Material developments are allowing longer blades that are opening more low-wind sites to wind development, which in turn is raising capacity factors and lowering the cost of energy. But transporting blades 53m and longer is becoming a construction bottleneck. Still, the U.S. wind industry is strong and cost competitive with other energy sources. Those are a few of the observations and forecasts presented by Aaron Barr with MAKE Consulting (www.consult-make.com) at the recent Sandia Wind Turbine Blade Workshop.

The consulting firm expects a global market recovery in 2014 after the slight dip in 2013 driven by weakness in the U.S. A back drop is that China is expected to install nearly 50% of the world’s wind-energy capacity over the next 10 years. Overall, Barr’s message is positive: he expects the industry to grow for the next 10 years all underpinned by macro-economic trends and climate-change initiatives.

In the U.S. long-term demand remains volatile for several reasons. One is that demand has shifted from 2014 to 2015 due to the relatively late guidance from the IRS on the PTC. “Developers and tax-equity investors are deciding which projects to commit to, making this an exciting time for them. And there is no shortage of good projects. It’s all a matter of how many projects they can get in by the deadline. MAKE expects an extension to the PTC in the lame duck session of Congress, although that is not a certainty. But what if the PTC goes away? Wind energy is developed enough to be economically competitive in some markets with other forms of power generation,” says Barr.

Wind energy is competitive now with natural gas, despite historically low natural-gas prices. “If you think about long-term cost aspects of where wind energy can go, technology is improving and cost of energy is expected to continue to decline. Wind power can become more cost competitive with natural gas in the near-term particularly by using the latest technology,” says Barr.

What is driving the cost of energy improvements? Much of it is around the blade. “We think by 2016 about half of the turbines deployed will be certified for IEC Wind Class III, targeted for the lowest spectrum of the resource. One key trend is that large rotors on Class III turbines are being sited in Class II winds. That is done safely with careful loads analysis by developers and turbine OEMs. This provides a double-dip for the project economics, by placing a high-production machine in higher-production winds and that helps lower the cost of energy. So the industry is getting smarter about micro-siting.”

The specific-power rating is another way to quantify new turbines. The specific rating is the power rating of the turbine divided by the swept area of the rotor. A lower specific rating uses a larger rotor and generally aligns with a lower wind speed turbine. Another trend in the last few years has the most recently released turbines dropping in specific rating within their IEC Class.. For example, a Class II turbine that was historically rated above 300W/m2 and is now getting into the low 200s with a larger rotor which leads to higher capacity factors. “Cutting-edge Class III turbines coming into the market now are below 200W/m2 which is a threshold that many in the industry thought we would never touch. It is something to be proud of and it’s all underpinned by technology in the blade,” adds Barr.

