This article comes through the Lexology newsfeed and law firm White & Case. The authors include Cenzi Gargaro, Karsten Wöckener, Tallat Hussain, and Mindy Hauman

Since their introduction in 2007, “green” bonds issuances have exponentially increased in volume and have become part of the lexicon of environmental finance. Simply defined, green bonds raise funds for new and existing projects with environmental benefits. While many different types of green bonds are starting to emerge, for the most part, green bonds are similar to mainstream bonds, with the key difference being a defined use of proceeds for environmental protection, sustainability, climate change solutions and other green project purposes.1 Market Guidelines, Rules, and Regulations

Standardization and Principles

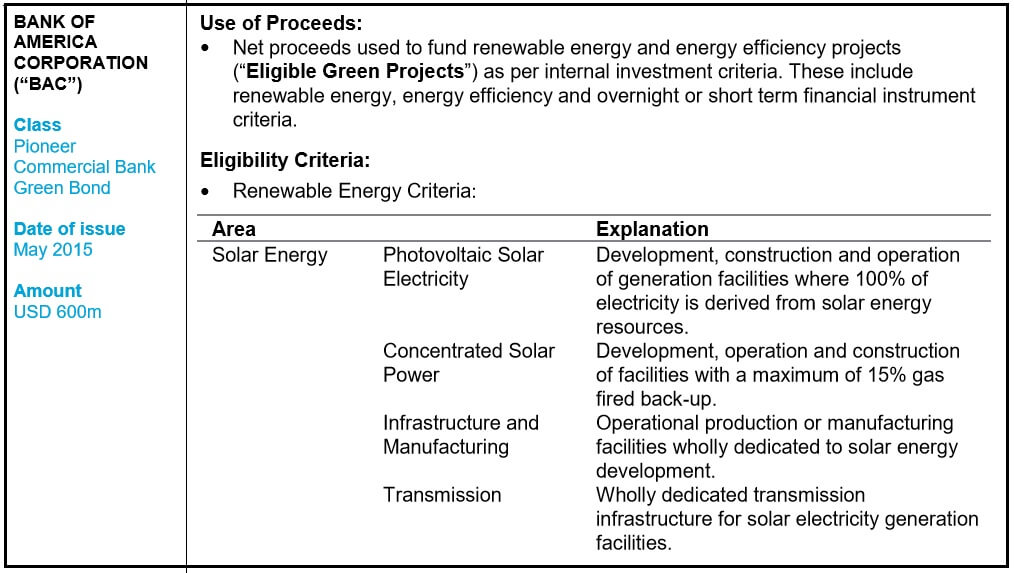

Tables in the report list several financial institutions and the range of green bonds each will issue.

The Green Bond market has developed on a self-regulatory and voluntary basis through such initiatives as the green bond principles (“GBP”)2 . The GBP and other similar standards are sets of voluntary guidelines to help clarify the issuance of Green Bonds. A microcosm of services has developed around the GBP to support the green bond market, involving standards providers (such as the Climate Bond Initiative – CBI), certifiers and assurance providers (such as the CBI, accountancy firms, analysts, and academics), and in some markets, elements of the voluntary guidelines of the GBP are being integrated into more Green Bonds-specific regulations.

Green defined

Although there are increasing attempts to rank the various possible “shades of green”, there is no legal definition of a green bond. Considering that the use of proceeds is the most distinctive feature of a green bond compared with other bonds, some countries, such as China and India, have recently complemented the GBP with policy-backed issuance guidelines, for a more determined focus on directing investment into green projects. Through the People’s Bank of China Announcement No. 39 [2015], China has set out recommendations and obligations which, in some instances, have the same foundations as the GBP. Recommendations include the use of independent external reviewers, a process for tracking and reporting on the use of proceeds, and a public annual report on the green projects financed by the green bond. Inspired by voluntary standards such as GBP, China has also sought to define “green” in its Green Bond Catalogue of sectors and projects. This catalog includes six categories: energy saving, pollution prevention and control, resource conservation and recycling, clean transportation, clean energy and ecological protection and climate change adaptation. The catalog seeks to strike a balance between responding to China’s 1 This Alert is based on a project in which White & Case advised the Chair of the G20 Green Finance Study Group on the terms and characteristics of Green Bonds in several markets and jurisdictions. 2 http://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/green-bonds/green-bond-principles/.

For the rest of this 14-page discussion: https://goo.gl/AijtXR

Filed Under: Financing, News