By Michelle Froese, Senior Editor

Windpower Engineering & Development

This article is part of Windpower Engineering & Development’s February 2017 issue. A complete digital version of the issue is here.

Repair, replace, run to failure, re-invest and expand? There are plenty of questions to consider when deciding how to move forward with an aging wind fleet. Fortunately, researchers are working on a support tool to help wind-farm owners make wise investment decisions when assets reach their expected end-of-life.

Given enough time, even the best-engineered machines begin to break down and wind turbines are no exception. Reliability, efficiency, and power production drop considerably with age in turbines, and so does the likelihood of finding compatible replacement parts for those that wear. Most wind-farm owners can expect a lifecycle of about 20 to 25 years from their fleet.

With manufacturers’ warranty periods lasting between eight and 20 years, O&M planning for aging turbines is a potentially tricky process. Reactive maintenance (waiting until something breaks) can result in time-consuming and extremely costly repairs, so there is motivation for replacing turbine components that still work quite well.

“When a component stops working, such as a generator, you need to order a crane, wait for it to arrive, hire technicians, and then decide on whether to repair or replace the generator, which may require an order for a brand-new one,” said Dr. Rupp Carriveau, an Associate Professor at the University of Windsor in Canada, who is researching the most profitable O&M options for extending turbine life.

“Of course, while waiting, the wind-farm owner is losing money because their downed turbine is not producing power,” he added.

Proactive maintenance lets a wind-farm owner plan ahead, order components and a crane in advance, and reduce turbine downtime. “The owner may also decide to replace the generators on five turbines at once to take advantage of having a crane on site.”

This sounds ideal. However, as Carriveau points, out how can a site owner know when it’s best time for proactive maintenance? “What year in a turbine’s life are component replacements ideal — year six or 16?” he asked. “And how do you know when the right time is to buy a new generator, for example, so that it makes the most sense from a financial standpoint?”

After all, there is an option of holding onto those purse strings and not spending money on a component that might last years longer than anticipated. It costs a pretty penny to have generators sitting in storage or to replace five of them on aging wind turbines “just in case” one breaks down in the near future.

Planning for failure

So proactive or reactive maintenance at a wind farm? That is the question Carriveau and a team of researchers are currently investigating. Led by the University of Windsor, with help from Western University Ontario and three industrial partners (Enbridge, Kruger Energy, the Wind Energy Institute of Canada), the goal is to build a financial risk-analysis model that supports wind-farm owners and operators when deciding on the best O&M strategy for their wind farm.

“Our aim is really about making good business decisions,” said Carriveau. “Wind turbines represent a large investment and without accurate planning, those dollars are easily wasted. The objective of this academic and industrial collaboration is to maximize the output of wind-turbine assets to ensure that every last cent put into these machines is maximized.”

The research project is called YEAR21 in reference to the year following a wind-turbine’s 20-year life expectancy. Each project partner has committed $C42,000 to the research over two years, and the team has also applied for a grant from Natural Sciences and Engineering Research Council of Canada.

Over time, project owners will need to decide whether to re-wind, new-wind, or unplug wind farms once these investments near their projected design life. Strategic owners will first want to know the potential impact of these actions on the total value of the wind farm over its projected lifetime. YEAR21 is a prognostic investment tool that integrates an asset’s physical conditions with current market dynamics and may help guide investment decisions.

“We are conducting our research with data that is already available that may not be fully leveraged. There is so much excellent and accessible third-party data, but it can be challenging to get a handle on what to look at and what is most useful,” said Carriveau. For example, he compares a wind turbine to owning an aging car. “Should you buy brand-new tires if the car may not last as long as the tires? Or should you try to make the vehicle last an extra five years with repairs and upgrades?”

The YEAR21 team has already begun analyzing data from wind farms and learning what data inputs are most relevant for more financially savvy O&M planning. “It is a trial and error process as we learn what data inputs to look at that are most relevant for accurately predicting life expectancy,” he said.

Learning from failure

In a recent case study, the YEAR 21 team looked at data from a wind farm with multiple turbine generator failure, and tried to determine when the ideal time would have been to buy those generators — before or after they began to fail.

“For example, would it have made more sense financially to buy each generator as needed upon failure, or to have purchased some in advance to have on hand in anticipation of these failures?” said Carriveau. “There was also the option of completely replacing those generators before necessary in anticipation of failure, and so we came up with two scenarios.”

According to Carriveau, the team primarily looked at user hours in this case because as time progressed and user hours accumulated, the chances of a generator failure also went up. Costs for each scenario were based on these numbers:

- Generator costs for one: $6,000

- Crane costs: $12,000/week (need for a minimum of one week)

- Labor costs: $5,000/week

Scenario 1. The pro-active approach

“This scenario involved replacing five aging generators at a time to take advantage of when the crane is onsite and minimize turbine downtown,” said Carriveau. “Expect to pay about $69,000 per generator in this pro-active mode.”

