From law firm Pierce Atwood LLP by Jared S. des Rosiers, James Avery, and Liam Paskvan

On April 28, 2017, the Massachusetts investor-owned electric distribution companies[1] (Distribution Companies), in coordination with the Massachusetts Department of Energy Resources (DOER) (together, the Soliciting Parties), submitted for review by the Massachusetts Department of Public Utilities (DPU) a joint request for proposals (RFP) for up to 800 MW of Offshore Wind Energy Generation and associated transmission to enter into long-term contracts of 15 to 20 years. The Soliciting Parties expect to issue the final RFP on June 30, 2017, with bid submissions due in December 2017.

The proposed RFP is the Soliciting Parties initial solicitation to contract for Offshore Wind Energy Generation consistent with Section 83C of the Green Communities Act, as amended in 2016, which requires the Distribution Companies to enter into cost-effective, long-term contracts for generation equal to 1,600 MW of aggregate nameplate capacity by no later than June 30, 2027. Together with the ongoing solicitation for onshore Clean Energy Generation issued on March 31, 2017 (and previously summarized here), the RFP reflects the Commonwealth’s continued commitment to procuring additional clean energy and provides bidders with a substantial opportunity to assist Massachusetts in meeting those commitments in a timely manner. This alert provides a high-level summary of the RFP, as well as next steps and important dates to remember.

A little background

Under the Climate Protection and Green Economy Act,[2] Massachusetts is required to “establish goals and meet targets for the reduction of greenhouse gas emissions by 2020, 2030, 2040, and 2050.”[3] Most immediately, the act requires a GHG emissions reduction of 25 percent below 1990 levels by 2020. Consistent with Section 83C of the 2008 Green Communities Act, as amended in 2016,[4] the RFP encourages proposals that will “maximize the Commonwealth’s ability to achieve such emissions reduction goals.”[5]

Purpose of the RFP

The RFP seeks proposals for “Offshore Wind Energy Generation” and/or RECs, as well as associated transmission necessary to deliver such generation to the ISO-New England, Inc.’s (ISO-NE) Pool Transmission Facilities (PTF) onshore. The RFP defines “Offshore Wind Energy Generation” as:

[O]ffshore electric generating resources derived from wind that: (1) are Class I renewable energy generating sources, as defined in Section 11F of Chapter 25A of the General Laws; (2) have a commercial operations date on or after January 1, 2018, that has been verified by the Department of Energy Resources; and (3) operate in a designated wind energy area for which an initial federal lease was issued on a competitive basis after January 1, 2012.The Soliciting Parties seek to procure a total of 400 MW of Offshore Wind Energy Generation, but will consider proposals for up to approximately 800 MW, and may contract for an amount in excess of 400 MW if a “larger-scaled proposal is both superior to other proposals . . . and is likely to produce significantly more economic benefits to ratepayers.”[6]

Bid requirements

Bid requirements

Each bidder must submit at least one bid for a 400 MW generation project. In addition, each bidder may also submit alternative bids for projects ranging from 200 MW to 800 MW. All projects must have a scheduled commercial operation date before January 1, 2027. Bidders must propose a price for Offshore Wind Energy Generation and/or associated RECs on a fixed $/MWh and/or $/REC basis. All payments under a long-term contract will be calculated based on actual production following delivery to the ISO-NE onshore transmission system. The RFP prohibits lump sum payments or prepayments to a selected generator.

Each bid must also include two alternative proposals for delivery facilities necessary to transmit the Offshore Wind Energy Generation to the ISO-NE PTF, either by means of (1) Project Specific Generator Lead Line; or (2) Expandable Transmission Proposal Under a FERC Tariff. Under the Project Specific Generator Lead Line approach, Offshore Wind Energy Generation will connect directly from the offshore generation site to the ISO-NE PTF through project-specific generator lead lines and associated delivery facilities. The bidder may elect delivery cost recovery either through a power purchase agreement (PPA) that includes both generation and delivery costs, or separately from generation costs, pursuant to a FERC-accepted tariff.

Under an Expandable Transmission Proposal Under a FERC Tariff, the bidder (either alone or in combination with other bidders) must propose to design and construct all necessary delivery facilities to allow for the transmission of 1,600 MW to the ISO-NE PTF, the full amount of Offshore Wind Energy Generation contemplated under Section 83C. The proposed transmission line would transmit the generation included as part of the generator’s bid, and retain sufficient excess capacity, or “headroom,” to allow for nondiscriminatory access to other bidders in the current RFP or in future solicitations. The RFP states that such expandable transmission bid types are “intended to support development of the offshore wind energy market by providing current and future Offshore Wind Energy Generation developers with expandable, nondiscriminatory, open-access facilities for the efficient delivery of their power” to the ISO-NE PTF.[7] The bidder is entitled to cost recovery under a FERC-approved tariff.

Bid and contract review

The RFP contemplates a three-stage evaluation of submitted bids by the Soliciting Parties, including (1) an initial review to ensure satisfaction of eligibility and threshold requirements; (2) a detailed quantitative and qualitative evaluation of each proposal using numerous identified criteria; and (3) a further discretionary evaluation of remaining proposals to “select the proposal(s) that provides the greatest impact and value consistent with the stated objectives and requirements of Section 83C . . .”[8] Any executed long-term contract between a bidder and the Distribution Companies must be reviewed by the DPU, and approved upon a DPU finding that the contract is “a cost-effective mechanism for procuring reliable Offshore Wind Energy Generation on a long-term basis . . .”[9]

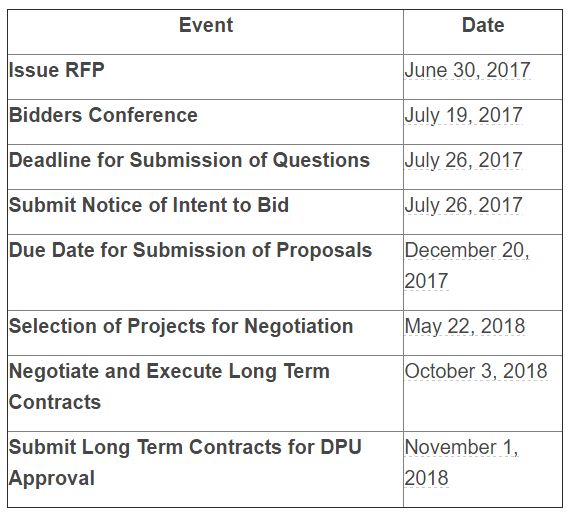

Next steps (table above)

The DPU will review the RFP as submitted by the Soliciting Parties and seek public comment. Subject to the DPU’s issuance of an order approving the RFP, the Soliciting Parties contemplate these next steps:

Filed Under: News