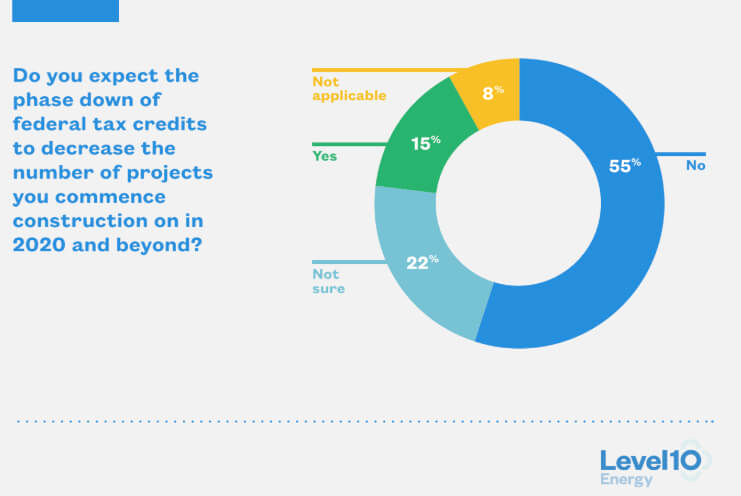

In the developer survey, LevelTen also explored whether or not changes to federal renewable energy tax credits would affect future renewable energy project development. Download the report here.

Every quarter, LevelTen Energy provides an in-depth look at power purchase agreement (PPA) offer price averages submitted through the LevelTen Marketplace, for both wind and solar projects, in five independent system operator (ISO) regions, including CAISO, ERCOT, MISO, PJM and SPP, in the United States.

Overall wind prices decreased (but not quite as significantly as solar prices). ERCOT and SPP saw material decreases in their prices, while CAISO, MISO and PJM saw slight increases.

The report also finds:

-

It’s a buyers market: Overall, PPA prices are on the decline. Across markets, an evenly weighted index of P25 wind and solar prices decreased $0.39/MWh, or 2.3% quarter-over-quarter.

-

Competition heats up: There was a 17% increase in the number of active projects submitted to the LevelTen Marketplace from Q4 2018 to Q1 2019. More active projects in the Marketplace means that developers are facing more competition from other developers, which could contribute to continuing price declines.

-

Texas drops it low: Prices in the South (specifically, ERCOT) dropped the most. Seeing a 6% decrease in solar and an 8% decrease in wind project costs.

This quarter, in addition to reporting on how much costs have changed, LevelTen also examined why they changed.

A survey of 40 utility-scale renewable energy project developers was conducted to find out which market factors impacted their offer prices the most in Q1. The results revealed that increased competition among developers and changes in engineering, procurement, and construction (EPC) costs had the greatest impact.

Filed Under: News