Editor’s note: This is the executive summary, background, and objectives from a UK report on electric vehicles.

Electric powertrains have been identified as a key technology to abate emissions of light-duty vehicles in support of the UK’s target of an 80% reduction in greenhouse gases by 2050 (compared to 1990 levels). However, electric cars and vans representing only 0.1% of light-duty sales in 2012 and significant market barriers to widespread EV adoption remain.

Electric powertrains have been identified as a key technology to abate emissions of light-duty vehicles in support of the UK’s target of an 80% reduction in greenhouse gases by 2050 (compared to 1990 levels). However, electric cars and vans representing only 0.1% of light-duty sales in 2012 and significant market barriers to widespread EV adoption remain.

In this context, a Committee on Climate Change (CCC) commissioned Element Energy, Ecolane Consultancy and the University of Aberdeen to identify possible pathways to achieve high penetration of light-duty electric vehicles (including car and vans, battery, plug-in hybrid and fuel cell electric vehicles) in the UK. The CCC’s high EV uptake pathway is defined by:

Indicative 16% market share for Plug-in Hybrid Electric Vehicles (PHEVs) plus Zero Emissions Vehicles (ZEVs) by 2020; ZEVs are defined as battery electric vehicles (BEVs) and fuel cell vehicles (FCVs);

60% market share (PHEVs plus ZEVs) by 2030;

100% market share for ZEVs by 2040, so that, taking the stock turnover into account, the vehicle park is virtually decarbonized by 2050.

Analysis method

Previous analysis2 has indicated that EVs should reach parity with conventional cars on an economic resource cost basis in the 2020s, as technology costs continue to fall and significantly lower running costs outweigh the higher capital costs. The CCC therefore concluded that EVs could be a cost-effective option to decarbonizing the transport sector.

(2) Element Energy, Cost and performance of batteries for EVs, 2012; Ricardo-AEA, A review of the efficiency and cost assumptions for road transport vehicles to 2050, 2012.

Alongside economic considerations, it is also important to consider how consumers will engage with EVs and in particular to assess the extent of potential non-financial barriers to take-up. The focus of this study is to develop a model to assess the value people place on different aspects of buying and driving a car. Together with information on the current state of the EV and conventional vehicle market (in terms of costs and supply), this enables the monetization of the value of non-financial barriers. The results highlight the significant barriers involved in reaching a high penetration of EVs in the set timescales, but this does not imply the need for financial incentives. The EV sector has demonstrated its ability to innovate to overcome barriers to uptake and the analysis sets out a range of non-financial measures that could be used to incentivize higher uptake.

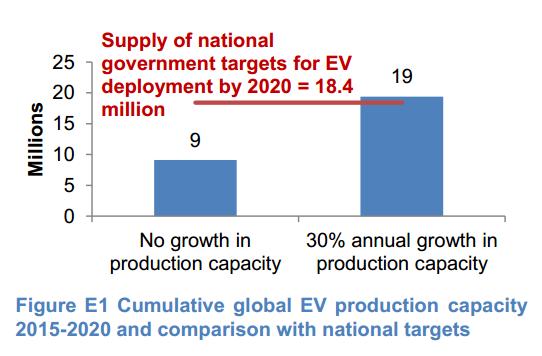

Current EV market and projected supply

Around 110,000 electric cars and vans were sold in 2012 globally (representing approximately 0.14% of car and van sales), more than double the previous year when less than 50,000 EVs were sold. In terms of absolute EV sales, the European and Asian markets are each about half the size of the North American market (21,500 sales in Pathways to high penetration of electric vehicles

Barriers to uptake

Identified barriers to EV uptake are based on extensive research regarding the main consumer factors influencing vehicle purchase. Taking into account the attitudinal factors that most strongly differentiate consumer segments (see below), together with more general vehicle purchase criteria, the key attributes affecting the purchase of EVs are: vehicle price and running costs, brand and segment supply, access to charging facilities, driving range and charging time and the consumers’ receptiveness to plug-in vehicles. With the exception of running costs (which are reduced), these attributes all currently act as barriers to EV uptake:

