Joule Assets provides asset information whcih is the key to driving revenue growth in an increasingly complex energy reduction marketplace.

A provider of energy-market analysis, tools, and financing, announced its Energy Reduction Asset (ERA) Market Tools. The technology, a proprietary software platform, provides accurate, current, and unbiased analysis of market cash flows nationwide. This is the first of a series centers on the demand response industry. Future releases will target categories including energy efficiency, renewable energy, and carbon reduction.

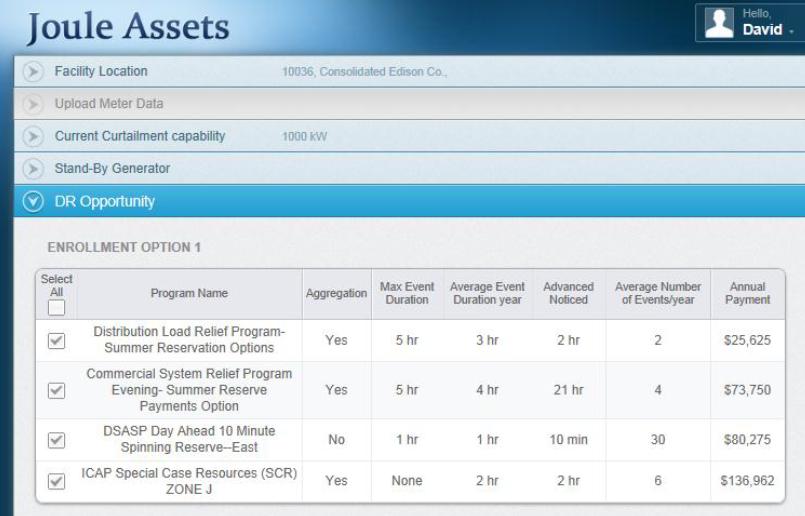

The ERA Market Tool, a web based system, includes meter and benchmarked data for those needing guidance in fine tuning a facility’s curtailment capability. In addition, the product will also provide a critical peak pricing (CPP) tariff calculator that will help users easily understand whether CPP is right for them. Beyond educating key customer audiences, Joule Assets will also offer counsel on the benefits their clients’ products and services can offer to enhance load management program participation.

“Information is the key to driving revenue growth in an increasingly complex energy reduction marketplace,” said Joule Assets CEO Mike Gordon. “For the first time, all stakeholders will have access to comprehensive information on revenue channels that are often overlooked. The ERA Market Tool is helping redefine how market players – building owners to utilities, product and service providers to consumers – can use this accessed value as a strategic asset. For some, such as the U.S. Energy Group, this can mean deeper touch with new or larger customers. For others, it means expanded opportunity with existing customers. Either way, it is access to information that is driving these strategies. ”

Joule Asset

Filed Under: Financing, News, Policy, Projects