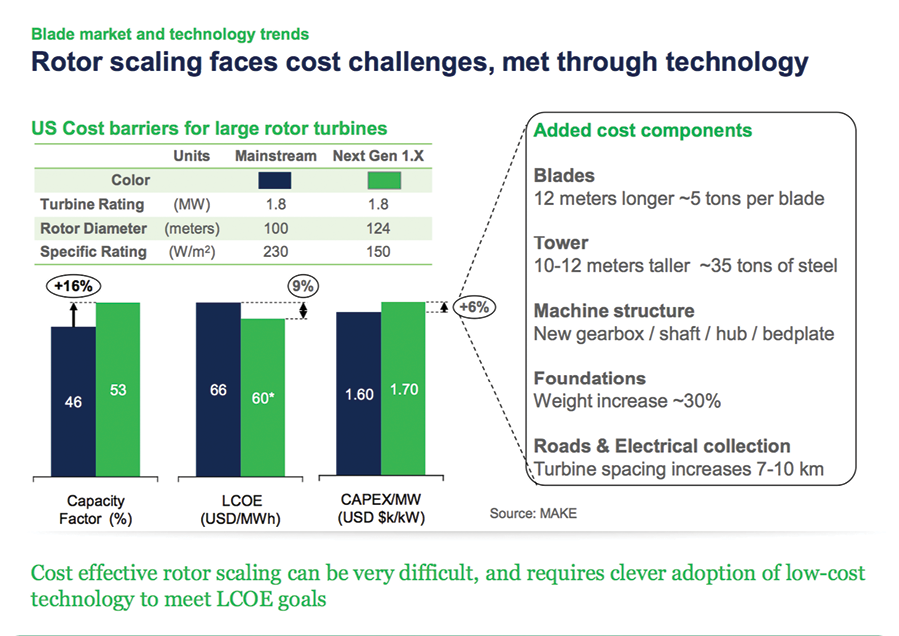

Also, by 2016, about half turbines in the market will have blades longer than 50m. That is a big change from 2012. “One thing to highlight is that blades 40m and shorter will become obsolete in the global-wind industry over the next few years because of trends to longer blades, although a few will be built for locations with high wind speeds. However, to make continual progress lowering the cost of energy, many things must be rethought. For instance, consider a mainstream turbine, a 1.8-MW unit with a 100-m rotor. “Hypothetically, with a 124-m rotor (with 61m blades) it could reach a 150 W/m2 density while the capacity factor gets a huge gain putting it close to 50%.

So to continue making progress, let’s consider what must be done to drop the LCOE by 10%. “The allowable additional capex (capital expenditure) is small, only about 6% of additional costs. That means making the blade longer using more material, building the tower taller with more steel, making the machine structure more durable, adding concrete to foundations, and spacing the turbine rows further apart. These are big challenges, but there is a lot of opportunity for technology to lead and many turbine OEMs are considering the tradeoffs,” says Barr.

Another significant challenge affecting longer blades will be transportation. “Many transport carriers were burned by2013, left with large lease payments and no shipments for their specialized trailers. We think the overall trailer capacity for the wind industry is down 20% because of last year’s dip. On top of that, the new products for 2015 are long-blade products that need more specialized transport methods. About one-third of the U.S. demand in 2015 will come from blades longer than 53m. That leaves us with a shortage of trailer capacity capable of hauling longer blades,” he says. It means carriers have to invest in new equipment which they are hesitant to do, or modify existing trailers to take on longer blades. That is happening, but it is a bottle neck the industry will face next year,” he adds.

Rear overhang from blade trailers is the primary driver of the logistics constrain. Federal regulations limit trailer overhang to 30 ft and different states enforce the rule differently. “Some indicators are that predominant wind states are enforcing the 30-ft limit, which means a lot of rerouting with more escorts and more permitting, compounding the bottle-neck issue. Still, there is opportunity for technologists to innovate, through modular construction or next-generation blade transportation methods.” says Barr.

One last item worth attention: advanced materials and carbon fiber in particular. “Over the last few years we estimate about one-fourth of new blades used carbon fiber. However, as cost pressures have mounted, blade manufacturers are innovating past carbon fibers and looking to high-modulus glass, or other use of existing glass fibers that allow for reduced cost, while satisfying the strength requirements for longer blades. We think there will be a retraction from carbon fibers in the years ahead. But the future looks bright for blade materials innovation and the table Commercial status of blade materials provide a peek into it,” he says.

E-glass and epoxy dominate the market due to cost and track record. High modulus glass is expected to gain share at the expense of high-priced carbon fiber. WPE

Filed Under: Blades

I believe it was at AWEA in San Francisco (around 1995) that I predicted the ultimate need for a 100+ ton multiple rotor helicopter to transport massive wind and infrastructure components (including crane components) to remote sites from the manufacturing facilities. I continue to be amazed that this such a heavy lift helicopter (quadcopter, octocopter) has yet to appear. Historically, the Russians have demonstrated the greatest prowess in such machines, given that the need for such a machine exists far beyond that of the wind energy industry.