There is a lot of news on the wind farms going into U.S. waters, but not much construction. So how close is the wind industry to the real action – construction and power from offshore turbines? For an answer to that, your dedicated staff contacted several companies involved in the effort for an update to the situation.

The good news is that plans are moving ahead on several fronts. Cape Wind off the coast of Massachusetts seems to get the lion’s share of attention but people are also working to make turbines sprout off the coast of New Jersey, Maryland, Virginia, Delaware, and the Great Lakes. In the latter region, a focused and energetic crew is working to get a 20-MW fleet of turbines off the coast of Cleveland, in the windy and fresh water of Lake Erie.

In the Great Lakes

The Great Lakes present fewer challenges for the offshore wind industry. First the lakes are generally shallower than ocean plots. In Lake Erie, the site of one project, the water depth is often 30 to 40 ft. within a mile of shore. And the lakes are fresh water, much less corrosive than salt water oceans.

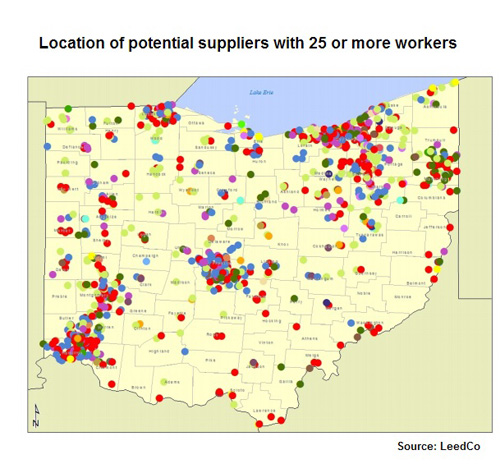

The Ohio map shows locations of companies that could contribute to a growing offshore wind industry in the Great Lakes.

Lorry Wagner heads the Lake Energy Development Co. (LeedCo.org), the project to plant about 10, 2-MW turbines in the lake. Recent news dealt with $4 million in funding which let the organization beef up the management team and push the project forward. “The first phase of the funding is for the engineering to make sure we understand the technical financial issues, so it’s an opportunity to do some engineering work and flag areas that need more investigation,” says Wagner.

Later, a crew will give the lake floor a more thorough examination. “And then permitting work will make sure all agencies are in synch with what must be accomplished. Additional needed studies will also be identified,” he says.

Another advantage of working in the Great Lakes is that the state owns the lake. For Ohio, Lake Erie is held in a public trust, a doctrine that covers its use.

One LeedCo project, called Ice Breaker, is to investigate potential problems with ice. “Typically the first question anyone asks is: what are you going to do about the ice?” says Wagner. “But wind turbines have been put in ice around the world and they are doing well, so it’s not as much an engineering challenge. What’s more, thousands of structures are built in icing areas, so while it’s not a huge challenge technically, we must make sure we can accomplish it with the right cost profile.”

The task of building offshore wind farms could require specialized vessels, such as jack- up barges. “As the industry starts, we have vessels of opportunity already in the Great Lakes, barges and others. Many projects have also looked at alternative construction techniques. As they develop, it may turn out that these others are more useful than a jack-up barge. Right now we are planning on using existing vessels,” he says.

As for how the towers might be anchored, Wagner says his team is considering a gravity-based structure. “The first thing to do is pick the class of foundation – a pile type or gravity base – then look at variations to suit the lake floor. The lake bottom has a 30 to 40-m depth of glacial till, soft and hard, and then it becomes solid under that.” In some areas, sediments get thinner.

Big question, however, is when might construction start? The funding stream the DOE proposes would put construction somewhere in 2016 or 2017. “There certainly could be some port work right now and visible signs of construction in 2015. Right now, it’s most reasonable to say 2016 or 2017,” says Wagner.

