy (aquionenergy.com) instead focused on materials that are inexpensive, abundant, and nontoxic, making the design recyclable and environmentally friendly, they say. “We’ve developed a battery that has excellent calendar and cycle life, high efficiency, and no thermal management issues which results in lower system costs,” says Ted Wiley, VP of Product & Corporate Strategy.

Furthermore, he says, it uses an inherently safe chemistry that is non-flammable and non-explosive, and has no dangerous failure modes. The design boasts a wide temperature operating range with 100% DoD cycling with minimal degradation, it’s self-balancing with minimal self-discharge and it needs no trickle charge. It also has a high tolerance to long stands at partial charge and requires no regular maintenance.

Vanadium electrolyte in the anode and cathode is up to 50% of the battery cost. A few benefits of the design include multi-hour and multi-megawatt capacity, unlimited cycling, and the battery can hold 99% of a charge for one year.

Designed to be competitive in cost with lead acid batteries, Aquion uses inexpensive materials to make its Aqueous Hybrid Ion (AHI) batteries: a manganese oxide cathode, synthetic cotton separator, carbon composite anode, and saltwater electrolyte. Bill Gates is involved with funding.

Modular flow battery. You’ve read a lot about Lithium as a primary element in modern batteries powering just about everything electric. Get ready to hear more about Vanadium, an element fundamental to a battery class intended for the long-term storage of large amounts of power. American Vanadium (americanvanadium.com) has recently introduced the CellCube vanadium flow battery to America.

First conceived by NASA decades ago, the vanadium redox flow battery uses positive and negative electrodes made of vanadium. This unique characteristic lets this type of energy-storage device avoid the classical electrochemical reaction of most batteries in which the exchange of ions between electrodes of different elements result in a degradation of the battery with each charge and discharge cycle.

Developer Aquion says its Aqueous Hybrid Ion technology is designed for stationary, long-duration, daily cycling applications. When applied to grid services, the battery allows load shifting, frequency regulation, and the integration of renewable energy.

Company president Bill Radvak says its design gives the battery several advantages including a 20 year lifespan with minimal loss of efficiency and the ability to maintain 99% of the energy in cold storage for a year. Also, the battery can repeatedly discharge to zero and back to 100% without damage. To double the required power period of the vanadium battery, just double the amount of electrolyte.

Aquion is now in limited productions for its 1.5 kWh S10 battery stack, a column of seven B10 batteries, with a voltage range of 35 to 52 Vdc. The company expects larger scale production for its 18 kWh M100 module, composed of twelve S10 stacks, in the second half of the year.

“The batteries are best for storing power for two to eight hours, 500 kW and more,’’ says Radvak. And while it has a long-term storage capability, it can also perform short duration functions which increase the quality of the power that runs through the battery.

“For wind operators, we can make energy storage economical anywhere,” says VP Operations Mike Doyle. “Grid operators will have to give energy-storage owners fair value for the power they provide. What’s more, the battery unit can be stacked together for storing large amounts of power in 200 kW power blocks combined with two-hour electolyte blocks.”

The battery is manufactured in Germany by Gildemeister Energy Solutions, (en.cellcube.com), now using material from sources such as South Africa and China. The company is expected to gear up production towards 2 GWh/yr after a Nevada vanadium mine comes on stream.

Free off-grid battery sizing calculator

Trojan Battery Co (trojanbattery.com), a manufacturer of deep-cycle batteries, has developed a battery sizing calculator to accurately size a battery bank for renewable energy applications. The calculator is available at batterysizingcalculator.com. When sizing a storage battery bank, the company says consider the electrical power required, or load for the application. A maximum depth of discharge to allow the battery; and the autonomy required – the number of days the battery will be used to power the loads.

Liquid-metal battery – An emissions-free liquid metal battery operates silently without pumps. These characteristics allow placing it in the middle of a city or a desert without special regulatory or permitting requirements. The battery will use existing power electronics and follow interconnection standards.

Developer Ambri (ambri.com) says the low cost comes through use of inexpensive, easy to procure, earth-abundant materials. “Our products also take advantage of the economies of scale inherent to electro-metallurgy and conventional manufacturing,” says Ambri President Philip Giudice.

Building a larger Ambri power storage facility starts with Cells (top) that are assembled into a 200 kWh Core, then a Pod, and into the size for a needed capacity.

“The liquid electrodes avoid cycle-to-cycle capacity fade because they reconstitute with each charge,” he says. Prototypes have operated in a lab environment for more than 17 months with daily cycling and no reduction in performance. A molten-salt electrolyte separates the electrodes and combines high conductivity with a tolerance for abuse.

The liquid components segregate themselves due to three immiscible liquid phases of different densities, like oil and water. This allows for reliable operation and manufacturing ease. These attributes let the liquid-metal battery exceed 70% round-trip ac efficiency for over a decade and without degradation. Management and control electronics are configured to allow remote operation and monitoring of the battery without on-site personnel.

Giudice says the battery responds with its entire nameplate capacity in milliseconds and can store up to 12 hours of energy and discharge it slowly over time. “The technology has been under development for more than six years,” he says. Recent accomplishments have resulted in a significant increase in size and total capacity of batteries tested. He says ARPA-e sponsorship of its development at MIT has been critical to its rapid scale up. WPE

Giudice says the battery responds with its entire nameplate capacity in milliseconds and can store up to 12 hours of energy and discharge it slowly over time. “The technology has been under development for more than six years,” he says. Recent accomplishments have resulted in a significant increase in size and total capacity of batteries tested. He says ARPA-e sponsorship of its development at MIT has been critical to its rapid scale up. WPE

Filed Under: Energy storage, News

Paul Dvorak has written an excellent article about some of the most important new energy storage technologies and the companies bringing them to market. An even more comprehensive review is available from Greentech Media: “Grid Scale Energy Storage Opportunities in North America: Applications, Technologies, Suppliers and Business Strategies.” See: http://www.greentechmedia.com/research/report/grid-scale-energy-storage-in-north-america-2013. At just over 300 pages, GTM’s report covers the most promising storage technologies, applications, geographic markets and market segments, and discusses the business models and competitive strategies being used in the storage industry. The report also profiles over 150 companies that are active in the North American storage industry, including 25 that are particularly well positioned to succeed.