Mark Bolinger, Lawrence Berkeley National Lab

Lawrence Berkeley National Laboratory is pleased to announce the release of a new report, “An Analysis of the Costs, Benefits, and Implications of Different Approaches to Capturing the Value of Renewable Energy Tax Incentives.”

In the United States, incentives for the deployment of utility-scale wind and solar power projects are delivered primarily through the tax code, in the form of accelerated tax depreciation and tax credits that are based on either investment or production. The combined value of these tax deductions and credits (together, referred to as a project’s “tax benefits”) generally exceeds a project’s internal ability to use them in each of the first five (or more) years of the project’s life.

In the United States, incentives for the deployment of utility-scale wind and solar power projects are delivered primarily through the tax code, in the form of accelerated tax depreciation and tax credits that are based on either investment or production. The combined value of these tax deductions and credits (together, referred to as a project’s “tax benefits”) generally exceeds a project’s internal ability to use them in each of the first five (or more) years of the project’s life.

Some project sponsors, said to have “tax appetite,” are able to efficiently (i.e., in the years in which they are generated) apply any excess deductions and credits against other sources of taxable income external to the project in question. This is the best possible outcome for the sponsor. Other project sponsors that lack tax appetite may carry forward excess tax benefits to future years until they can eventually be used internally by the project itself, but this strategy sacrifices some of the incentives’ value, due to the time value of money. A third option is to bring in – at a cost – a third-party “tax equity” investor who is able to efficiently use the project’s tax benefits, and who invests in the project in exchange for being allocated most or all of its tax benefits; this is known as “monetizing” the tax benefits (i.e., converting their value into money that can be used to finance the project).

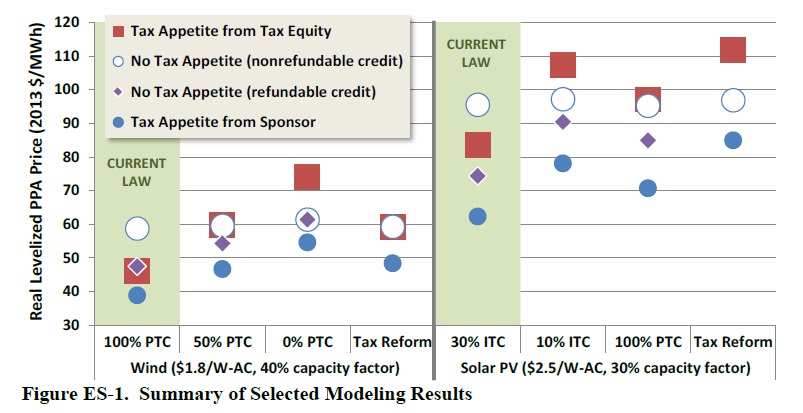

This report analyzes and compares the relative costs, benefits, and implications of capturing the value of renewable energy tax benefits in these three different ways – i.e., applying them against outside income, carrying them forward in time until they can be fully absorbed internally, or monetizing them through third-party tax equity investors – to see which method is most competitive under various scenarios. It finds that under current law and late-2013 market conditions, monetization makes sense for all but the most tax-efficient project sponsors. In other words, for most project sponsors (i.e., those without much tax appetite), bringing in third-party tax equity currently provides net benefits to a project.

Under a variety of plausible future policy scenarios that are relevant to utility-scale wind and solar projects, however, the benefit of monetization is found to no longer outweigh the incremental cost of tax equity. Under these scenarios, which range from a permanent expiration of tax credits to making tax credits refundable to comprehensive tax reform, it would make more sense for sponsors – even those without tax appetite – to use tax benefits internally (even if it means carrying them forward in time) rather than to monetize them through third-party tax equity investors.

These findings have implications for how wind and solar projects are likely to be financed in the future, which, in turn, influences their levelized cost of energy (“LCOE”). For example, if any of these scenarios were to come to pass, many wind and solar projects would likely forego tax equity in favor of cheaper sources of capital like long-term debt. This shift to lower-cost capital would, in turn, partially mitigate any negative impact on LCOE resulting from the policy change itself (e.g., in the case of tax credit expiration or tax reform), thereby leaving the net LCOE increase less than one might otherwise expect.

Notably, this report does not attempt to estimate the impact of these policy shifts and resulting changes to LCOE on future deployment. It can, however, inform such studies by suggesting likely financing structures, as well as net LCOE impacts, to be used as appropriate inputs to deployment models under a variety of policy scenarios.

This report, along with a slide deck summary of the report and a pre-recorded 30-minute presentation of that slide deck, can all be freely downloaded from the following link:

This work was co-funded by the U.S. Department of Energy’s Wind and Water Power Technologies Office and Solar Energy Technologies Office, both within the Office of Energy Efficiency and Renewable Energy, under Contract No. DE-AC02-05CH11231.

LBNL

emp.lbl.gov

Filed Under: News

I am interested in the lbnl company job. my power specialist AC/DC.