In a nutshell, the company:

- Delivered strong 2016 Adjusted EBITDA, cash from operations and Free Cash Flow before Growth (FCFbG)

- Reaffirming 2017 Adjusted EBITDA, Cash From Operations and FCFbG guidance

- Corporate debt reduction and preferred stock redemption throughout 2016 under the current program totaled $1.0 billion; approximately $100 million1 of recurring FCFbG

- Exceeded the targeted $400 million in cost reductions by over $100 million, ahead of the anticipated 2017 time frame

- Executed agreements with NRG Yield to drop down 311 net MWs of utility-scale solar assets for total cash consideration of $130 million2 and expanded Right of First Offer (ROFO) pipeline by 234 net MW; raised another $128 million3 through non-recourse financing at Agua Caliente

- 2.2 GW of coal-to-gas conversions and Petra Nova Project completed on time and on budget

- Recorded $1.2 billion non-cash assets and goodwill impairment charge

Our focus on strategic priorities and strong execution in 2016 sets the foundation for 2017, said the company president.

In more detail:

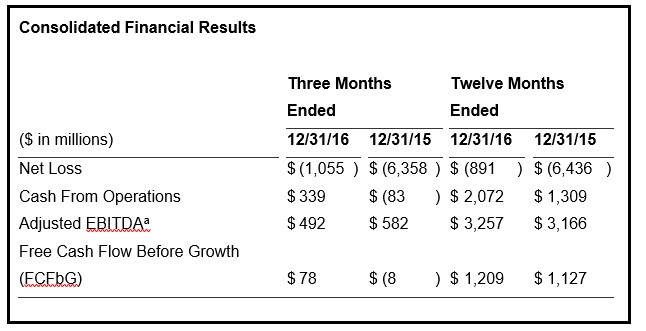

NRG Energy Inc. reported full year 2016 net loss of $891 million, or $2.22 per diluted common share. The loss and resulting loss per share were driven by a $1.2 billion impairment of goodwill and fixed assets as forecasted gas and power prices continue to decline. Adjusted EBITDA for the full year 2016 was $3.3 billion, cash from operations was $2.1 billion and FCFbG was $1.2 billion. Additionally, NRG realized its second best safety year in company history with a full year top decile recordable rate of 0.624.

“Our business delivered a year of strong results, both EBITDA and Free Cash Flow, driven by Retail, which had a record 2016 adjusted EBITDA and its third consecutive year of EBITDA growth,” said Mauricio Gutierrez, NRG President and Chief Executive Officer. “Our focus on strategic priorities and strong execution in 2016 sets the foundation for 2017, allowing us to seize market opportunities while continuing to streamline the business, strengthen the balance sheet and deliver value to shareholders.”

a. For comparability, 2015 results have been restated to include the negative contribution from Residential Solar of $43 million and $173 million for the three and twelve months ended December 31, 2015.

Filed Under: Uncategorized