From the study’s executive summary: Lazard’s Levelized Cost of Energy Analysis (“LCOE”) addresses the following topics:

Comparative “levelized cost of energy” for various technologies on a $/MWh basis, including sensitivities, as relevant, for U.S. federal tax subsidies, fuel costs, geography and cost of capital, among other factors

Comparison of the implied cost of carbon abatement given resource planning decisions for various generation technologies

Illustration of how the cost of utility-scale and rooftop solar-produced energy compares against generation rates in large metropolitan areas of the United States

Illustration of utility-scale and rooftop solar versus peaking generation technologies globally

Illustration of how the costs of utility-scale and rooftop solar and wind vary across the United States, based on average available resources

Forecast of rooftop solar levelized cost of energy through 2017

Comparison of assumed capital costs on a $/kW basis for various generation technologies

Decomposition of the levelized cost of energy for various generation technologies by capital cost, fixed operations and maintenance expense, variable operations and maintenance expense, and fuel cost, as relevant

Considerations regarding the usage characteristics and applicability of various generation technologies, taking into account factors such as location requirements/constraints, dispatch capability, land and water requirements and other contingencies

Summary assumptions for the various generation technologies examined

Summary of Lazard’s approach to comparing the levelized cost of energy for various conventional and Alternative Energy generation technologies

Other factors would also have a potentially significant effect on the results contained herein, but have not been examined in the scope of this current analysis. These additional factors, among others, could include: capacity value vs. energy value; stranded costs related to distributed generation or otherwise; network upgrade, transmission or congestion costs; integration costs; and costs of complying with various environmental regulations (e.g., carbon emissions offsets, emissions control systems). The analysis also does not address potential social and environmental externalities, including, for example, the social costs and rate consequences for those who cannot afford distribution generation solutions, as well as the long-term residual and societal consequences of various conventional generation technologies that are difficult to measure, such as nuclear waste disposal and environmental impacts.

While prior versions of this study have presented the LCOE inclusive of the U.S. Federal Investment Tax Credit and Production Tax Credit, Versions 6.0 – 8.0 present the LCOE on an unsubsidized basis, except as noted on the page titled “Levelized Cost of Energy—Sensitivity to U.S. Federal Tax Subsidies”

I Unsubsidized Levelized Cost of Energy Comparison

Certain Alternative Energy generation technologies are cost-competitive with conventional generation technologies under some scenarios; such observation does not take into account potential social and environmental externalities (e.g., social costs of distributed generation, environmental consequences of certain conventional generation technologies, etc.) or reliability-related considerations (e.g., transmission and back-up generation costs associated with certain Alternative Energy generation technologies)

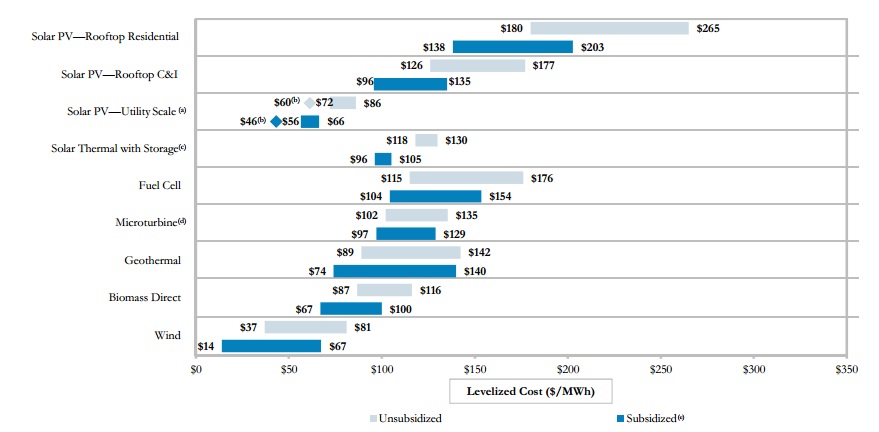

Levelized Cost of Energy—Sensitivity to U.S. Federal Tax Subsidies Source: Lazard estimates.

(a) Low end represents single-axis tracking. High end represents fixed-tilt installation. Assumes 10 MW fixed-tilt installation in high insolation jurisdiction (e.g., Southwest U.S.).

(b) Diamonds represent estimated implied levelized cost of energy in 2017, assuming $1.25 per watt for a single-axis tracking system.

(c) Low end represents concentrating solar tower with 18-hour storage. High end represents concentrating solar tower with 10-hour storage capability.

(d) Reflects 10% Investment Tax Credit. Capital structure adjusted for lower Investment Tax Credit; assumes 50% debt at 8.0% interest rate, 20% tax equity at 12.0% cost and 30% common equity at 12.0% cost.

(e) Except where noted, reflects 30% Investment Tax Credit. Assumes 30% debt at 8.0% interest rate, 50% tax equity at 12.0% cost and 20% common equity at 12.0% cost.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior consent of Lazard.

U.S. federal tax subsidies remain an important component of the economics of Alternative Energy generation technologies (and government incentives are, generally, currently important in all regions); while some Alternative Energy generation technologies have achieved notional “grid parity” under certain conditions (e.g., best-in-class wind/solar resource), such observation does not take into account potential social and environmental externalities (e.g., social costs of distributed generation, environmental consequences of certain conventional generation technologies, etc.) or reliability-related considerations (e.g., transmission and back-up generation costs associated with certain Alternative Energy generation technologies)

For the full report: http://www.lazard.com/PDF/Levelized%20Cost%20of%20Energy%20-%20Version%208.0.pdf

Filed Under: News