Philip Totaro / Founder & CEO / Totaro & Associates

Renewable energy finds itself in a bit of a Catch-22 when it comes to innovation. Intrepid entrepreneurs with impressive ideas which would reduce levelized cost of energy (LCOE), improve annual energy production (AEP), reduce the CapEx cost of wind turbines, solar panels and energy storage systems, or even reduce the OpEx cost to maintain renewable energy installations are being stifled.

Even OEMs have shown either incremental product and technology innovations, or pie-in-the-sky new products which have little hope of ever seeing the commercial market.

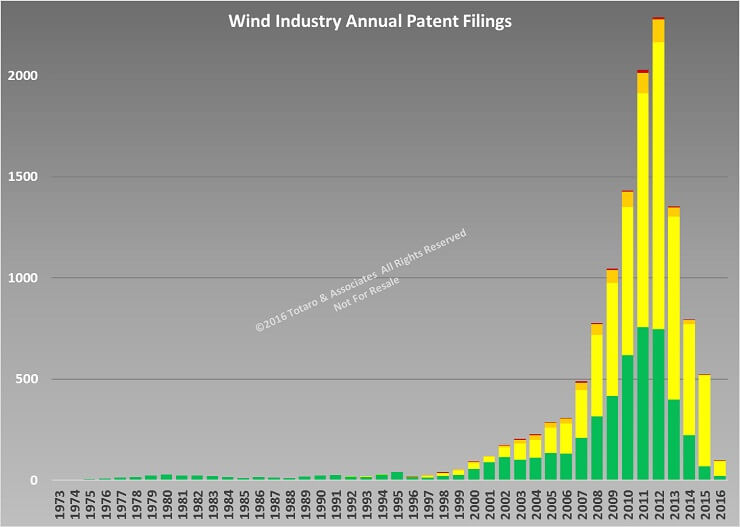

To further highlight this, the wind industry’s recent innovation trends suggest a sharp drop-off due to the market downturn in 2012 – 13. Companies slashed R&D budgets and reduced the percentage of R&D spend vs. their overall revenue intake.

But there is hope, and our best days in innovation are not behind us. As most OEMs push towards 4 to 5 MW onshore designs, the size constraints of scaling what was essentially 750 kW technology up to these new levels necessitates innovation.

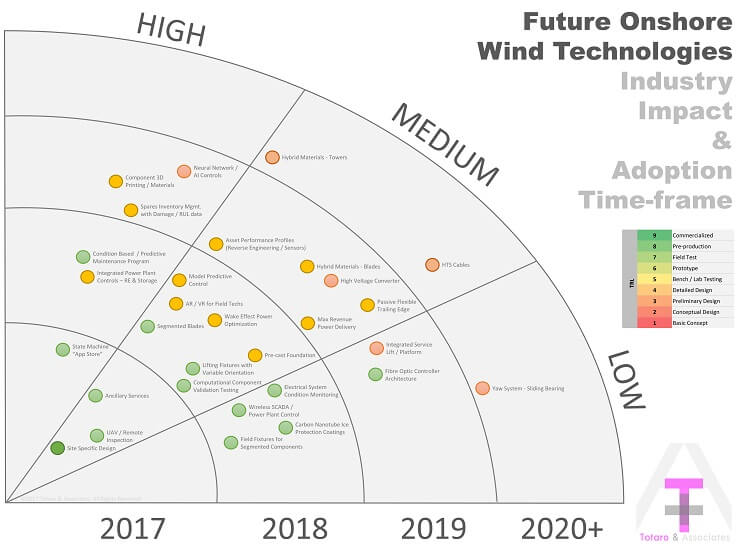

From compact, medium-speed drivetrains to segmented blades and towers, the industry should be prepared for a rash of new innovations which will be introduced in the coming years.

A look at the future technology trends suggests numerous innovations which have been contemplated, but are not yet commercially available. All of which will require differing levels of R&D spend to get those technologies to a TRL 9 (commercial availability), as highlighted by the infographic.

But, a question remains as to whether or not all of these inventions, which have the ability to impact LCOE, AEP, CAPEX and OPEX, will see the light of day.

One of the constraints of commercial adoption of new technologies has been a lack of acceptance on behalf of project financiers and insurance underwriters (and therefore by proxy, developers and asset owners as well) to fund the prototypes. The implementation of new products which comprise “radical” and “unproven” technologies that might adversely impact a 99% availability rating or potentially increase unscheduled maintenance while early stage-kinks are worked out simply aren’t “bankable.”

It has led to turbine OEMs to propose new wind turbines as merely an evolution of a previously proven, reliable, and “bankable” product family, in spite of some products which possess significant design changes.

Even when startups or inventors with novel and commercially viable ideas for a new generator architecture, new multi-piece blade joint, or a new segmented tower seek funding from venture capital or private equity firms to complete their proof of concept, they are stymied by a risk aversion due to lack of an OEM partnership. With no window to payback they tend not to receive funding. But in all fairness, the OEMs are unlikely to take a big gamble on as-yet unproven technology until there is validation. Thus the Catch-22.

One solution has been for governments to step up and bear some of the brunt for the costs of new technology validation. In Denmark and Germany, we have seen federal commitments for new testing facilities come to bear. Even in the US, new facilities at NREL and other test sites instantiated in Massachusetts and South Carolina over the past few years are already helping to prove new capabilities. But government coffers for providing funds for new technology validation can be unfortunately fickle in a competition over scarce resources or alternative priorities by government administrations.

Another solution is for OEMs to vendor-finance the prototypes and development projects which will prove the viability of new technologies. Going back 7 to 10 years, most OEMs had a development entity as part of their organization, which they have subsequently wound down or sold off to dedicated developers. Interestingly, several Chinese OEMs who are attempting to globalize their technology are currently having to Build, Operate, and Transfer (BOT) assets which have served as a vehicle for them to prove their product bank-ability.

Nevertheless, the future will be interesting, and potentially expensive for OEMs to contemplate if they are forced to re-engage in a development company acquisition or partnership to provide a vehicle for the commercial proof of concept for these new product platforms. While this is not yet an assured strategy for all OEMs, it remains an option if the roadblocks to new technology and product introduction remain in place by the project financiers and insurance underwriters.

So in this future scenario, what happens to all those intrepid entrepreneurs with innovative ideas? They will continue to bring their ideas to market with the right help to facilitate their technology proof of concept. Let’s hope the risk aversion among the investment community loosens up to release these good ideas from the minds of inventors to the benefit of humanity.

I trust the cream will rise to the top.

Filed Under: News