Editor’s note: This article comes from New Energy Update, and is authored by Neil Ford. To read the full version, click here.

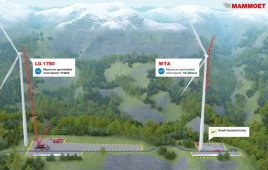

Wind operators are upgrading to larger, more efficient turbines before tax credits expire. (Image: Ictor)

U.S. wind repowering is booming as operators take advantage of technology advances and tax credit windows to increase asset returns. Falling costs and growing wholesale market exposure have pressured margins for suppliers and operators.

In 2017, MidAmerican Energy Company launched a $1 billion-project to repower seven wind farms in Iowa which were commissioned between 2004 and 2008. A subsidiary of Berkshire Hathaway, MidAmerican operates over 4 GW of wind power at 23 wind farms in Iowa and plans to build a further 2 GW of new capacity under a $3.6 billion investment program.

MidAmerican’s 176-MW Intrepid, 200 MW Century, and 105-MW Victory wind farms were repowered in 2017, and current repowering activities focus on the 75-MW Charles City plant. The operator will then move on to repower the 286-MW Pomeroy, 150-MW Carroll, and 153-MW Walnut facilities.

The repowering work includes installing larger blades and hubs and replacing various components inside the nacelle. MidAmerican expects annual energy production (AEP) to increase by 19 to 28% across the seven projects, depending on site-specific factors.

MidAmerican’s repowering of seven wind farms in Iowa will increase annual output by up to 28% and could provide over 20 years of revenues, a MidAmerican spokesman told New Energy Update. To read the full article, please click here.

Filed Under: Construction, News, Policy