Scenario 2. The reactive approach

“Here, no action is taken until a generator fails,” he said. He noted that this scenario must account for additional lost revenue based on the time it would take to order and wait for a crane and work crew to arrive onsite. “Considering the downtime and crane costs in reactive mode, which can add up to an extra week or two, the price goes up to about $95,000 per generator.”

The YEAR21 team calculated a ratio of 1.37 between the pro-active and reactive scenarios. “This means that a wind-farm owner who decided on a ‘wait and see’ approach in this case would have paid 1.37 times the proactive costs by waiting — assuming that a generator failed over time. But there was always the probability that the generator wouldn’t fail and that the wind-farm owner could hang on to his or her money longer.”

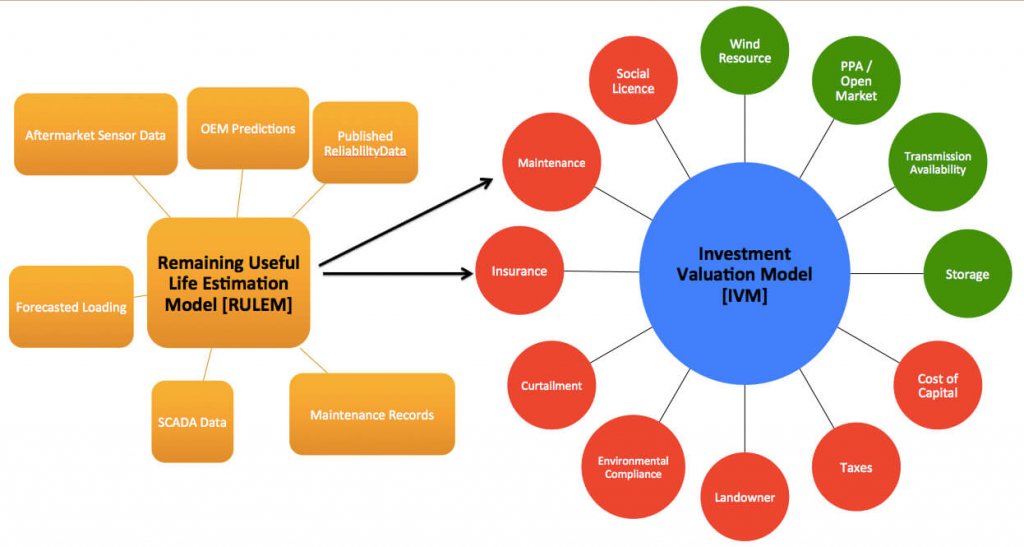

YEAR21 study aims to leverage years of public domain and stakeholder supplied historical data to produce estimates of Remaining Useful Life (RUL) of major wind energy assets. It then links physical assets RUL with a Business Valuation Model (BVM). The BVM seeks to include the major factors influencing the financial viability of a farm operation. YEAR21 also offers an inclusive model of present-day and forecasted risk-adjusted wind-farm valuation based on asset conditions (fed from RUL estimates), market, regulatory, and social factors.

To determine which scenario was more likely, Carriveau and his team conducted a life data analysis. “We needed to find out what the break-even point would be.” To do so, he said they looked for a maximum life prediction analysis that best fit their data set, and chose a two-parameter Weibell or continual probability analysis. He admitted that the analysis was based on a small data set that was not statistically significant, but still indicative of a reliable result.

“Here we found that when we hit a failure rate of 73%, that was the break-even point. So when the generators began to fail at a rate of 73%, it was necessary to become pro-active in order not to lose revenue,” he said. “With our modeling for this data set, year 15 or 16 you hit that point and it was no longer worth waiting to react.”

This means that before year 15, the best economic approach was for the wind-farm owner to wait and fix the turbines as they failed. By year 16 in a generator’s life, this rule changed and a proactive approach became the ideal choice.

“Sounds simple, right?” Carriveau asked. “However, if you follow this advice, something interesting happens to your data set and you essentially alter the population of your generators.” He explained that as each year goes by and a generator fails and gets replaced, the population changes. Some turbines may still require a generator upgrade at year 15, but others may have just had one.

“So by year 15, you may no longer have a large amount of aging generators worthy of a pro-active approach, but a dynamic age range of these components.” Ideally, re-analysis would be required to determine the best scenario at this time.

“This brought us back to square one,” said Carriveau. “But what it also told us was that if you’re trying to scale models based on a component’s user hours alone, that’s not enough information. The lesson was that more inputs are required for better data analysis.”

The YEAR21 team is now focusing on new inputs, such as the cumulative power through a generator over its lifetime including transient loading rates. Transient loads are particularly relevant to the wind industry because of the variable nature of wind power.

“It’s one thing just to log power through a generator, but we’re also interested in when and where that power served through a transient event because there’s almost always an additional fatigue side to that,” said Carriveau. The team is also considering vibration data and looking at other potential inputs, such as wind speed and turbulence.

“We’re ultimately trying to build a financial risk-analysis tool that will improve as the engineering data that drives it improves,” said Carriveau. “By pro-actively mapping these scenarios, we want to help wind-farm owners maximize their assets and investments — just like they might their car or home.”

Filed Under: Financing, News, Projects