“The Future of U.S. Renewable Energy Investment: A Survey of Leading Financial Institutions,” collected data and insights from senior-level respondents across banking institutions, asset managers, private equity firms and other financial firms that together represent approximately one third of annual U.S. renewable energy investment. Download the report here.

The American Council on Renewable Energy (ACORE) launched a new campaign that aims to reach $1 trillion in U.S. private sector investment in renewable energy and enabling grid technologies by 2030.

Through $1T 2030: The American Renewable Investment Goal, the country’s major providers of capital for energy infrastructure projects have now come together in a coordinated effort to accelerate the investment and deployment of renewable power as the sector moves to the next stage of market maturity.

$1T 2030 is managed through the Partnership for Renewable Energy Finance (PREF), a senior-level ACORE member program widely regarded as the nation’s most credible educational resource on renewable energy finance. The campaign will leverage the network of ACORE members and supporters, highlighting a combined set of common sense policy reforms and distinct market drivers that are necessary to reach this ambitious goal.

In the absence of new policies, most analysts expect the recent booming pace of renewable investment to decline in the early 2020s, but if we adopt the pathway for growth articulated by this campaign,

America will close the innovation and investment gap with other nations, build on the impressive track record of job creation in wind, solar, and related fields, and stay within striking distance of the U.S. commitment for greenhouse gas emission reductions outlined in the Paris Accord.

America will close the innovation and investment gap with other nations, build on the impressive track record of job creation in wind, solar, and related fields, and stay within striking distance of the U.S. commitment for greenhouse gas emission reductions outlined in the Paris Accord.

The pathway to $1 trillion includes:

- A long-term federal policy commitment providing support for carbon-free electricity generation, presumably as part of an effort to address the externalities associated with greenhouse emissions, after the wind and solar tax credits phase out in the early 2020s.

- Federal, state and regional policies to promote modernization of the nation’s electrical grid, including rules that allow renewables to compete fairly in electricity markets, and new incentives for energy storage and other enabling grid technologies.

- Continued expansion of state renewable portfolio standards to support increasing deployment of renewable electricity.

- Reforms to facilitate siting and permitting processes for renewables and transmission and allow for accelerated renewable energy growth.

Some key market drivers include:

- A scale-up of the energy storage market, via new business models, improving economics and technology innovation, that will enhance integration of renewables as its makeup of America’s power generation portfolio achieves new levels.

- Increased corporate renewable purchasing by diversifying procurement options and developing market incentives for middle market and industrial companies, expanding renewable energy use throughout the C&I sector.

- High-levels of public awareness and support for renewable energy and electric vehicles as an actionable solution to combat climate change, leading to increased deployment of rooftop solar, purchase of electric vehicles and demand for renewable energy from electricity suppliers.

- Continued financial innovation as capital stacks evolve to replace tax equity as a key source of project financing, and as the industry seeks a more standardized approach to finance new project offerings, such as renewables plus storage systems.

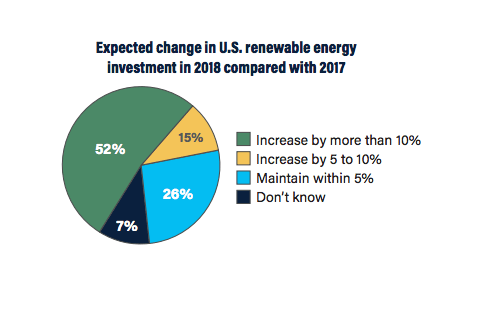

$1T 2030 is founded on a range of insights drawn from an ACORE survey of renewable energy investors gauging confidence in the U.S. renewable sector and the impacts of supportive policy reforms and market drivers.

Filed Under: News, Policy