This article comes from Wind Energy Update, and is authored by Richard Wachman. The full piece can be read here.

Original Equipment Manufacturers are fending off competition in wind-power operations and maintenance (O&M) through a combination of longer service agreements, tailored offerings and takeovers of independent service providers, experts told Wind Energy Update.

Competition from solar and gas-fired power generation and the gradual removal of renewable energy subsidies have increased the importance of reducing onshore wind-power costs and raising O&M efficiency.

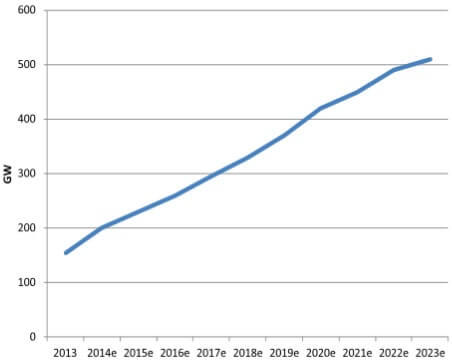

Global growth of out-of-warranty O&M market. (Source: Wind Energy Operations and Maintenance Report 2016.)

Advancements in big data analytics are accelerating cost reductions in wind O&M. As post-warranty installed capacity continues to rise, OEMs are facing stiff competition from independent service providers (ISPs) and in-house operator O&M teams.

The global onshore turbine O&M market is forecast to grow by 10% per year to over $22 billion by 2025, according to a report published by MAKE Consultancy in November 2016.

O&M costs, which represent up to 25% of total lifetime costs, have fallen 20% since 2014, MAKE said.

Upcoming wind-power tenders in Europe will highlight the recent cost reductions in the O&M market, Keegan Kruger, an analyst at Bloomberg New Energy Finance, told Wind Energy Update. “If service providers benchmark O&M contracts from the inflated prices of two years ago, they probably won’t win any of the large number tenders coming up in 2017 and beyond,” he said.

Around 230 MW of current wind-turbine capacity is out of warranty, according to FTI consulting. This will increase as installed turbines age and O&M services represent “a huge go-forward business for wind farm operators, OEMs, components suppliers, and ISPs,” FTI said in a report published in 2015.

Under pressure

OEMs currently hold around 60% of the global onshore wind O&M market, according to some industry estimates. Until a few years ago, OEMs were the dominant force in O&M, but ISPs entered the market with innovative software and bespoke solutions which led to greater cost competition and a wider range of products.

Competition has cut wind O&M prices and widened the range of services. (Image: Dutchscenery)

Another trend has been for large utilities, particularly in the U.S., to perform O&M in-house to leverage economies of scale. Around 80% of large U.S. wind operators currently take this approach, Kelly Dallas, director of asset management at ISP Wind Prospect Operations, told Wind Energy Update.

Switching to self-performance of wind O&M at end-of-warranty can cut costs by between 25% and 35%, and allow operators to make more design improvements to increase unit reliability, Jeff Wehner, VP Renewable Operations, Duke Energy, said in April 2016.

Duke Energy owns 2.5 GW of U.S. wind-power capacity and self-performing O&M gives the operator full control of the site’s performance and better control over safety and reliability, Wehner told Wind Energy Update’s O&M Dallas 2016 conference.

“We find that there are substantial cost savings by in-sourcing it…We have more freedom to go in there and make the changes we might want to make, in terms of operating philosophies and resource allocations,” he said.

Read the full article here.

Filed Under: News, O&M, Projects