This article comes from law firm Taylor Wessing and is authored Carsten Bartholl and Dominic FitzPatrick

The wind energy market remains one of the most dynamic international markets: according to the results of a study carried out by Taylor Wessing in cooperation with Frost & Sullivan, a consultancy and market research company, $94.4 billion was invested in new installations in 2016 and the number of players in the international wind market has increased, leading to a growth of competition in the market for wind services.

Market for wind energy has become increasingly global

In recent years, the market for wind energy has become increasingly global. In 2016, China overtook Europe and is now the largest regional market in the world. A study produced by Taylor Wessing and Deloitte in 2012 indicated that India played a negligible role in the area of wind energy, but now this country is set to double its capacity to generate wind energy between 2015 and 2020. According to our latest study, the areas with the greatest anticipated growth rates are Latin America and Turkey (around 17%).

Consolidation in the wind services market

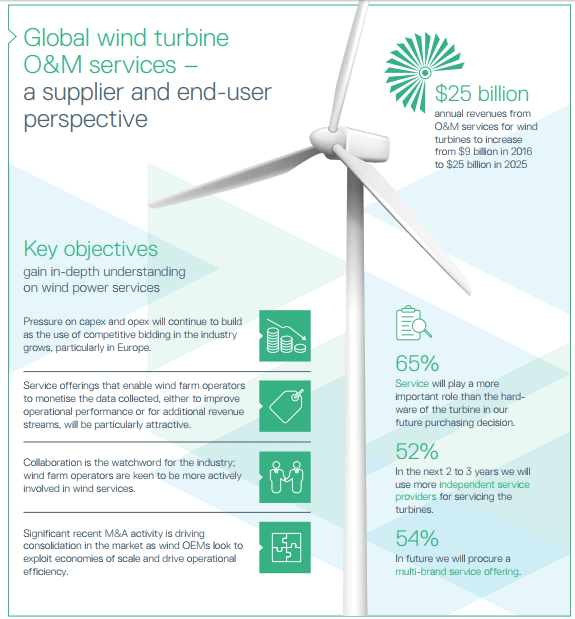

The growth of the wind energy market has been continuously accompanied by a corresponding growth in the market for required services. The study predicts a growth from $9 billion in 2016 to $25bn by 2025. The prognosis from 2012 that independent service providers (ISPs) on the basis of their local market knowledge and easy availability would regain ground over original equipment manufacturers (OEMs) has not proven to be true. Even in the market segment of wind parks, the first guarantee of which has expired, the OEMs could defend their market share up until now.

Furthermore, OEMs purchased ISPs or component manufacturers and in doing so strengthened their market presence. The market is developing further. The study indicates that by 2025 the installed wind capacity outside the first guarantee agreement will increase worldwide to 620 gigawatts. At the same time, particularly in Europe, the pressure on operational costs is increasing through the change-over to competitive bidding. 78% of those interviewed expect in the course of these developments a further market consolidation. The way in which the wind service providers will adjust to this situation is indicated by the study.

Digitalisation of the wind service market

The future is digital – this also applies to the service and maintenance sector of wind power equipment. The results of the survey in the study show that 79% of those interviewed in Europe (worldwide just 42%) work on the assumption of an improved monitoring of equipment through new technological solutions in the next few years. The use of production data for the increase of the operational performance is likewise considered to be promising. Overall the expectations of the service provider companies are rising: 65% of those interviewed agree with the statement “service will play a more important role than the hardware of the turbine in our future purchasing decision”.

Design of the study

The research project is based on a qualitative procedure. For the qualitative investigation in the form of expert interviews, a relevant group of 176 experts was identified (165 onshore, 11 offshore) from the field of wind energy in Europe (101 experts), North America (25 experts), Latin America (25 experts) and Asia (25 experts). 62% of those interviewed are managers with authority to make decisions.

Filed Under: O&M