According to Simon-Kucher’s global Green-tech Study 2013, half of the surveyed solar companies across the Americas and Europe are struggling – Asian firms especially are under pressure. But the outlook is more positive for some firms, primarily in the wind energy and biofuel/biogas sectors. Several companies could even recover in the short-term.

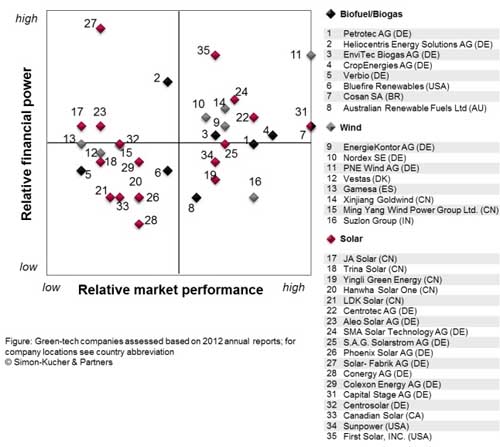

Where is the untapped potential in the green-tech sector? Posing this question, the international strategy consultancy Simon-Kucher & Partners conducted the Green-tech Study 2013*. The study analyzed and rated the market performance and financial power of 35 solar, wind, and biofuel/biogas companies across the Americas, Europe, and Asia. The results reveal the ability of companies to grow profitably and sustainably.

The transnational comparison across the various green-tech sectors shows that performance varies widely: Where some companies are very strong in market performance and financial powe

r, many hold a weak position. Companies from Asia in particular are underperforming. For companies from the Americas and Europe, the results are relatively mixed. “There’s still a lot of room for improvement. Many companies of the study show definite development potential,” says Dr. Philip Grothe, Partner at Simon-Kucher. Absolute frontrunner across the international green-tech sector is German PNE Wind AG with very high financial power and outstanding market performance.

Looking at the different green-tech sectors, it’s the wind energy companies that are especially well positioned with moderate to strong financial power and above-average market performance. “These companies should take advantage of their strengths to internationalize, clearly segment markets, and develop their product and service portfolio,” advises Alexander Thoele, Director at Simon-Kucher.

Small raise, big impact

What’s more, if companies were to raise their prices, even just slightly, they could break even or, much better, increase profits. A two percentage price improvement, for example, could cause a profit increase or loss decline at least in the two-figure percentage range. “This kind of improvement is usually possible with simple measures that can be quickly implemented,” says Thoele. If a company such as the US American First Solar made a slight price adjustment, it could increase profits by 169%, thereby turning a loss of approximately USD 41 million (EUR 31 million/GBP 27 million) into a profit of USD 28 million (EUR 21 million/GBP 18 million). Chinese Xinjiang Goldwind, to take another example, could similarly increase profits by 109%, turning a loss of USD 34 million (EUR 25 million/GBP 22 million) into a profit of USD 70 million (EUR 53 million/GBP 46 million). Canadian Solar and Brazilian Cosan SA, for instance, could decrease losses – or increase profits – by 13% each with only marginal price improvements. Generally speaking, every sixth company would more than double its profits.

No matter the country, no matter if solar or wind energy, or biogas/biofuel: “Waiting for sunnier forecasts will not help. If companies want to move forward, they have to get directly involved in sales and pricing, not just in consistent cost management,” explains Grothe. The untapped profit potential could strengthen the companies’ financial power and the market performance in the long-term and, at the same time, lay the groundwork for solid profitable growth.

The study is available upon request.

*Green-tech Study 2013: Expanding on their studies of solar firms in past years, Simon-Kucher & Partners’ Green-tech Study 2013 analyzed the market performance and financial power of selected listed green-tech (solar, wind, biofuel/biogas) companies worldwide. The study covered 19 solar, 8 wind, and 8 biofuel/biogas companies; 22 in Europe (Germany, Spain, Denmark), 9 in Asia-Pacific (China, India, Australia), and 5 in the Americas (USA, Canada, Brazil).

Simon-Kucher & Partners

www.simon-kucher.com

Filed Under: Financing, News