From the World Economic Forum and the preface to the Handbook. Authors include: Richard Samans and Michael Drexler / World Economic Forum

The World Economic Forum is pleased to present the Renewable Infrastructure Investment Handbook, a guide for institutional investors interested in climate finance. This handbook is part of the World Economic Forum’s System Initiative on Shaping the Future of Long-Term Investing, Infrastructure, and Development and supports the Forum’s decade-long effort to illustrate how investors with a long-term outlook can make meaningful change in economies and societies.

The World Economic Forum is pleased to present the Renewable Infrastructure Investment Handbook, a guide for institutional investors interested in climate finance. This handbook is part of the World Economic Forum’s System Initiative on Shaping the Future of Long-Term Investing, Infrastructure, and Development and supports the Forum’s decade-long effort to illustrate how investors with a long-term outlook can make meaningful change in economies and societies.

The adoption of the Paris Agreement on 12 December 2015 by 195 governments is a major turning point in the global fight against climate change. To date, 190 governments have committed to specific actions to reduce their national greenhouse gas (GHG) emissions, covering over 95% of total global emissions. While these efforts alone will not suffice in keeping the world climate-safe, these bottom-up national pledges will provide a solid foundation from which ambition can be ratcheted up in the coming years.

At the same time, the Fourth Industrial Revolution has contributed to a significant reduction in technology costs, and new and attractive economics of the sector provide an opportunity for investors to find stable, inflation-protected yields while accelerating much-needed deployment of clean energy.

The World Economic Forum platform exists at the intersection of energy, climate, and investment which gives us the unique opportunity to bring all parties together towards a mutually beneficial goal.

This handbook comes at a crucial time, when the renewables sector constitutes a compelling alternative to the low-yielding global environment, while the world strongly needs radical change to its energy matrix. We would like to thank the many World Economic Forum Partner companies that have contributed their expertise and leadership. In particular, we wish to express appreciation to Capricorn Investment Group, Caisse de dépôt et placement du Québec (CDPQ), PensionDanmark, GIC, CERES, and Bloomberg New Energy Finance. Richard Samans Head of the Centre for the Global Agenda Member of the Managing Board World Economic Forum

One of the most important challenges for institutional investors in the next several years is dealing with an environment of low-yielding opportunities combined with the rising need to deploy large amounts of capital and meet growing liabilities. At the same time, one of the most important challenges for the world as a whole is dealing with global warming and its proven economic impacts and negative consequences for humanity. While seemingly disparate, the two challenges have only recently converged to a point where they become synergetic.

Renewable infrastructure has reached sufficient maturity to constitute a sound investment proposition and the best chance to reverse global warming.

Two key concerns that have historically inhibited investments in renewable infrastructure are size and risk. First, large institutional investors look for opportunities to deploy meaningful amounts of capital, which has not been previously possible in the incipient industry. Second, renewable energy has always been associated with frontier technology risks, outside the realm of feasibility for traditional investors.

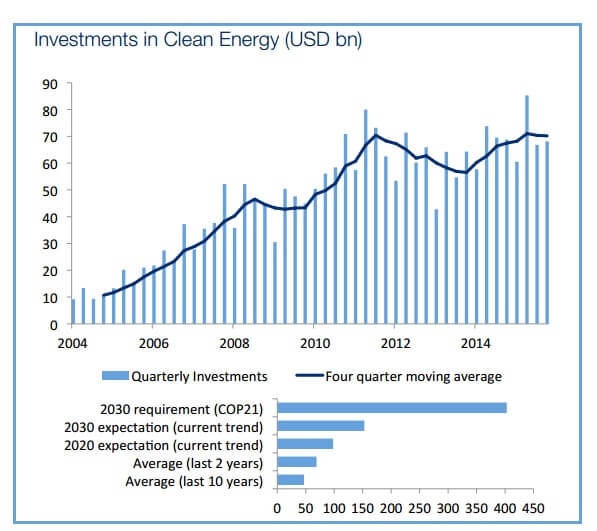

Both dynamics shifted in the past five years. First, renewable infrastructure now exhibits sizeable investment potential. Conclusions from the United Nations Conference on Climate Change (COP21) in December 2015 highlight the need for an additional $1 trillion in annual renewable infrastructure investment by 2030 to meet the goal of limiting global warming to 2 Celsius degrees. This need compares to a current annual average capacity investment of around $200 billion. Furthermore, among the top 500 asset owners, including foundations, pensions, and endowments, only 0.4% of total assets under management (AUM) have been identified as low-carbon investments ($138 billion versus $38 trillion AUM).

For the full 18-page report: https://goo.gl/Kce4b2

Filed Under: Financing, News, Projects