By 2021, almost half (49%) of institutional investors expect to increase their exposure to assets supporting and participating in the energy transition, according a new study by Aquila Capital. This transition involves the progressive replacement of fossil fuels by renewable sources of energy production.

According to the research by Aquila Capital, 68% of investors think that the increasing share of renewables in the energy mix make the energy transition more appealing financially.

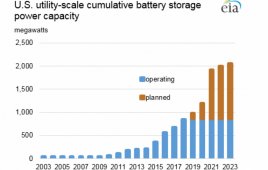

The new research reveals the fast-growing popularity of the energy transition among institutional investors and the most attractive opportunities it currently presents. Nearly two-thirds (63%) cited energy storage (e.g. batteries) as offering the greatest investment potential. This was followed by electricity transmission (45%), which involves building and operating the links from power plants to substations, and the inter-connectors between energy grids (41%).

“These findings underline the growing appeal of the energy transition among institutional investors and the opportunities that they find most appealing,” said Susanne Wermter, Head of Investment Management Energy & Infrastructure EMEA, Aquila Capital. “Indeed, 82% of investors said they would be attracted by a multi-asset class fund mandated to invest in renewable energy generation, storage, and transportation.”

According to Aquila Capital, energy storage is becoming particularly appealing because of the growing role it will play in maintaining the supply of renewable electricity to Europe’s energy mix. Aquila Capital believes that cost reductions, technology development and improving regulations will continue to strengthen the investment case for storage moving forward.

The study identifies several factors that make participating in the energy transition more interesting financially for investors. The most important of these, cited by 68% of investors, is the increasing share of renewable sources in the energy mix, followed by the restructuring and decentralization of energy grids (62%).

“To meet growing investor demand, we launched the Energy Transition Infrastructure Strategy (ETIF) in April last year. The ETIF aims to invest in these three key sub-sectors. Europe is making progress on its energy transition journey and investors have an unprecedented opportunity to benefit from this,” says Wermter.

Download Aquila Capital’s whitepaper on energy storage here.

Filed Under: Energy storage, Financing, News