More than 200 GW of new offshore wind projects have been announced since the beginning of 2020 — accounting for more than 44% of all global capacity at the pre-construction or early development phase — according to the “2020 Global Offshore Wind Annual Market Report” issued today from The Renewables Consulting Group (RCG).

Despite a global pandemic, 2020 was a year of substantial milestones for global offshore wind. With new projects announced from Colombia to Brazil in the Americas, Spain to Estonia in Europe and Australia to the Philippines in the APAC region, the technology has been adopted by markets at contrasting levels of socio-economic development and distinct geographies. New projects exceeding 500 MW in capacity were announced in Spain, Ireland, Norway, Taiwan, South Korea, Italy, Brazil and Vietnam through early 2021. Technology continues to emerge as floating offshore wind continues to emerge as a utility-scale option for markets with deep-water seabed areas.

While offshore wind enjoyed a transformative year for market growth, new policies, and targets, fostering development at a government level and ongoing installation across all regions, there remain significant challenges to the industry in meeting ambitious targets and enabling the realization of projects in the pipeline beyond 2030.

Supply chain constraints across all regions, as well as undefined development frameworks and route to market mechanisms, will limit deployment of capacity across the sector through to 2030. The rate of deployment in the near-term should not be underestimated, however the ambition of government authorities and investors may exceed sector capability in some areas.

“This year’s Annual Market Report is an invaluable data source and its findings clearly demonstrate that global offshore wind continued to its impressive growth in all sectors during 2020,” said RCG’s COO, Dr. Lee Clarke. “With a steady and predictable framework, we continue to see positive developments emanating from emerging markets, such as in the APAC and the Americas regions. The ongoing maturation of technology and declining costs for offtake have inspired governments and investors to embrace offshore wind, with many authorities touting offshore wind as a cornerstone to a green economic recovery in the wake of a global recession.”

Key takeaways from RCG’s latest report include:

- Record year for capacity investment

The total capacity financed for offshore wind in 2020 reached 8,370 MW across the European, Americas and Asia Pacific (excluding China) regions, eclipsing the previous total of 6,438 MW financed in 2018. Global investment for offshore wind also set new highs last year as investment reached $30 billion, surpassing the previous high of $22 billion set in 2018.

- APAC portfolio set to overtake EMEA by year-end

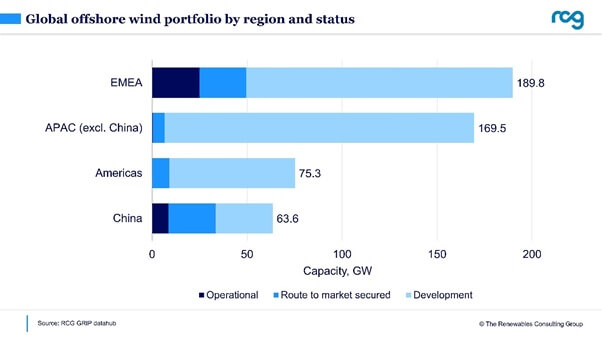

For the first time, the APAC market portfolio has surpassed the EMEA region in project development capacity. For the first time, the UK will lose its No. 1 global offshore ranking by the end of the year to Vietnam and China, respectively.

Vietnam, with just 99 MW of inter-tidal capacity operational, sports a massive development pipeline of 64.9 GW. Vietnam’s early-stage development capacity is almost entirely comprised of projects proposed under the recent national power development plan (PDP8). Of the offshore wind farms proposed under the PDP 8, many have not disclosed site characteristics beyond prospective capacity. It is therefore expected that large projects located in areas of prominent resources will overlap. As result of potential overlapping boundaries, as well as other constraints such as grid availability and demand, it is unlikely all projects will advance to operation.

China, which has 8.5 GW of offshore wind operational and 30.2 GW underdevelopment, is in second place with a total portfolio of 63.6 GW. Project commissioning took place at an unprecedented rate during 2020. The offshore wind feed-in-tariff (FiT) supporting rapid development and installation timelines is due to expire in 2022, with no new subsidy mechanism announced to date. Developers, meanwhile, race to install projects by the commissioning deadline.

- Floating wind continues to emerge

Floating offshore wind continues to emerge as a utility-scale option for markets with deep-water seabed areas. The floating market expanded rapidly in 2020 and early 2021, embracing more innovative technology concepts at a large scale. The first competitive tender for a commercial scale floating sites is currently underway in France, while more projects are set to be offered in competitive processes in Scotland and Norway later in 2021, with plans to lease projects in California also ongoing. Development of new projects of over 100 MW in capacity across at least eight different countries to date has shown floating technology to be a viable power generation option in a wide range of environments.

- Leasing/route to markets framework

Leasing headlines for the year were dominated by the results of the Round 4 auction for new sites in England and Wales. The cost-based competitive allocation drew in bids from oil and gas majors exceeding £230 million per year in option fees. The explosion of growth in the portfolio capacity of projects in the APAC region was encouraged by the prospect of new leasing rounds and offshore wind frameworks. However, not all projects will proceed beyond an auction round and there is heavy risk associated with pre-tender project development. The success of offshore wind allocation frameworks has encouraged the formulation of new policies supporting development in markets such as Brazil, Sweden, Ireland, Australia, Spain, Romania, Greece and Vietnam.

- Americas show future promise

As new project announcements in the United States stalled in 2020, the Brazilian market flourished with over 31 GW of new projects announced throughout the year and into 2021. Despite a slowdown in federal permitting and new leasing in the last year of the Trump presidency, state authorities issued solicitations for offtake contracts in New Jersey and New York. The first project installed in federal waters, the 12-MW CVOW demonstrator, was commissioned by Dominion Energy in October 2020. The development and operations of the project will inform the build out of the adjacent 2.64-GW CVOW offshore wind farm. Other project developers also advanced sites, with construction and operations plans submitted for three projects on the north-eastern coast of the country. There was also increased interest in pursuing offshore wind projects off the coasts of California, Louisiana and Oregon. The development and operations of the project will inform the build out of the adjacent 2.64-GW CVOW offshore wind farm. Offshore wind projects were explored in both Colombia and Chile in 2020. Local onshore renewables developer Prime Energia submitted plans for a 200 MW project near the Port of Cartagena to Colombian authorities in late December, while turbine supplier GE announced it was exploring floating opportunities off the Chilean coast in September.

News item from RCG

Filed Under: News