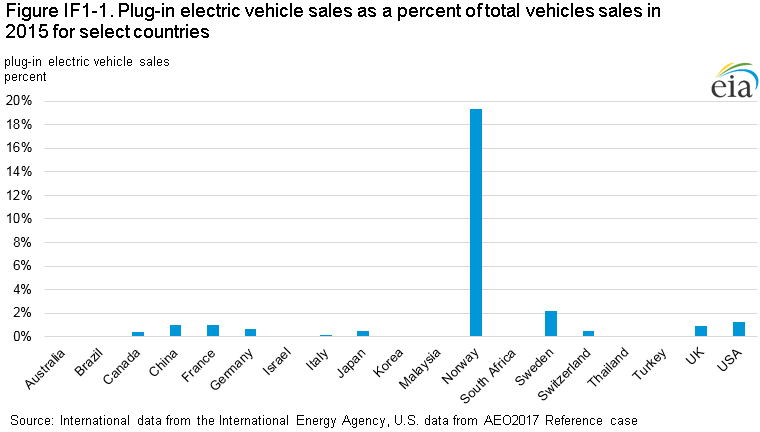

Editor’s note: The U.S. Energy Information Administration (EIA) released a new report, “Plug-in electric vehicles: future market conditions and adoption rates,” which looks at the long-term international outlook for electric vehicles. Melissa Lynes, Ph.D., discusses some of the results and market developments in this article. She is an Industry Economist on the Transportation team in the Office of Energy Consumption and Efficiency Analysis for the EIA’s Office of Energy Analysis. For the full version of Lynes analysis, click here.

Variability surrounding future battery technology, government policies, consumer preferences, and other developments related to personal transportation markets casts a great deal of uncertainty on the long-term effects that battery electric and plug-in hybrid vehicles may have on worldwide energy consumption.

A number of market-related factors can affect the demand for PEVs, but the factors most commonly focused on are differences in the purchase prices and operational costs between plug-in and a gasoline-fueled vehicles. Although such measures are informative, other less tangible or difficult-to-measure costs are also important factors that affect adoption rates. These less tangible costs relate to whether the vehicles serve as perfect substitutes or not, given current technology and supporting infrastructure. In addition, income levels and a more general notion of consumer tastes and preferences are likely to influence the demand for PEVs.

To compare the relative costs associated with the two different types of vehicles, measures of vehicle price parity are commonly used. The idea behind these measures is that once the price of PEVs begins to approach the price of gasoline-fueled vehicles, consumers will become more willing to purchase PEVs rather than gasoline-fueled vehicles because it makes sense to do so financially.

Two methods are typically used to create measures to examine vehicle price parity. The first is based on total cost of ownership (TCO). Under this concept, parity is achieved when ownership costs are the same for two types of vehicle measured over their service lives. Factors such as fuel cost per mile, maintenance, and length of ownership factor prominently into these types of measures. Because the cost-per-mile and maintenance costs are typically lower for PEVs, TCO parity is usually achieved even though electric vehicles have a higher purchase price than gasoline vehicles.

The second measure of vehicle price parity is based on the purchase price of a comparable vehicle. Under this concept, price parity is reached when the upfront cost in purchasing a PEV without discounts or incentives is the same as that associated with an equivalent gasoline-fueled vehicle. To reach price parity with gasoline-fueled vehicles, battery packs for plug-in electric vehicles will likely need to decrease to about $100/kilowatt hour (kWh).

Customers in the more developed countries are more likely to purchase electric vehicles once TCO parity is achieved. This outcome results because consumers in less-developed countries who are purchasing a new vehicle for the first time are likely to face a greater financial burden in spending the additional money upfront to purchase a PEV.

The main factor that may contribute to future vehicle price parity is increasing economies of scale for vehicle powertrain components. As more batteries are produced, lower per-unit costs are realized because fixed overhead and development costs are spread across a greater number of units. However, a large increase in battery demand may lead to bottlenecks in the supply chain for essential components, keeping PEV prices high, at least in the near term.

The most expensive component affecting the overall costs of PEV vehicles is the battery cell. The cost of lithium-ion cells, the most commonly used PEV battery, has decreased from about $1,000 per kWh of storage in 2010 to between $130/kWh – $200/kWh in 2016, depending on the manufacturer. However, the cost of the battery pack for most manufactures is still more than $200/kWh. Further reductions in cost will need to be realized to fully achieve vehicle price parity with gasoline vehicles.

A potential bottleneck in the supply chain could be caused by the need for lithium or cobalt to produce PEV batteries. Over the past few years, the cost of lithium has quadrupled as the demand for lithium has grown more quickly than supply. In the long run, however, lithium production is likely to be sufficient to support robust growth in the production of PEVs.

The price of cobalt has also doubled in the past couple years. However, long-run prospects for using this material in PEV batteries are not as strong as those for lithium. Cobalt is a scarcer resource with lower proven reserves. In addition, many of the known reserves exist in less politically stable regions of the world. The degree to which such supply chain bottlenecks could inhibit or delay the ability of electric vehicles to achieve price parity is uncertain.

Infrastructure to support the growth of PEV use needs to be further developed in many countries. For example, less than 80% of the population in India had access to electricity in 2014. In addition, many of those with access to electricity, often do not have a reliable source or enough electricity to power more than few basic household appliances. To circumvent this issue and keep costs down, India plans to sell plug-in electric vehicles and lease the batteries to consumers. When the battery is empty, the consumer can swap out the battery for a fully charged battery at a station. Thus, consumers will not need individual access to a reliable source for electricity, as long as they have access to battery replacement stations.

In more-developed countries, access to charging stations still places limits on PEV adoption. With the current technology, it takes hours to fully charge an electric battery without using a high-speed charger. Even with such a charger, it still takes longer to charge a battery than to fill a tank with gasoline. Because of limited availability of high-speed chargers, consumers need to be able to charge their vehicles at their residences or places of work. However, many consumers do not have access to electrical outlets where they park their cars. As a result, many countries will need to install charging stations near residences.

Another important factor affecting PEV adoption is personal tastes and preferences. In China, the government offers the second-highest monetary incentives to promote the purchase of PEVs, but consumers have been more frequently opting for more-expensive gasoline-powered sport-utility vehicles. In May 2017, SUV sales in China experienced 17% year-on-year growth, reaching 3.78 million vehicles sold year to date. However, new energy vehicles, which include battery electric, plug-in hybrid electric, and fuel cell cars, experienced 7.8% year-on-year growth, reaching 136,000 vehicles sold year to date.

Read the full article here.

Filed Under: Energy storage