Offshore Virginia

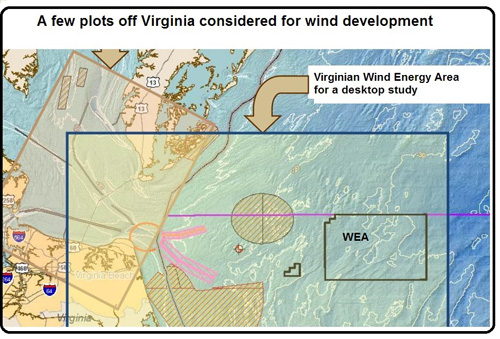

The plots are for several areas off the Virginia coast that could be developed to harvest wind energy. Most attention so far is focused on the WEA, the rectangle in the lower right of the image. Virginia and North Carolina are visible to the lower left.

Source: Fugro Consultants

Constructing a wind farm offshore in U.S. water will be a bit more involved than in the Great Lakes. “First of all, states with seacoasts generally own the ocean out three miles, and beyond that is Federal water,” says Tom McNeilan, Vice President with Fugro Consultants (fugroconsultants.com). The U.S. Dept of Interior Bureau of Ocean Energy Management is planning a lease auction later this year of the designated Wind Energy Area (WEA), off the coast of Norfolk, a plot that measures about 15 by 20 miles in water depths of about 50 to 100 ft.

Preparations are underway in Virginia for underwater geophysical surveys of the WEA to commence this spring. The work is funded by the Virginia State Department of Mines, Minerals, and Energy, and the Department of Interior Bureau of Ocean Energy Management. This is important predevelopment work because most of the Atlantic outer continental shelf, in federal waters, is unexplored. The Bureau Ocean and Energy Management calls them frontier areas. “There has been no history of energy development nor project-level evaluation of conditions on and below the sea floor and what they mean for development,” says McNeilan. “So our work is to start that process and provide information that can be used to anticipate development conditions and costs in advance of auctions leases or sales.”

Once a lease is auctioned off to expedite development considerations, the 2013 survey data will help expedite plans for long-term wind condition measurements.

Sufficient meteorological data is yet to be collected. That will be the job of several instrumented buoys recently installed. “The installation of additional measurement devices is critical to define the wind resource there,” says McNeilan. He adds that Fugro has conducted surveys and geotechnical ground investigations, installed met towers and contributed to wind turbine installations on many projects in Europe. All these were on the water activities that require appropriate vessels, barges, and specialized equipment capabilities and experience.

The Jones Act will influence offshore constructions. The act requires that cargo shipped in U.S. water be transported in U.S. flagged vessels and with U.S. crews. Ships and crews may be needed from Europe and there may be legal ways to accommodate the Act. One understanding, for the moment, is that a European vessel could install projects in U.S. waters. But the Jones Act would prohibit those vessels from going to shore to pick up material and equipment and transport it to the site. That task, transport from shore to site, would have to use U.S. flagged or Jones-Act complement ships.

A project timeline for Furgo’s survey shows a Final Survey Plan completed by April 2013 and a Final Report Publication by September.

Offshore Delaware

The first offshore lease was issued under the U.S. Interior Department’s “Smart from the Start” program and a second U.S. commercial lease behind Cape Wind, both issued last fall. The company sees the Delaware coast as an optimal location for one of the U.S.’s first offshore wind farms.

Although, wind-power developer, NRG Energy, has ramped down its offshore development activity, the company is taking necessary steps to preserve its wind development assets. Currently, NRG is required to submit a construction and operations plan (COP) “Survey Plan” at the end of this year. The plan filing, due December 31 unless extended, will describe how Bluewater will meet the information requirements to support the broad COP filing for the overall project.

NRG continues to seek strategic and financial investors for the Mid-Atlantic Wind Park. “This was always a central part of our plan since acquiring Bluewater Wind in 2009, says David Gaier, Communications Director, NRG Energy.

The company appreciates the leadership and support of Delaware Governor Markell, Senators Carper and Coons, and Representative Carney, he adds.

Filed Under: Offshore wind, Projects