EVs have a high price premium over non-EVs

As vehicle price is the most important factor influencing vehicle choice, financial incentives (including the Plug-in Car and Van grants of respectively up to £5,000 and £8,000) are currently essential to offset the higher purchase price of EVs and reduce the Total Cost of Ownership (TCO), even in cases where innovative acquisition models are employed (e.g. battery leasing). Given that consumers show high discounting rates for future spending, the potential running cost savings offered by EVs are insufficient to offset the EV capital premium as perceived by most car buyers.

While, in some circumstances, the current incentives make the four year TCO (the typical time horizon considered by consumers) of EVs competitive with conventional vehicles, cost projections suggest that without support measures the capital cost premium of EVs will remain a barrier to at least 2030, especially for BEVs. Pathways to high penetration of electric vehicles

Supply of EVs model is limited, in terms of vehicle segments and brands

The choice of vehicle segment (e.g. small, medium or large car) is related to the consumer requirements of size, comfort and practicality, whereas brand choice reflects more emotional factors such as brand attachment (loyalty is strong among vehicle buyers), perceived reliability and the buyer’s identity construct.

Based on OEM announcements of series model releases up to 2015, the overall outlook for brand supply of EVs in the next few years is noticeably improving: the UK’s top three car brands will be represented by the end of 2013, and the top ten brands by 2015. The level of supply (in terms of model diversity) however varies across vehicle segments and EV types: the outlook for BEVs is better than for PHEVs, and is better for cars than for vans.

Consumers are concerned by EV’s short range and long charging times

Extensive trials and current usage of charging infrastructure indicates that utilization of publicly accessible charging networks is low, EV owners instead preferring to use overnight charging (at home or workplace), and/or at work during the day. The level of access to overnight charging locations is high among new vehicle buyers in the UK (70% for new private cars and 60% for new vans) suggesting access to infrastructure is not a dominant barrier to initial EV adoption in terms of actual need (based on the typical daily distance travelled). However, potential EV buyers and EV owners frequently demand more public charging infrastructure, which is based on their perceived need to drive longer distances than currently offered by BEVs.

Recharging time is consistently reported as a barrier by EV users, regardless of the ability to recharge overnight. The level of utilization of rapid 50 kW chargers observed in other countries, together with the proportion of sales of EVs with DC charger ports, confirms the high value placed on reducing charging time by EV users The analysis conducted for this study finds that a network of rapid chargers would be the most efficient way to complement overnight charging and support the high EV adoption targeted in this study. A public network based on normal 3-7kW chargers would not be able to provide adequate day charging.

Most private vehicle buyers are not currently receptive to EVs

Consumer acceptance, defined as the readiness to consider purchasing or using an EV, varies across consumers, with the majority of private consumers not accepting as sufficiently advanced the capability of current EV models. In addition to the concerns already discussed, reliability, safety and battery degradation issues, as well as uncertainty regarding residual values, also contribute to consumers’ reluctance to purchase electric vehicles.

A pre-cursor to acceptance is consumer awareness. Evidence collated by this study shows that UK car buyers currently have a low level of awareness of EVs and their associated incentives, with only around 20% of UK drivers being ‘very familiar’ with the EV technology and only 25% being aware of the Plug-In Car Grant.

According to a recent study of around 3,000 UK car buyers, attitudinal segmentation is a better predictor of EV acceptance (and hence adoption) than more conventional demographic indicators, including travel patterns. The study, which develops a segmentation of the UK new private car buyers, identifies distinct market groups: Pathways to high penetration of electric vehicles

Read the rest at: http://www.theccc.org.uk/wp-content/uploads/2013/12/CCC-EV-pathways_FINAL-REPORT_17-12-13-Final.pdf

University of Aberdeen

http://www.theccc.org.uk

Filed Under: News